The Canadian dollar continues to hold its own, imposing its game on the US currency. The loonie felt quite confident even during the recent dollar rally, relying on the growth of the oil market, the hawkish position of the Bank of Canada and the growth of key macroeconomic indicators. Today, the loonie received another reason for its strengthening: the data on inflation growth in Canada exceeded the expectations of experts, being in the "green zone". This release made it possible for USD/CAD bears to launch a counteroffensive, as a result of which the price fell to the base of the 27th figure. The Canadian currency is one of the few currencies that is able to oppose itself to the greenback in the current conditions. Therefore, it is advisable to use any more or less large-scale upward pullbacks here to open short positions.

Let me remind you that last Friday the "Canadian Nonfarm" was published, which also pleased the USD/CAD bears. All components of the release were released in the green zone, reflecting the growth of the Canadian labor market. In particular, the number of people employed in February in the country increased by 336,000, with a growth forecast of 120,000. The most important indicator not only got out of the negative zone, but also more than twice exceeded the forecast values, showing the best since October of the year before last. The unemployment rate also showed positive dynamics, falling to 5.5% (from the previous value of 6.5%). This is the lowest value since February 2020. The share of the economically active population has also increased. This indicator increased to 65.4%, whereas in the previous reporting period it amounted to 65.0%.

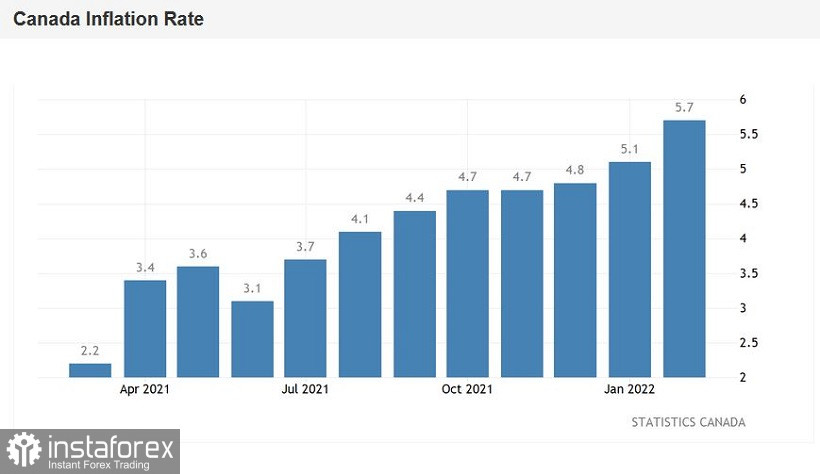

The inflation release today complemented the rosy fundamental picture. The overall consumer price index in Canada jumped to 1.0% on a monthly basis (the strongest growth rate since 2013) and to 5.7% in annual terms (this is the highest value of the indicator since 1991 (!)). The overall CPI exceeds the five percent mark for the second consecutive month, reflecting the strongest price pressure. However, core inflation also shows positive dynamics: the core consumer price index jumped to 4.8% year-on-year, updating the annual high.

All this suggests that the Bank of Canada will continue to tighten the parameters of monetary policy. Having raised the interest rate by 25 points on March 2, representatives of the Canadian central bank noted that further tightening of monetary policy is "obviously necessary." Today, this need was once again confirmed by the inflation release. Also, the head of the Bank of Canada, following the results of the March meeting, noted that he would continue the phase of reinvestment of the balance sheet, keeping the total stocks of Canadian government bonds "approximately at the same level."

There is no doubt that at the next meeting, which will be held on April 13, the Canadian central bank will again raise the rate by 25 basis points. This scenario is supported not only by macroeconomic reports (rising inflation and falling unemployment), but also by some other fundamental factors. For example, the situation on the commodity market also plays into the hands of the Canadian dollar, provoking further inflationary growth. In particular, today the quotes of WTI oil futures rose again during Asian trading. A barrel of oil of this grade is traded around $100 (for comparison, it is worth noting that at the beginning of the year the cost of WTI fluctuated in the range of $77-80).

All this suggests that the USD/CAD pair retains the potential for its further decline. The US dollar is no longer feeling as confident as it was in early March, when anti-risk sentiment in the markets went off scale. Today, the focus of dollar bulls is the negotiation process between Russia and Ukraine, which, according to some reports, has moved forward. For example, according to the Financial Times, the negotiators have made "significant progress" in preparing a compromise plan that allegedly includes 15 points. These points, according to the newspaper's insiders, are now being discussed and agreed upon.

This informational background reduced the level of anti-risk sentiment in the foreign exchange market, simultaneously putting pressure on the US currency. This circumstance allowed the USD/CAD bears to organize an offensive, as a result of which the price fell to the bottom of the 27th figure.

In my opinion, the priority for the pair remains with short positions, so it is advisable to use the northern pullbacks to open short positions. From a technical point of view, sellers were unable to impulsively break through the support level of 1.2705 (the upper limit of the Kumo cloud on the daily chart) to enter and settle in the 26th figure. Therefore, it is advisable to go into sales only after overcoming this price barrier. In this case, the next target for the southern movement will be 1.2640, whi