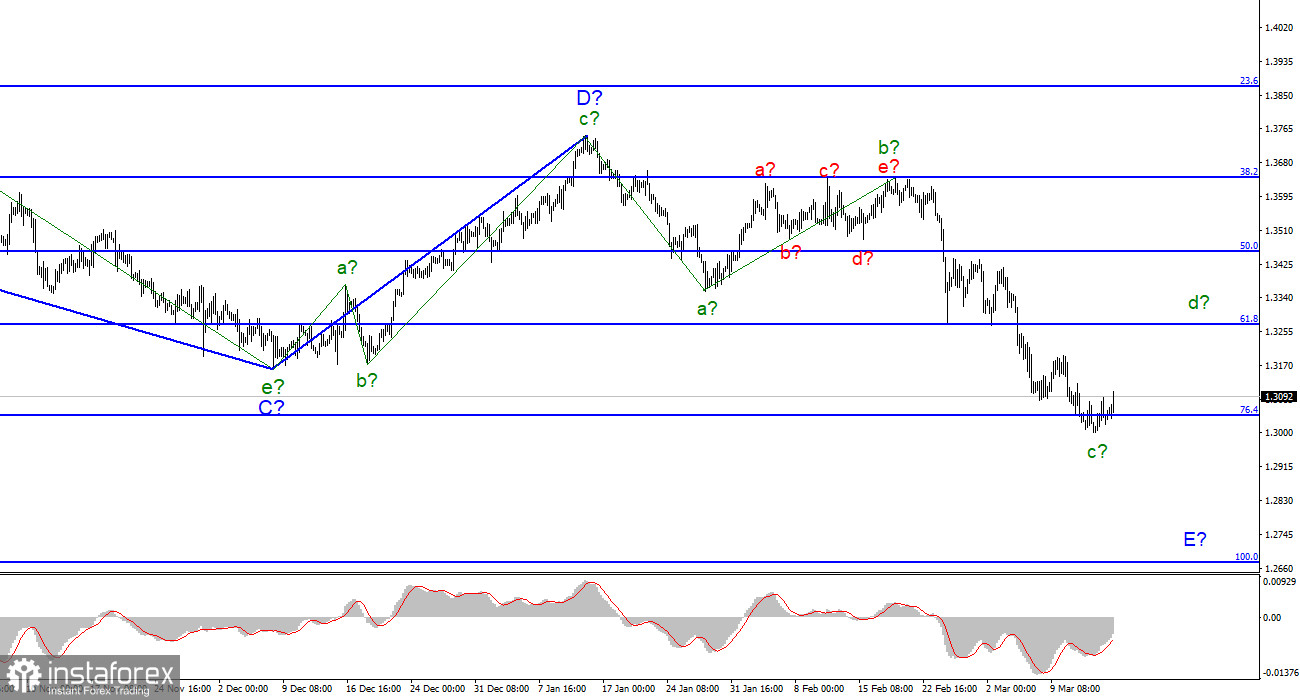

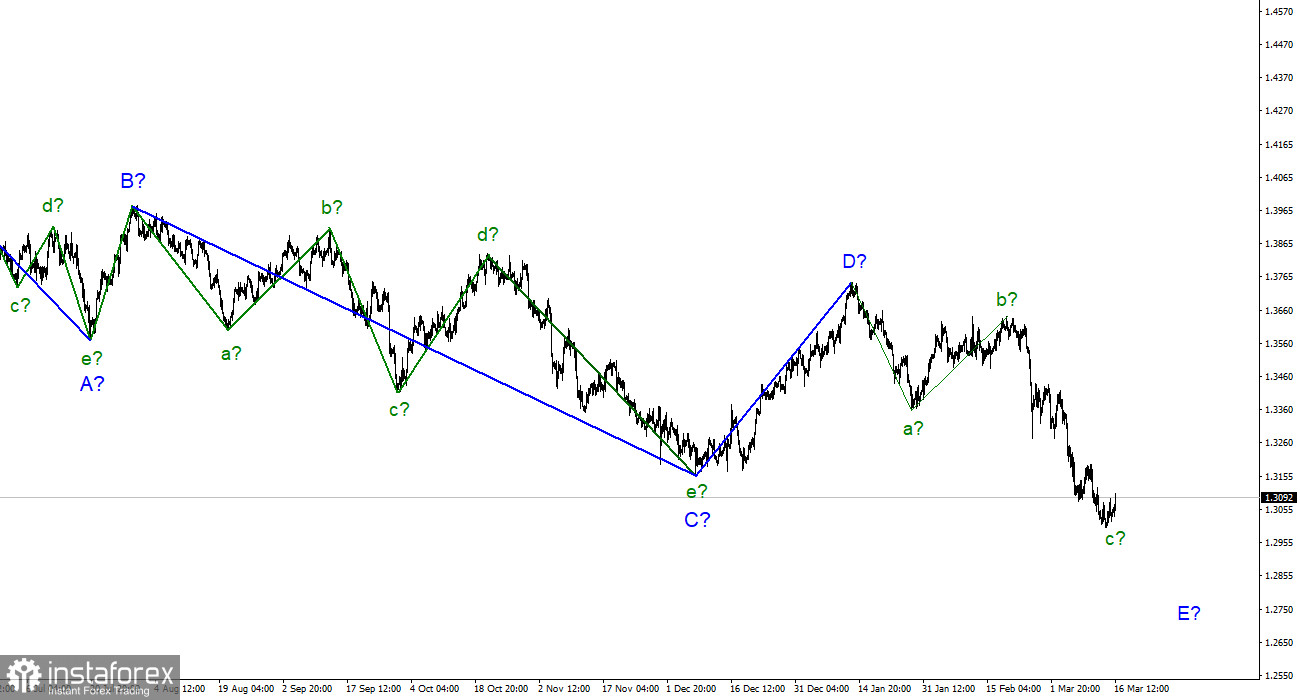

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The decline in quotes at the current time indicates the construction of a wave c in E, which is already getting very long. In total, there should be five waves inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for at least another month. At the moment, the quotes of the British are only slightly below the low of wave C. This indirectly suggests that the decline is just beginning, and the last descending wave E may turn out to be very long. A successful attempt to break through the 1.3041 mark, which equates to 76.4% by Fibonacci, may lead to an even greater increase in demand for the US currency. However, most likely, this option should be counted on already with the beginning of the construction of the wave e in E. I don't see any alternative options for wave marking yet. Everything is quite unambiguous. Geopolitical information also has a devastating effect on the British, but the decline of the British is fully consistent with the current wave markup.

The Bank of England may surprise the market.

The exchange rate of the pound/dollar instrument increased by 60 basis points during March 16. However, this increase in quotes is practically not noticeable on the chart and practically does not matter. Now, perhaps, the construction of a new corrective wave in the composition of E. However, the wave itself does not look fully equipped, which means that the decline in the British dollar may resume. Meanwhile, the market a day before the announcement of the results of the meeting of the Bank of England begins to increase the probability of an interest rate increase by 50 bps at once. Let me remind you that the same option is present today at the Fed. The reasons for this decision are the good state of the British economy, the growth of wages above forecasts, the fall in unemployment below forecasts.

At the same time, inflation in the UK continues to rise and may rise to the same 8% that America has already reached. Given that the Bank of England was the first to raise the rate and did it quite unexpectedly, there is a certain probability of an increase of 50 bp at once. However, I believe that the Bank of England, just like the Fed, will not take risks in a difficult geopolitical and economic situation for itself. The British economy looks good, although many predicted a long recession after Brexit. However, it is not as good as the American economy. For example, GDP in the fourth quarter in Britain grew by only 1% q/q. This is six times weaker than in the USA. Thus, I believe that the probability of a 50 bp rate increase is small. And an increase of 25 bp points will not come as a surprise to the market. Therefore, if we put all the arguments together, it turns out that the market should not be surprised either by the Fed rate hike or the Bank of England rate hike. If this is true, then the wave pattern should not change much after the meetings of the two central banks.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The instrument made two unsuccessful attempts to break the 1.3645 mark, but the third was successful. Therefore, I continue to advise selling the instrument, now with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the E wave does not look complete yet. Today and tomorrow, the news background will be very strong, it may lead to the beginning of the construction of a corrective wave d in E. In this case, it is recommended to resume sales after the completion of this wave.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.