The Fed raised the federal funds rate for the first time since 2018. It is expected that at each of the remaining meetings in the current year, the rate will rise by 0.25%. The QE program ends in March, and a decision is expected to start reducing the Fed's balance sheet (probably, the first stage will be the refusal to reinvest redeemable securities). Forecasts have been changed for the worse: GDP growth has been reduced for 2022 to 2.8% vs. 4.0% in December, inflation, on the contrary, is expected to be higher at 4.3% vs. 2.6%.

The markets reacted with the growth of the dollar, which is natural, but a day later the dollar lost ground across the entire spectrum of the foreign exchange market, which looks a little strange against the backdrop of the obviously hawkish results of the Fed meeting. But there is an explanation for this.

If everything is more or less clear in terms of rate hikes, and unless something super unexpected happens, the rate will grow at a rate calculated by the markets long ago and with clear consequences, then the expected reduction in the Fed's balance sheet carries too many uncertainties.

The pace at which the Fed's balance sheet will be reduced from the current 9 trillion will become clear after the next extended meeting on May 4. The main danger that is now being exaggerated by the markets is that a reduction in the balance sheet will lead to an increase in rates, and higher rates usually lead to a fall in the stock market due to the flow of capital.

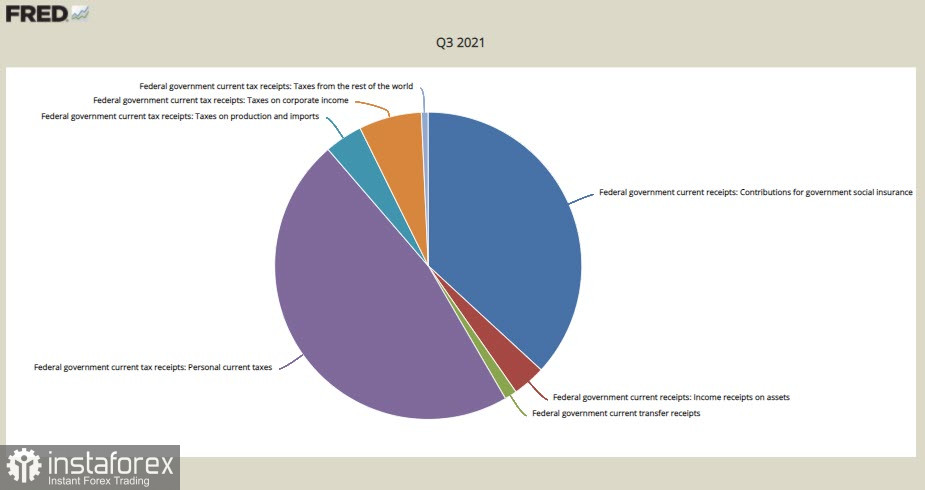

But there is another, yet hidden, but no less serious consequence. The structure of taxes collected by the U.S. government critically depends on two components: from personal taxes (personal current taxes), in Q3. In 2021, they accounted for 47.1% of all taxes collected, and from contributions for government social insurance, their share was 36.9%.

Other sources of revenue, such as export earnings or taxes on corporate income, make up a much smaller amount in the total revenue structure. Accordingly, the government's revenues critically depend on the expenditures of citizens, and expenditures - on their own incomes.

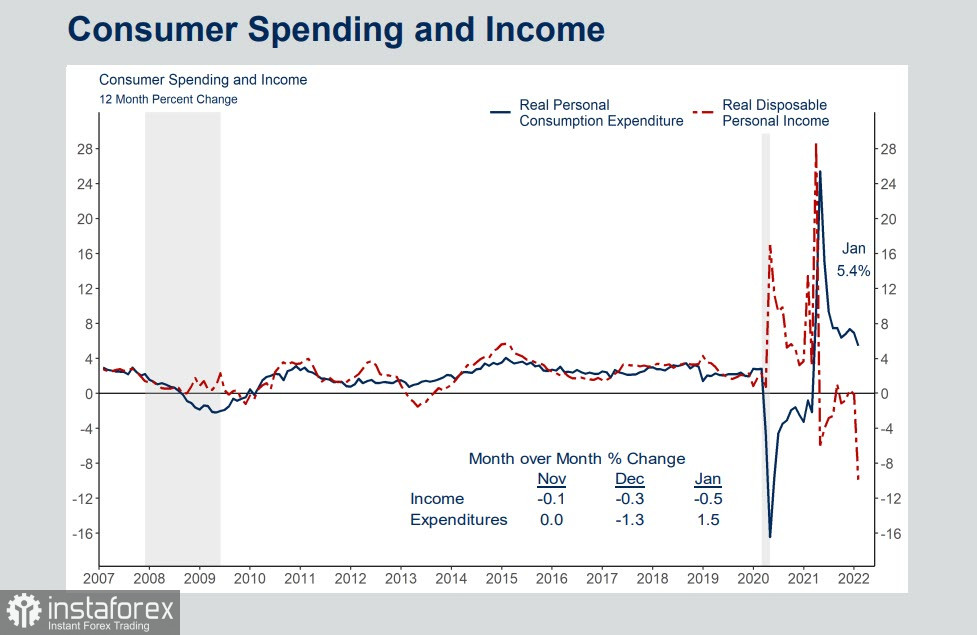

And if we look at the dynamics of income and expenses, we will find that the situation is not just bad, but very bad. The coronavirus pandemic has brought a sharp drop in spending due to lockdowns being put in place, while disposable income has skyrocketed as the government has provided significant support funds. This excess spending was formalized in the form of public debt, which, in turn, was largely bought out, including by the Fed, through the purchase of government bonds.

At the current stage, both expenses and especially incomes are going down. This means an obvious threat of lower tax revenues in the near future.

In 2020, the U.S. budget deficit amounted to 14.9% of GDP against -4.6% a year earlier, the reason for such a sharp increase was both a drop in revenue from anti-COVID measures and an increase in spending due to support for the economy and the population. In 2022, the deficit fell to 12.4% of GDP, which is also extremely large, and was covered by the growth of public debt, which reached 30 trillion.

The Fed's plans to increase the rate and start reducing the balance sheet will lead to increased pressure on the U.S. budget in two directions at once. An increase in the rate will increase profitability, which means an increase in the cost of servicing the public debt, interest payments will increase significantly, which means that the volume of public debt will continue to grow, since it is not possible to stop the fall in real incomes of citizens in the short term. The growth of debt, in turn, forces us to look for sources of its financing, and as soon as the Fed begins to reduce the balance sheet, the question will arise of who will be the main buyer of U.S. government debt in the coming years.

Forecasts about the growth of the dollar against the backdrop of high rates of Fed rate hike will not be justified. The need to curb inflation by rigid monetary methods repeatedly increases the risk of recession, and a drop in budget revenues will activate a negative feedback mechanism as borrowing rates will have to be increased to service the growing debt.