Buy on rumor, sell on news

Hi, dear traders!

Yesterday, the Federal Reserve made its decision on interest rates and published its updated economic outlook. It was followed by a press conference held by Fed chairman Jerome Powell.

The Federal Open Markets Committee raised the Fed funds rate by 25 basis points. The new target range for the interest rate is 0.25-0.50%. 8 out of 10 members of the FOMC Board of Governors voted for a 25 basis point increase. Jim Bullard, president of the Federal Reserve Bank of St. Louis, voted for a 50 basis point hike. The regulator noted major risks and factors creating uncertainty for the US economy, such as high inflation and Russia's war against Ukraine. New Fed projections showed a median interest rate of 1.9% this year and 2.8% for the next two years, up from 0.9% and 2.8% respectively in December. The median inflation projections were revised upwards to 4.3% compared to 2.6% in December. Inflation is expected to fall to 2.7% by the end of 2023 and reach 2.3% in 2024, approaching the target of 2%.

During his press conference, Fed chairman Jerome Powell stated there could be a possibility of seven interest rate hikes at each of the remaining seven policy meetings. Powell said the regulator was ready to raise interest rate more quickly if necessary. The Fed chairman was more optimistic on inflation – despite revised economic forecasts, he sees inflation begin to decline at the end of 2022. "The committee really does understand that the time for rate increases and for shrinking the balance sheet has come. As I looked around the table at today's meeting, I saw a committee that's acutely aware of the need to return the economy to price stability and determined to use our tools to do exactly that," Powell told journalists. He noted that inflation could be accelerated by several risks: supply chain disruptions, high energy prices, and Russia's war against Ukraine.

Market reaction

The Fed's policy decision and clear hawkish tone matched market expectations, but EUR/USD still ended up under bearish pressure. Traders possibly followed the old "Buy on the rumor, sell on the news" rule, or expected a 50 basis point increase. The decision has already been priced-in by the market. As a result, traders started closing long USD positions and taking profit.

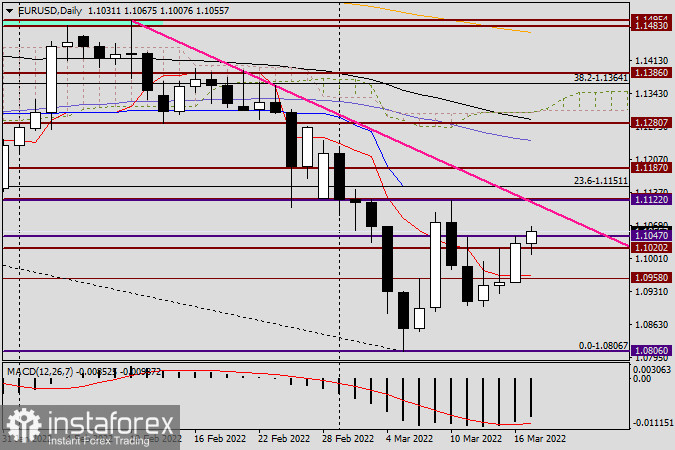

Daily

The pair closed on Wednesday in positive territory, finishing the session above the psychological level of 1.1000 and resistance at 1.1020. At the time of writing, EUR/USD surpassed yesterday's high of 1.1047 and was trading near 1.1067. The pair has upside potential – if it moves upwards, it could move into the 1.1100-1.1120 range. Short positions can be opened in this area at lower timeframes, if candlestick sell signals appear. The rally seems to be only temporary, and opening long positions at this point could be quite risky.

Good luck!