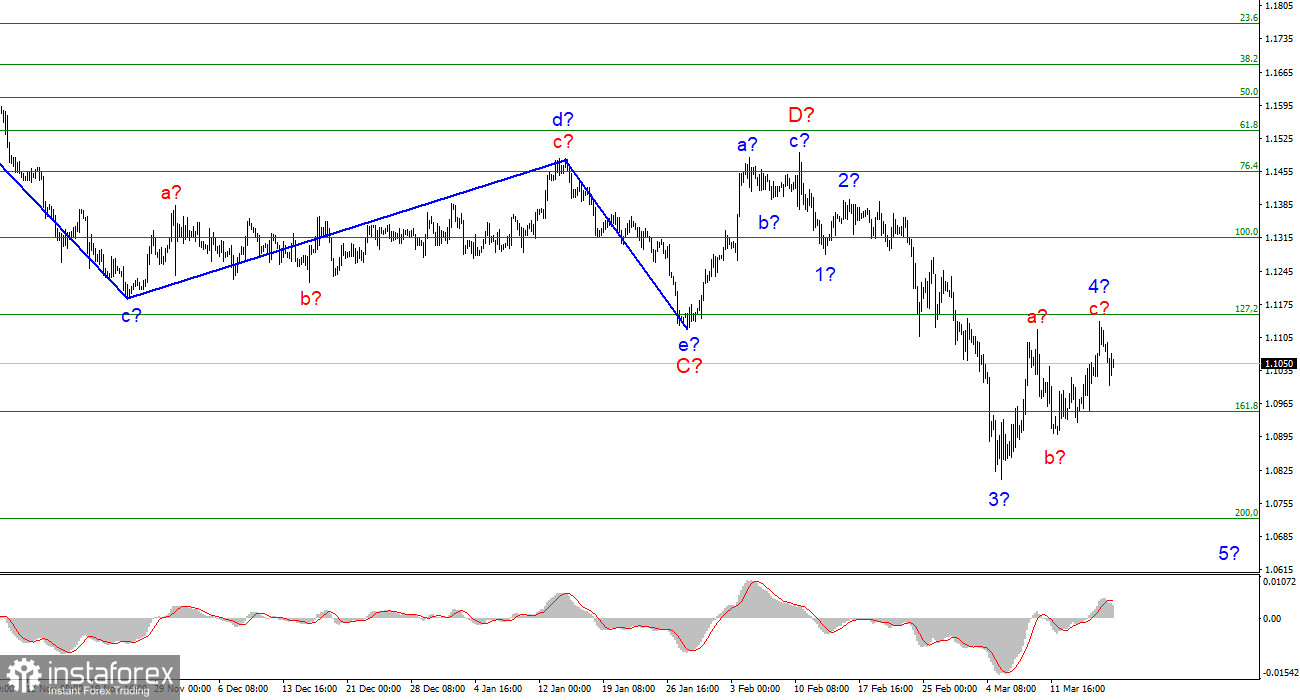

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. At this time, the construction of the proposed wave E is continuing, which should take a five-wave form. The low of the previous wave was broken, thus building a downward trend section. Since wave E has already taken on a sufficiently extended form, a scenario appears in which the construction of this wave will soon be completed. However, so far, the internal wave marking of wave E indicates that wave 4 has now been completed, and the construction of wave 5 has begun. Wave 4 has taken a clear three-wave form and is much more massive than the corrective wave 2. However, if it becomes even more complicated, it may cast doubt on the further decline in the quotes of the instrument. This wave can also take the five-wave form a-b-c-d-e, but in this case, it will be knocked out of the general wave pattern. Therefore, I expect that the decline in quotes will resume next week with targets located near the 7th figure. I am not considering alternative options yet, since there are no serious violations in the current wave marking.

The euro currency took advantage of a temporary respite.

The euro/dollar instrument fell by 50 basis points on Friday. The decline was weak enough, however, it is still enough to suggest a transition to the construction of a descending wave 5. If this is true, then the decline will continue in the coming weeks. From my point of view, the decline should have started much earlier, but the Fed meeting this week led to a rather contradictory market reaction. I expected to see an increase in the dollar, not the euro, given that the rate was raised by 25 basis points, and Jerome Powell announced six more interest rate hikes this year. But, perhaps, the market was originally programmed to build a three-wave wave 4. If so, now this plan has been implemented and now it is possible to start new sales.

Separately, I would like to note that there has been little geopolitical news in recent days. I mean those that could lead to a de-escalation of the conflict in Ukraine. Several important speeches have taken place, several important telephone conversations have taken place, but it seems that world leaders are voicing a maximum of 5% of what they discuss with other world leaders. The most important news now is the refusal to close the skies over Ukraine by NATO, Macron's statement about the need to prepare for World War III, Washington's statement that he does not see Moscow's real efforts to reach a peace agreement, London's statement that Moscow is preparing a second wave of offensive, as well as Xi Jinping's statement that Peace should be restored in Ukraine. But all this news, as you understand, does little to restore peace in Ukraine. Thus, the market still has all the necessary grounds to buy the US currency again, in accordance with the current wave markup.

General conclusions.

Based on the analysis, I conclude that at this time the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave layout still allows for the construction of a wave 5-E.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.