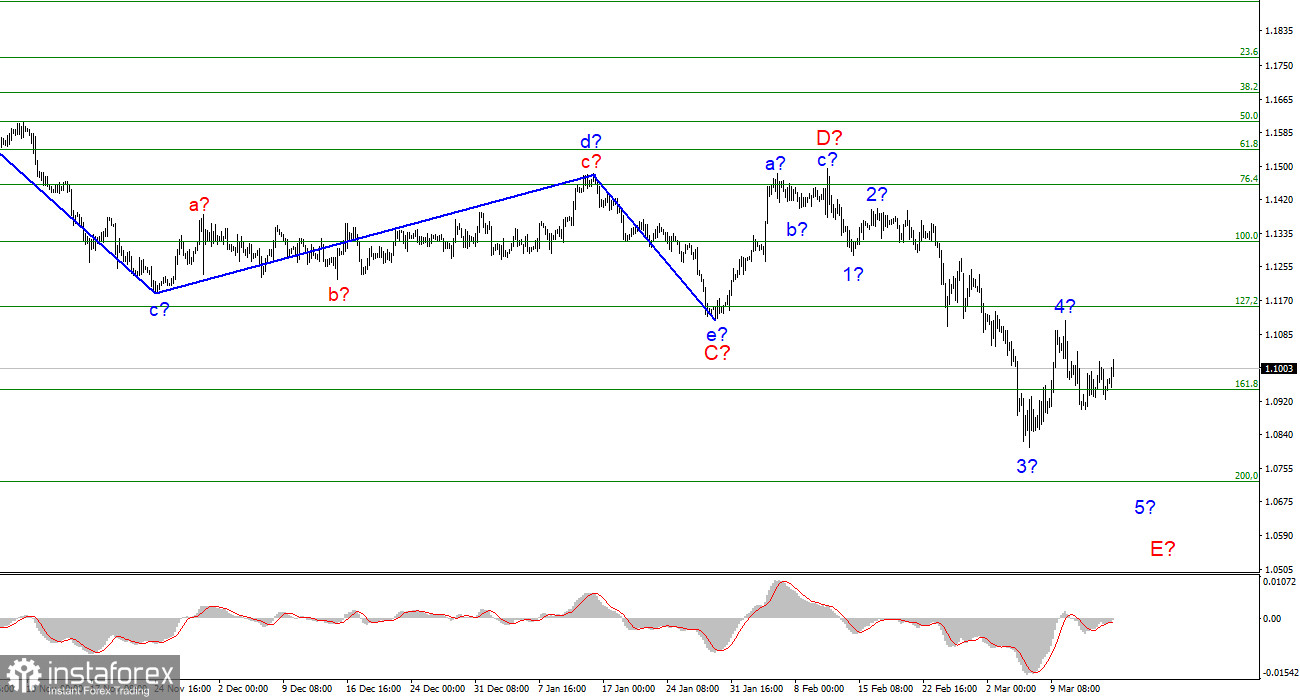

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. At this time, the construction of the proposed wave E is continuing, which should take a five-wave form. The low of the previous wave was broken, so the construction of a downward trend section is preserved. I have applied small waves to the wave marking, but they are most likely not internal waves of E, but internal waves in the first wave in E. That is, the entire wave E can take a much longer form than it is now. One way or another, the internal wave marking of this wave indicates that wave 4 has now been completed, and the construction of wave 5 has begun. If this assumption is correct, then the decline in quotes will continue this week with targets located near the 7th figure. After the completion of the first wave in E, you will need to get confirmation that this is only the first wave, and wave E itself will not receive a shortened form.

Will the Fed meeting surprise the market with its results?

The euro/dollar instrument increased by 50 basis points on Wednesday, but in general, the deviation of quotes from the reached lows is no more than 100 points. This is a fairly small value. I am more inclined to the idea that the market is just waiting for the results of the meeting, which will be known tonight, and does not want to take risks. It remains only to understand what kind of decision on the rate will be made. There are only two options: either an increase of 25 basis points or an increase of 50 basis points. The probability of the first scenario is 80%, the probability of the second is 20%. I believe that the increase in the interest rate by 25 basis points has already been taken into account in the current rate of the euro/dollar instrument. For a long time, the market expected that in March there would be an increase of 50 bps at once, but it is unlikely that members of the FOMC committee will take risks in conditions of global geopolitical and economic uncertainty. This was openly stated by Jerome Powell during his last speech. Thus, I suggest starting from the option that the rate will be increased by 25 bp.

If this assumption is correct, then the market reaction may not follow at all or it will be quite weak. Let me remind you that the current wave markup requires an increase in demand for the dollar, but this does not mean that the Fed should raise the rate by 50 bps, otherwise there will be no further decline in quotes. Most likely, the reaction to the Fed meeting will be spot-on. That is, the market will work it out and then return to its longer-term and strategic plan, which involves a further increase in the US currency. Jerome Powell's speech, which will begin half an hour after the announcement of the results of the meeting, will also be important. I believe that Powell will again take a calm position and will not rush out loud statements. There will certainly be words about global uncertainty, increased risks, and the need to contain inflation, which continues to grow in America. Energy carriers will also be "blamed" for the fact that prices are rising much faster than the Fed expected. I can't say how the market might view such statements. I will only say that today the market reaction will be unpredictable, but the market will very quickly move away from the results of the meeting.

General conclusions.

Based on the analysis, I conclude that at this time the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The construction of the fourth correction wave has been completed, and the fifth wave may turn out to be a little more complicated than I initially assumed.

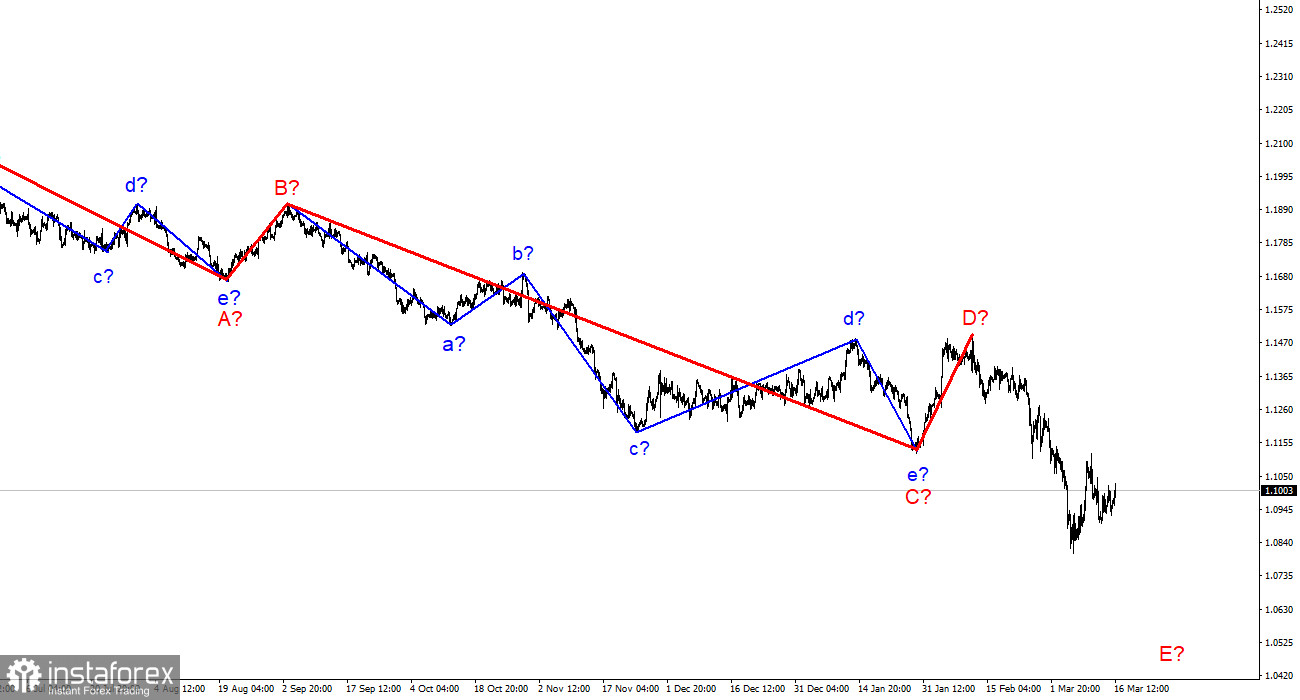

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend segment is being built, which may turn out to be as long as wave C. If this assumption is correct, the European currency will decline for a long time.