Long positions on EUR/USD:

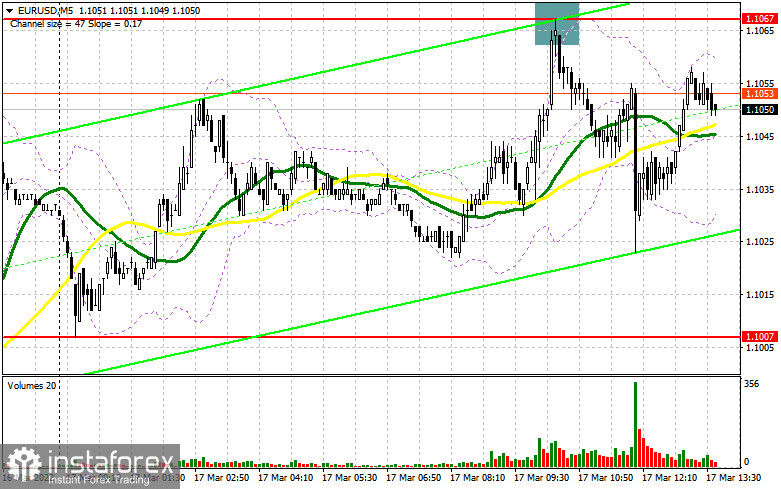

In my forecast this morning, I drew your attention to the level of 1.1067 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze what happened. In the first half of the day, euro buyers pulled the pair to 1.1067 but did not manage to break through this level. The bullish momentum after yesterday's meeting of the Federal Reserve System has declined. A false breakout at 1.1067 formed a sell signal, but a large sell-off did not occur. After a 40-pips decline, the pressure on the euro also eased. The pair was trading within the morning sideways channel. In the second half of the day, the technical pattern has not changed.

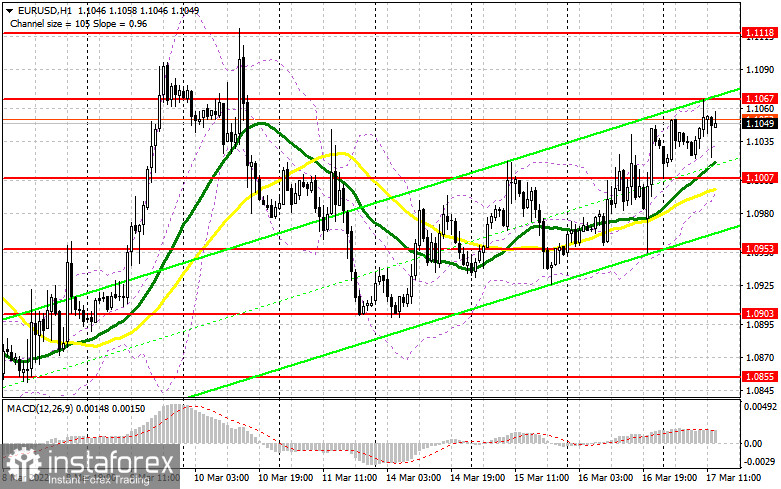

Markets are assessing yesterday's Federal Reserve meeting, which met all economists' expectations. It's hard to call traders' activity low in the first half of the day, as volatility was quite moderate amid the lack of new fundamental statistics on the euro area. In the second half of the day, it is better to focus on the data on the US economy. The big releases are reports on building permits and housing starts in the USA. I expect a bigger movement after the release of the Industrial Production data, which may lead to a retest of resistance at 1.1067, which might be worse than expected. Bulls have a chance to establish a further bullish correction and test resistance at 1.1067. However, bulls need to hold the price above support at 1.1007, which was formed yesterday. Below that level, there are moving averages, which should also support the further strengthening of the EUR/USD. Only a false breakout of this level will form the first entry point into long positions. In order to see a major increase in the EUR/USD, we need more activity from bulls and a breakthrough of resistance at 1.1067. A top/bottom test of this level will give a buy signal and the pair may rebound to resistance at 1.1118, which may change the balance of power in the market in favor of bulls. The next target is a high of 1.1165, where traders may lock in profits. A breakthrough of this level will cancel the bearish trend and trigger sellers' stop-orders, opening a direct way to the highs at 1.1227 and 1.1271. However, this scenario can be counted on with another good news on the progress in the negotiations between Russia and Ukraine. This will lead to the reduction of geopolitical tension and increase demand for risky assets. If the pair falls and there is a lack of bulls' activity at 1.1007, it would be better to postpone opening long positions. A false breakout of the low around 1.0953 would be the best buy scenario. The best way for opening longs is from 1.0903 allowing an upside correction of 30-35 pips.

Short positions on EUR/USD:

Bears did a great job this morning, allowing the pair to make some gains on the rebound from 1.1067. Sellers of the euro need to keep thinking about how to hold the price below this level and only strong data of the industrial production in the US might lead to a bigger downtrend in the pair. A false breakout at 1.1067 may form another sell signal, with the target at the support of 1.1007. Probably, the breakthrough of that area may happen only in case of another market reversal in order to trigger some stop-loss orders of the speculative buyers, who were gaining long positions after yesterday's FOMC meeting. A reverse test of 1.1007 may happen, which will give an additional signal for opening short positions, and the potential for falling to the levels of 1.0953 and 1.0903. The next target is located at a new low of 1.0855. If the euro grows and there is a lack of activity of bears at 1.1067, bulls may start to accumulate long positions. After the expected rate hike from the ECB in October and a more aggressive policy of the European regulator, it is good news. In this case, it is better not to rush to sell. The optimal scenario would be to open short positions if a false breakout occurs around 1.1118. Selling the EUR/USD on the rebound is possible from 1.1165 or 1.1227, allowing a downward correction of 15-20 pips.

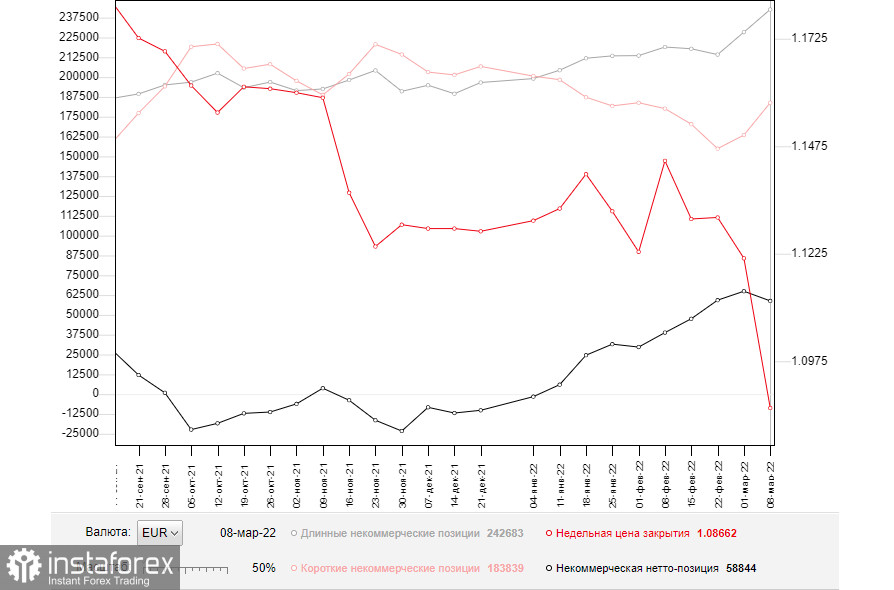

The COT (Commitment of Traders) report for March 8 recorded an increase in both long and short positions. It was expected that amid Russia's military special operation in Ukraine, there were more sellers, which led to a reduction in the positive delta. However, what is surprising is that amid a major drop in the euro, buyers have not given up and continued to actively accumulate long positions, taking advantage of attractive prices. Last week, the European Central Bank held a meeting where the regulator revealed its policy in more detail. This also adds confidence to buyers of risky assets in the current difficult geopolitical environment. Christine Lagarde announced the ECB planned to more aggressively roll back measures to support the economy and raise interest rates. It formed a strong bullish medium-term signal for euro buyers. This week we have the Federal Reserve meeting and how the US regulator will behave amid the highest inflation rate over the last 40 years is a big question. Although Russia and Ukraine are negotiating, so far these meetings have not yielded any particular results. Against this background, it is better to keep buying the US dollar, as the bearish trend of the EUR/USD pair is still there. The COT report shows that long non-commercials rose to 242,683 from 228,385, while short non-commercials rose to 183,839 from 163,446. At the end of the week, total non-commercial net positions were down to 58,844 against 64,939. The weekly closing price dropped to 1.0866 from 1.1214.

Indicator signals:

Trading is conducted above the 30 and 50 moving averages, which indicates active purchases of the euro in the short term.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the indicator's lower boundary at 1.1000 may increase the pressure on the euro. A breakthrough of the upper boundary of the indicator at 1.1075 is likely to push the pair to the upside.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.