The Federal Reserve, as expected, raised the interest rate to a range of 0.25% to 0.50%. This is the first interest rate hike since 2018. Then the dollar began to strengthen. But the scale of growth turned out to be so ridiculous that it is just right to look at it through a microscope. Then, already against the backdrop of chairman Jerome Powell's speech, the dollar began to fall in price again, having fully won back the previous growth. And if you take into account Powell's words, then such behavior is simply contrary to common sense.

It's all about the Fed's updated forecast. And the point here is not the rate of economic growth, which was lowered for obvious reasons. The consequences of the sanctions confrontation, which began immediately after the special operation of the Russian Federation in Ukraine, will be felt by absolutely all countries of the world. Some to a greater extent, and some to a lesser extent. But even in the best of circumstances, we are talking at least about a slowdown in economic growth. True, it is somewhat surprising that the Federal Reserve System revised its forecasts for economic growth rates only for the current year, while further forecasts remained unchanged. Perhaps this confused many.

Especially if you pay attention to the new forecasts for the interest rate. The previous forecast stated that at the end of this year the interest rate should have been at the level of 0.75% - 1.00%. Now it has been revised to 1.75% - 2.00%. But this is only the beginning. Previously, it was expected that at the end of 2023 the rate would be in the range of 1.50% - 1.75%, while now the forecast has been raised to 2.75% - 3.00%. Exactly the same forecast for 2024. Although back in December the regulator predicted interest rates at the level of 2.00% - 2.25%.

In other words, we are talking not just about a large-scale revision of forecasts, but about the strongest and most rapid tightening of monetary policy in several decades. In less than two years, the rate should be raised from the current 0.50% to 3.00%. And by the end of this year, by 1.50% at once. Given that there are only six meetings left this year, it turns out that the interest rate will be increased by 0.25% during each meeting of the Federal Open Market Committee.

According to these forecasts, we should have seen a steady growth of the dollar. But instead, we see movement in the opposite direction. Even if it is insignificant. It is quite possible that this is a slight bewilderment and shock. The changes are so radical that market participants need time to realize this fact. And as soon as it comes, everything will immediately fall into place and the dollar will resume a confident upward trend.

The EURUSD currency pair has been moving along the psychological level of 1.1000 for several days in a row. This swing signals a characteristic uncertainty among market participants that calls into question the recent upward momentum. Thus, the price concentration along the psychological level may remain for some time until the main direction is determined in the market.

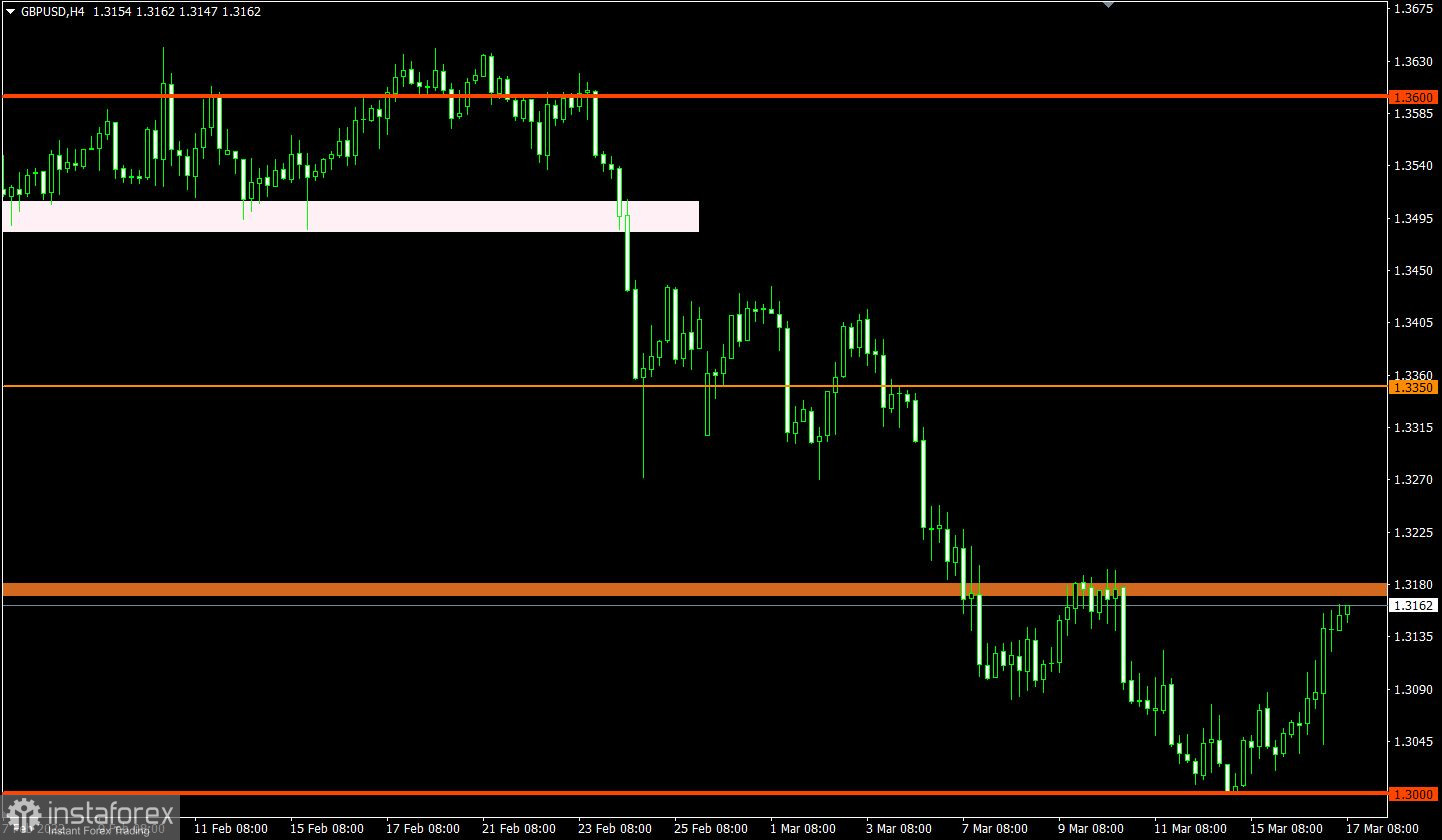

The GBPUSD currency pair managed to strengthen by more than 150 points from the support level of 1.3000. This move indicates a full-length corrective move that is still in play in the market. Now the resistance level of 1.3200 stands in the way of buyers, which may put pressure on long positions. In order for the correction to be prolonged, the quote needs to stay above the control level. Otherwise, price stagnation is not ruled out.