The euro is steadily growing on Thursday thanks to the hopes of bidders for the implementation of negotiations between Russia and Ukraine. But the decision of the US Federal Reserve to raise rates in the country did not make a significant impression on the market.

The fighting on the territory of Ukraine has not stopped for the fourth week, while the advance of Russian troops on the territory of the country continues. The most fierce battles have recently been fought near the southern city of Mariupol, where the drama theater building was blown up today. Women and children took shelter from the shelling in the bomb shelter of this building. There was no data on deaths after the explosion at the time of writing this material. The Russian side categorically denies that the attack on the theater was carried out by its armed forces. Recall that the Russian government insists that the Russian army is aimed at destroying exclusively military facilities, not civilian ones. The president of Russia constantly reminds people that this military operation is aimed only at fighting the armed national battalions of Ukraine, and not at civilians.

It is important that today Mariupol, like many other cities where hostilities continue, is in a state of humanitarian catastrophe, when hundreds of thousands of civilians have been living in basements without food, water and electricity for several weeks. Humanitarian corridors, which, apparently, were the result of previous negotiations, allowed one part of civilians to finally leave the combat point. At the same time, a considerable part of the civilian population is forced to remain in the besieged Mariupol, as the exit from the city is blocked. According to the Russian media, Ukrainian armed battalions are blocking the exit from the city, as they regard the civilian population as a human shield. In turn, the Ukrainian authorities criticize these reports and accuse the Russian army of blocking humanitarian corridors.

At the same time, the Kremlin said that negotiations with the Ukrainian side were continuing on Thursday via video link. They will address not only military and political issues, but also humanitarian ones, namely the exit of the civilian population through special safe corridors and, most likely, the exchange of prisoners. The messages that appeared in the information field about the continuation of negotiations between the warring parties are perceived by the market as a breath of fresh air. Even the very possibility of negotiations between representatives of Russia and Ukraine gives bidders hope for an early settlement of the conflict. And this settlement is extremely important today for the entire foreign exchange market, which is still in deep ignorance about the energy crisis in Europe. Obviously, this crisis would be inflationary and would have to do with the exchange rate for many reasons. Although the negotiations between Russia and Ukraine symbolize a very fragile peace today, they are extremely important in this regard.

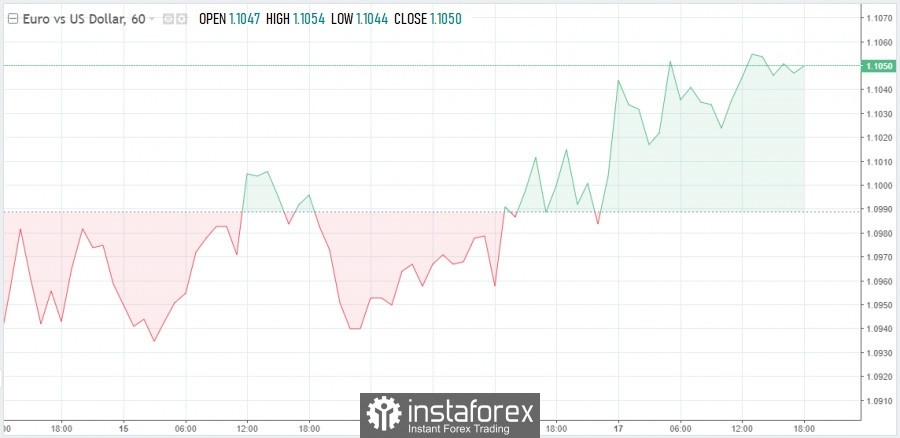

The hope that appeared on the market against the background of news about the negotiations gives the single European currency a head start for growth. As a result, the EUR/USD pair broke through the 1.1000 level today on general optimism and gained a foothold above it, which activates the correction scenario and makes us wait for further growth with a target of 1.1145.

A very hawkish FOMC meeting took place yesterday, at which it became clear that American politicians are quite ready to step up their fight against inflation. The Fed, as expected, raised the refinancing rate from 0.25% to 0.50%. Recall that this is the first increase in the interest rate since 2018.

Most American politicians during the Fed meeting predicted that the federal funds rate increase would occur to the range of 1.75-2% by the end of this year. However, it is worth admitting that yesterday's market reaction was not particularly strong, which suggests that investors were already ready for such a development. Unsupported by a strong news background and traders' optimism, the dollar index, which measures its strength against six traded currencies, fell 0.3% on Thursday. By the time the material was prepared, USDX quotes were at 98.38.