Hi, dear traders!

On Wednesday, EUR/USD continued to rise towards 1.1050. Yesterday's price movement did not match the event that happened on March 16. The Federal Reserve held one of its most important meetings in years, agreeing on a series of interest rate increases. According to Jerome Powell, there could be 6 rate hikes in 2022 – one at each Fed meeting. It is a strong hawkish factor for the dollar. However, traders realize that inflation in the US could very well surpass the current level of 7.9%. Powell noted that the US economy lacked price stability, but it was very strong and would not enter a recession after the interest rate hike. However, the current GDP growth upsurge is unlikely to be significantly slowed down by even several rate hikes.

Nevertheless, USD failed to find support from traders yesterday. At this point, inflation is the most significant issue – traders do not believe that the new Fed policy could return inflation to the 2% target. Low unemployment and the strong state of the labor market is pushing up prices, Powell said yesterday. Amid low unemployment, employers are forced to raise wages to prevent them from leaving to a different employer offering higher wages. It leads to more consumer spending, boosting demand for goods and services, and allowing manufacturers and retailers to increase prices. Another factor boosting inflation is rising commodity prices, such as crude oil and natural gas. The ongoing problem with inflation is more of a structural issue and not an issue related to monetary policy.

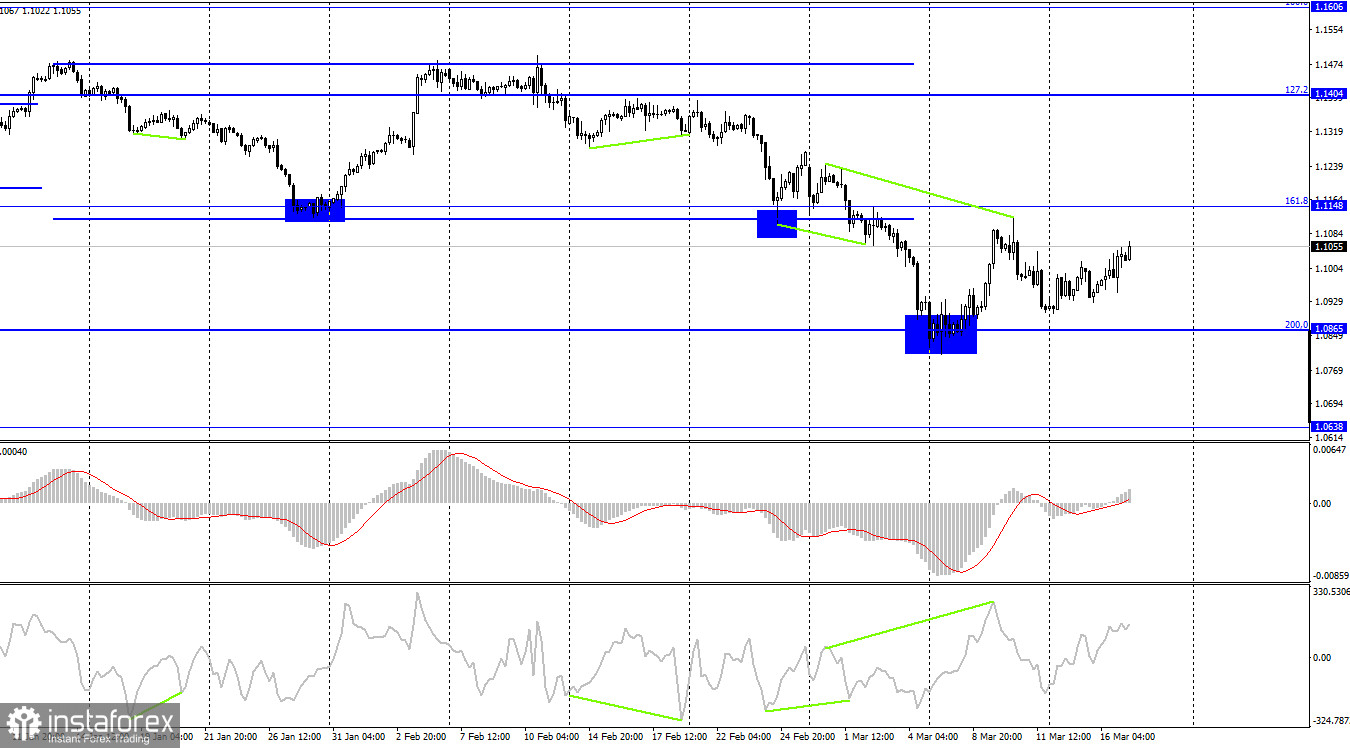

According to the H4 chart, the pair reversed upwards towards the retracement level of 161.8% (1.1148). If EUR/USD bounces off this level downwards, it could fall towards the Fibo level of 200.0% (1.0865). Indicators show no signs of emerging divergences today.

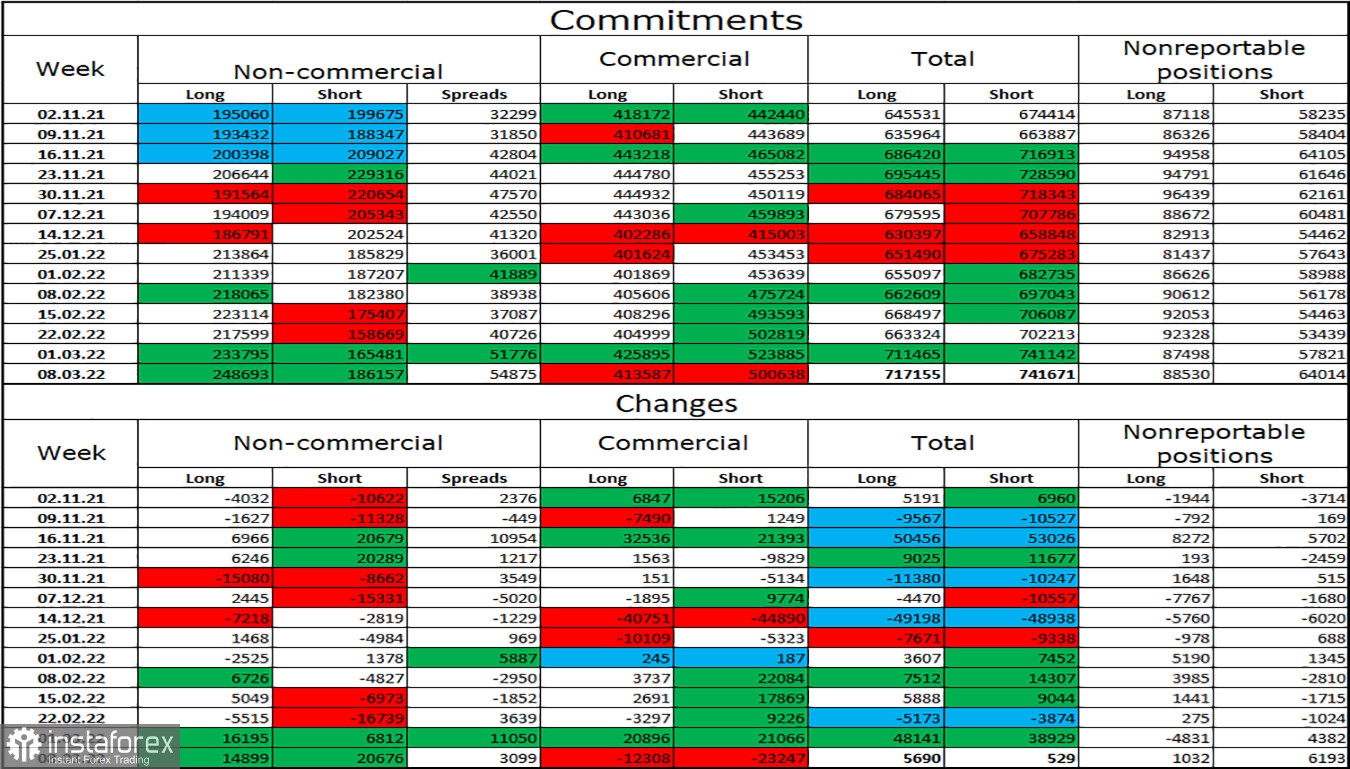

Commitments of Traders (COT) report:

In the last week covered by the report, traders opened 14,899 Long positions and 20,676 Short positions, indicating major market players are now less bullish. The total amount of open Long positions is now 248,000 against 186,000 Short positions. Overall, the mood of Non-commercial traders is very bullish and could push EUR up. However, recent events strongly support USD. Geopolitical factors have the most influence on the European currency, which is tumbling despite the increasingly strong bullish sentiment of major market players over the past several months.

US and EU economic calendar:

EU – Speech by ECB president Christine Lagarde (09-30 UTC).

EU – CPI data (10-00 UTC).

US – Initial and continuing jobless claims report (12-30 UTC).

US – Industrial production (13-15 UTC).

There are only two relatively important events today. EU's inflation data for February is due today – traders expect inflation to reach 5.8%. The speech by Christine Lagarde is not really notable now, one week after the ECB meeting.

Outlook for EUR/USD:

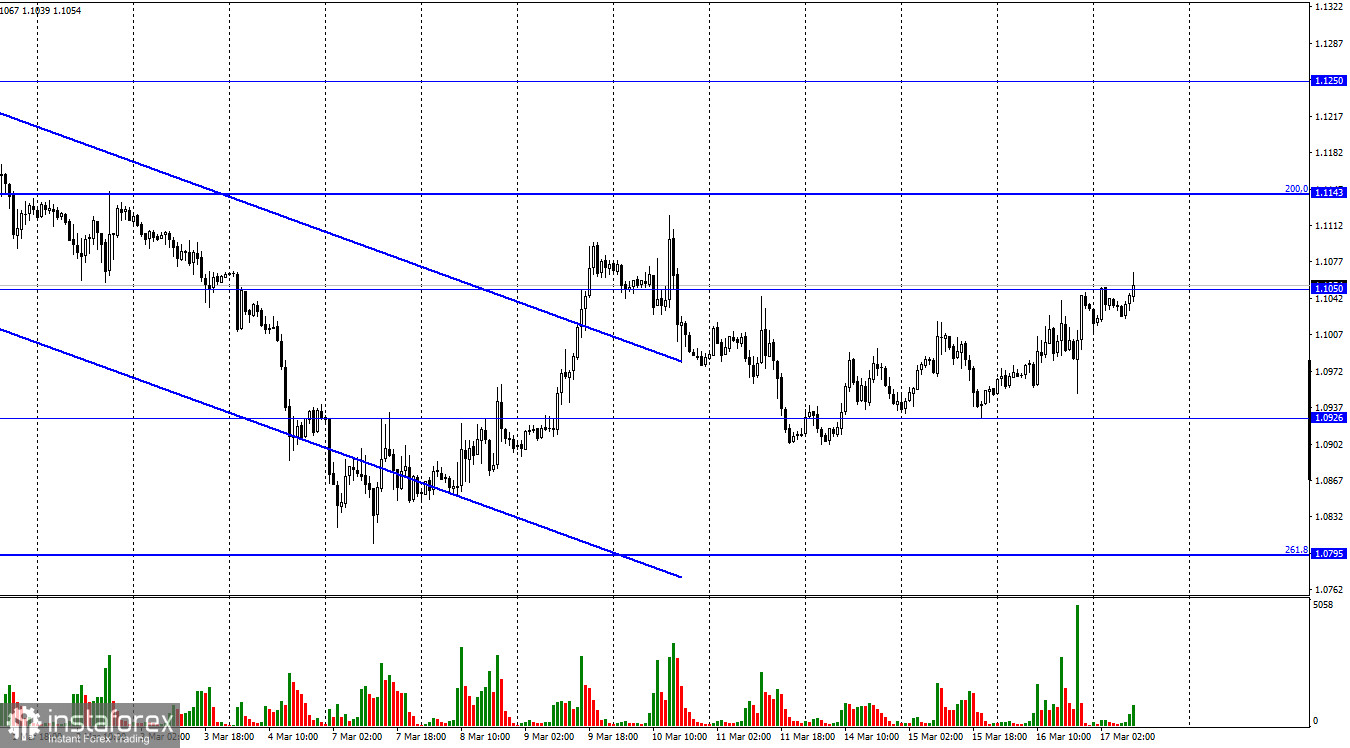

Traders are recommended to open new short positions if the pair bounces off 1.1050 with 1.0956 and 1.0865 being targets. Long positions could be opened if the pair closes above 1.1050 with 1.1143 being the target.