Bitcoin has kept from falling again in the last few weeks. We continue to consider the option with its fall to the level of $ 31,100 as the main one, guided by the fact that this year will be very difficult for all risky assets. Recall that bitcoin was actively getting more expensive while the Fed and other central banks of the world were actively stimulating their economies, creating trillions of dollars, euros, and other currencies in their accounts to inject them into the economy. It is not surprising that there was more money and they had to settle in the markets. It should also be remembered that the key rates of many central banks were and are at "ultra-low" values, which made bank deposits or purchases of government bonds that offer too low a yield practically meaningless. In addition, inflation has grown strongly around the world over the past year, which forced investors to look for instruments with returns above inflation. And there are not so many instruments with a yield above 5-6-8%.

But now the situation is changing in the opposite direction. It doesn't change fast, but it does change. It is precise because of its slow reversal that bitcoin cannot be expected to simply collapse downwards. It also falls not too hastily, with interruptions. The Fed has set a course for a rate of 2.0-2.5%, which means a cycle of increases stretched for at least 2 years. The quantitative stimulus program has already been abandoned in the States, and the European Union will also abandon it this year. Therefore, the fundamental background for bitcoin remains extremely unfavorable, and there has been no positive news for a long time. Of course, institutional investors who own a huge number of coins of the main cryptocurrency in the world are doing everything possible so that the exchange rate does not decline and does not fall below the $ 30,000 mark. But will their efforts be enough for this? After all, all bitcoin coins cannot be on the wallets of only large and institutional investors. Or can they? From our point of view, indeed, if all the coins are transferred to the disposal of the "cryptocurrency elite", then they will determine the course. But so far this has not happened, the course is still free-floating.

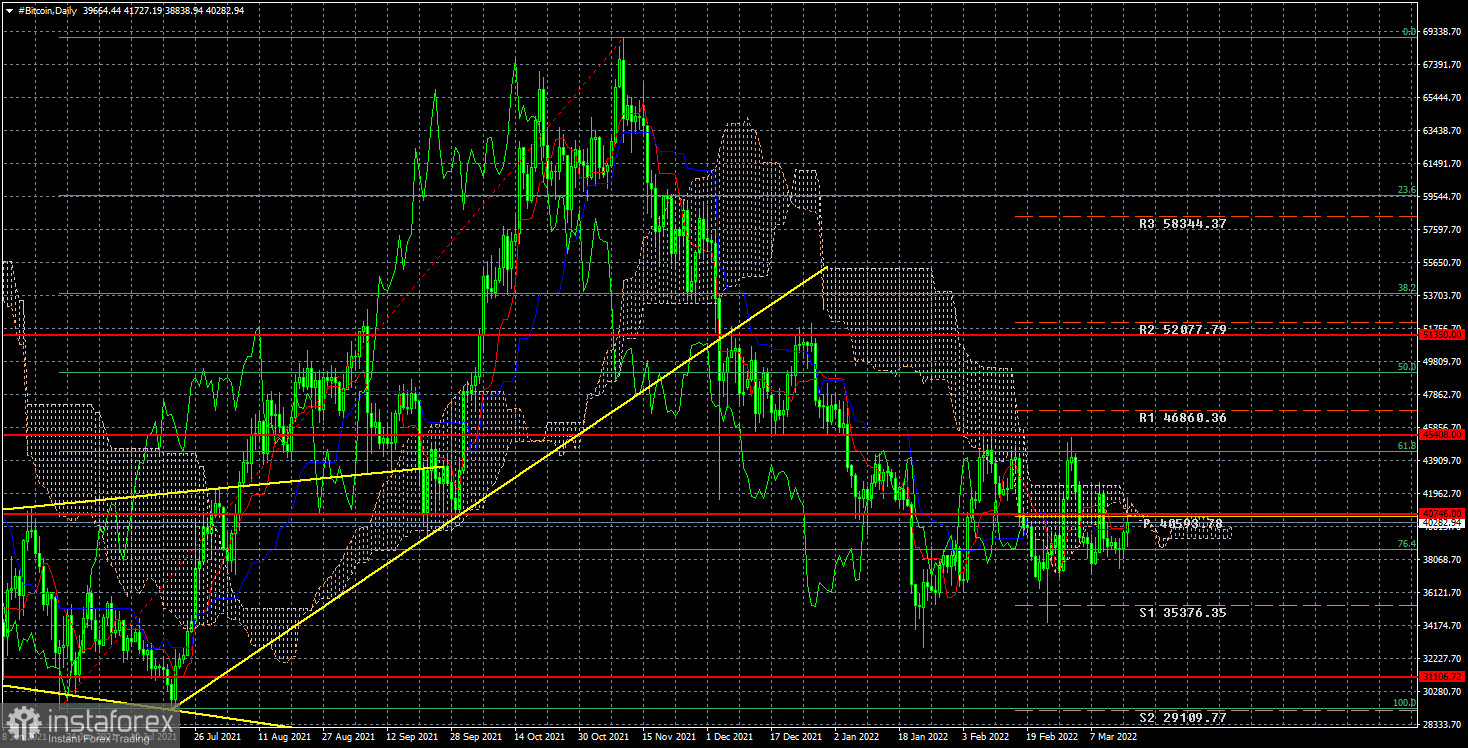

The technical picture of bitcoin is quite eloquent now. The cryptocurrency failed to overcome the Fibonacci level of 61.8% on two attempts (which is perfectly visible in the illustration below) and at the same time the level of $ 45,408. But it also failed to update the minimum of January 24. And in recent weeks, it has been consolidating between the levels of $35,000 and $45,000. It turns out a kind of triangle. Or a side channel. And, most likely, both the first and the second. The fact remains that bitcoin is currently trading in a limited price range, but this range is quite wide, about $ 10,000. There is a feeling that the spring is compressed before a new strong movement. After a huge number of sanctions were imposed against Russia, everyone who wanted to transfer money to bitcoin has already done so. There is little new demand.

On the 24-hour timeframe, the quotes of the "bitcoin" failed to overcome the level of $ 45,408 and began a new round of downward movement within the framework of the downward trend that has been observed for 5 months. There are no obstacles on the way to the $31,100 level. If traders manage to overcome it, then the drop in quotes of the "bitcoin" will continue almost guaranteed. Geopolitics and the fundamental background continue to deteriorate, so bitcoin is also becoming less and less reason for growth.