Yesterday, US stock futures posted their third consecutive day of gains, while Asian stocks remained unchanged as traders received mixed signals from Russia-Ukraine peace talks that pushed oil above $100 per barrel.

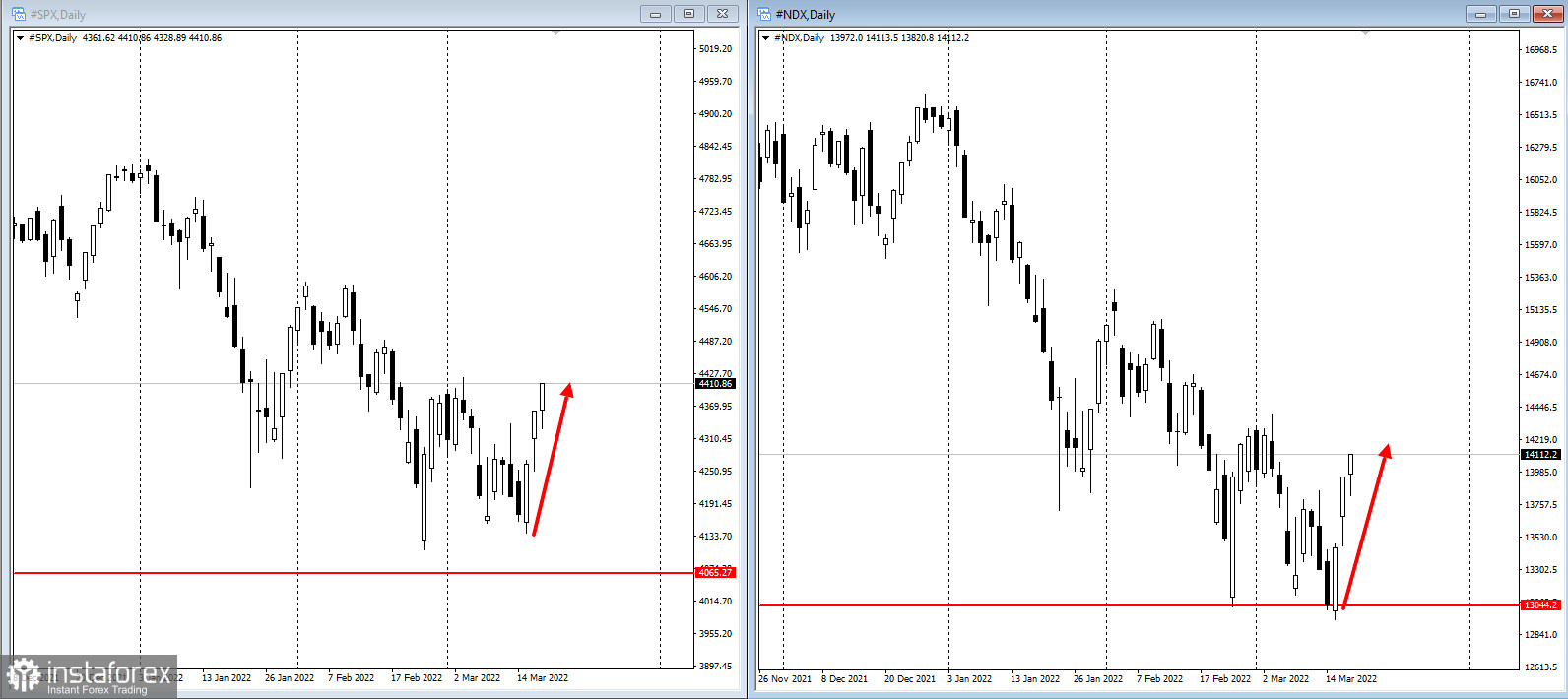

The S&P 500 and Nasdaq 100 indices rallied for a third straight day:

Chinese tech stocks rebounded from session lows and mainland Chinese stocks increased as the government promised to propose supporting measures for the market. There was speculation that the country's central bank might soon ease monetary policy.

The special operation of the Russian military forces in Ukraine and the sanctions imposed against Russia continue to influence market sentiment. JPMorgan processed interest payments sent by the Russian government for the country's bonds, boosting investor expectations that Moscow would avoid defaulting on its debt.

Treasuries and the US dollar were steady, while commodity-linked currencies advanced. The yen fell against the US dollar to its lowest level in six years after the Bank of Japan left rates unchanged today.

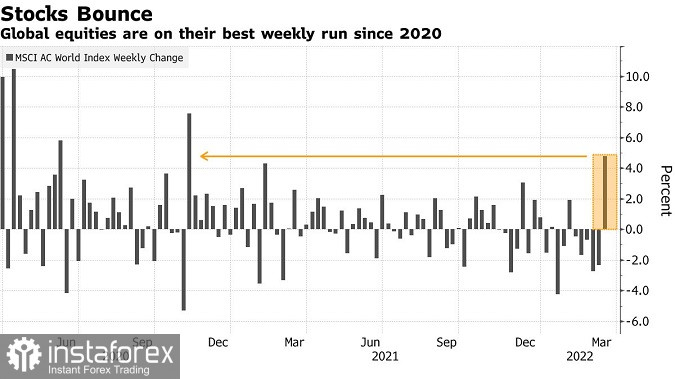

Global stocks have rebounded in recent days, putting them on course for their best week since November 2020. This suggests that some of the worst fears about an inflationary commodity shock and military actions have eased.

"I don't necessarily expect the rest of the year to be that easy," said Lori Calvasina, head of US equity strategy at RBC Capital Markets LLC, on Bloomberg television. "Volatility is likely to remain elevated for some time."

US President Joe Biden and Chinese President Xi Jinping are set to discuss the situation in Ukraine today. The Biden administration is concerned that Xi Jinping may be moving closer to supporting Moscow. According to Secretary of State Antony Blinken, Biden is expected to try to persuade his Chinese counterpart to back away from any support for Russian President Vladimir Putin and warn of serious consequences of such a decision.

US lawmakers have voted to suspend normal trade relations with Russia, paving the way for the US government to impose higher tariffs on Russian goods. Meanwhile, S&P Global Ratings has cut Russia's credit score, saying the country's debt is "highly vulnerable to nonpayment."