To open long positions on GBP/USD, you need:

In my morning forecast, I paid attention to the level of 1.3144 and recommended deciding on entering the market. Let's look at the 5-minute chart and figure out what happened. The pound's decline to the area of 1.3144 and the formation of a false breakdown there led to the formation of an excellent entry point into long positions in the continuation of the pair's growth at the end of the week, but the obvious enthusiasm of speculative players was not supported by large market participants, so after moving up by 10 points, the bears achieved a breakdown of 1.3144, which led to fixing losses. Closer to the afternoon, the reverse test 1.3144 from the bottom up led to the formation of a signal to open short positions. But after moving down by 25 points, the pressure on the pound also decreased. And what were the entry points for the euro this morning?

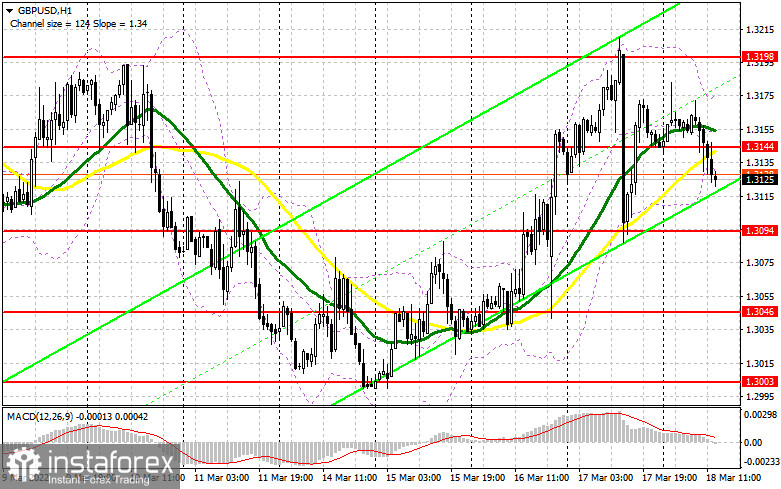

Yesterday's decision by the Bank of England on monetary policy limits the upward potential of the pair, as the regulator did not say anything good, expressing some concerns due to excessively high inflation and an overheated labor market, which itself has overheated with stimulating measures. The lack of positivity in the geopolitical arena, which was visible at the beginning of the week, also repels those who want to buy the pound at the end of this week. News has already appeared that Putin discussed with German Chancellor Scholz the course of the Russian special operation in Ukraine, saying that Moscow is ready to continue the search for solutions in line with its principled approaches at the talks. Also tonight, the Russian president will hold a telephone conversation with Macron. In case of a decline in the pair in the afternoon, it is very important not to miss the level of 1.3094, in the area in which the market reversal took place yesterday. Long positions from it can be considered only after the formation of a false breakdown, as well as after weak fundamental statistics on the American economy. An equally important task for the bulls will be to return the resistance 1.3144 under control. Fixing above this range with an update of this area from top to bottom will allow buyers to get to the area of this week's maximum - 1.3198. It is unlikely that there will be those who want to buy higher, so I recommend fixing profits there. The 1.3244 area will remain a longer-range target. In the scenario of a decline in GBP/USD during the US session and the absence of bulls at 1.3094, it is best to postpone purchases against the trend until the next support - 1.3046, this is a more reliable level. But I also advise you to open long positions there only when a false breakdown is formed. You can buy GBP/USD immediately on a rebound from 1.3003, or even lower - from a minimum of 1.2966, counting on a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears coped with the task and dragged the pair below 1.3144, but it never came to a major drop. The priority goal of sellers for today remains the protection of 1.3144. In case of growth and a false breakdown at this level after the data on the volume of housing sales in the US secondary market and the index of leading indicators, I recommend opening short positions to reduce to the support of 1.3094. A breakout and a reverse test from the bottom up and this range will form an additional sell signal, which will give a direct path to the lows of 1.3046 and 1.3003, where I recommend fixing the profits. However, such a scenario is unlikely, as high volatility is not expected in the afternoon. In case of GBP/USD growth in the afternoon and lack of activity at 1.3144, and most likely it will be, it is best to postpone sales to a major resistance of 1.3198. I also advise you to open short positions there in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3244 or even higher - from a maximum of 1.3275, counting on a correction of the pair down by 20-25 points within a day.

The COT reports (Commitment of Traders) for March 8 recorded a sharp increase in both long and short positions. Some took advantage of the panic in the market, others had attractive prices. However, there were more of those who increased short positions, which led to an increase in the negative delta. This week, we will have a meeting of the Federal Reserve System, and how the American regulator will behave in the conditions of the highest inflation in the last 40 years is a big question. A more active policy on interest rates will increase the demand for the US dollar, which is already trampling the British pound almost every day to the next annual lows. We also remember that although Russia and Ukraine have sat down at the negotiating table, so far these meetings do not give any special results. Against this background, I recommend continuing to buy the dollar, since the bearish trend for the GBP/USD pair has not gone away. The only thing that now saves the pound from a major sell-off is high inflation in the UK, which will force the Bank of England to act more actively as well. The very next day after the Fed meeting, the Bank of England will hold a meeting. This is where a reversal of the pound may occur in the opposite direction, so when selling at the lows of GBP/USD, think about tomorrow. The COT report for March 8 indicated that long non-commercial positions increased from the level of 47,679 to the level of 50,982, while short non-commercial positions increased from the level of 48,016 to the level of 63,508. This led to an increase in the negative value of the non-commercial net position from -337 to -12,526. The weekly closing price dropped to 1.3113 against 1.3422.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates market uncertainty at the end of the week.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3129 will increase the pressure on the pound. A break of the upper limit of the indicator in the area of 1.3170 will lead to the growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.