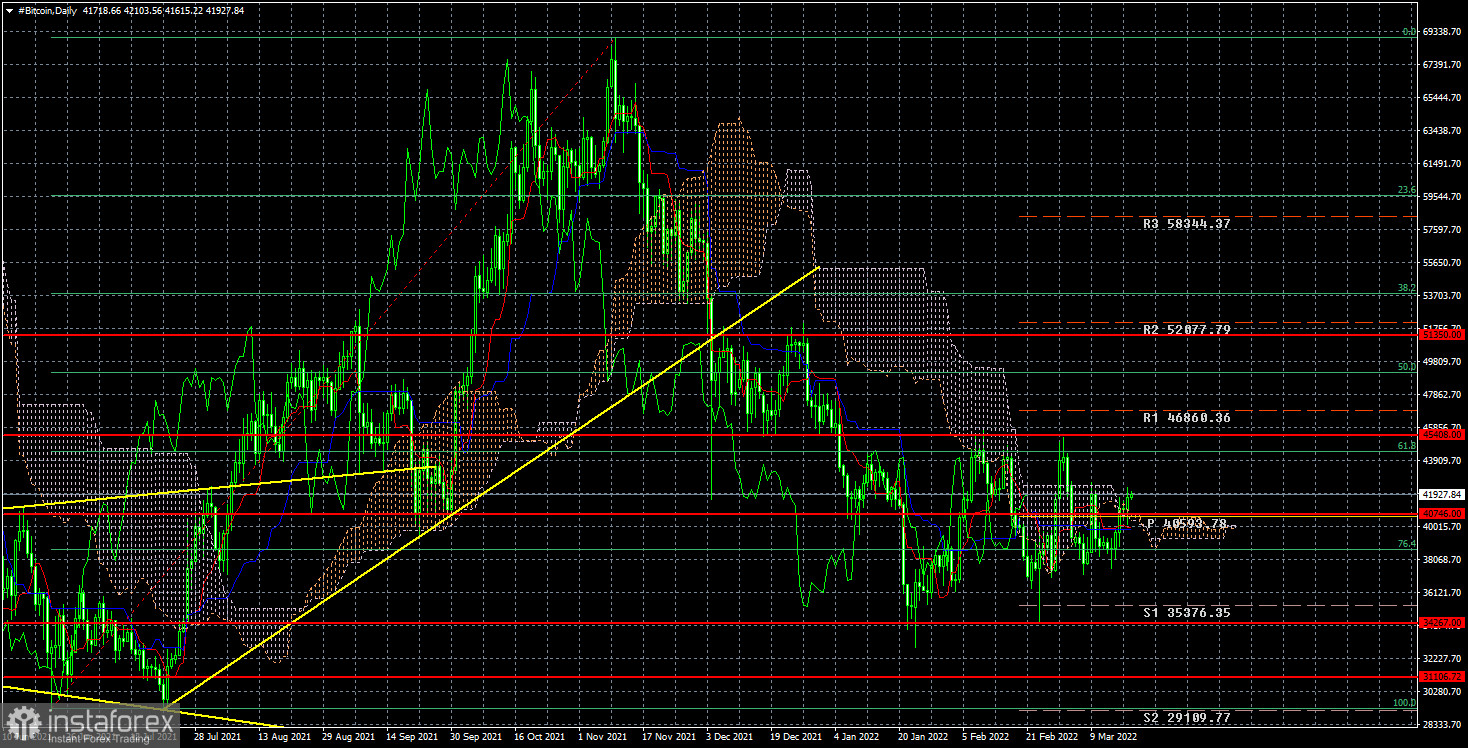

Over the past five trading days, bitcoin has managed to rise in price by $ 3,100. This is not too much for bitcoin, usually, its volatility is much higher. However, what is important now is not even the fact of the growth of the cryptocurrency, but the fact of its location inside the side channel. This channel has boundaries of $ 34,267 and $ 45,408. That is, its width is more than $ 10,000. It is difficult to say whether this is a lot or a little since bitcoin is extremely rarely traded in flats. Nevertheless, the illustration below shows very clearly that the upper boundary was worked out twice and the lower one twice. After the last rebound (from the upper limit), the price could not work out the lower one, and the growth over the past five days completely confused the technical picture. Thus, now we can only say that the instrument is in the flat and nothing else. Based on this, only overcoming any of the channel boundaries can serve as a clear signal to a new trend.

We have repeatedly drawn the attention of traders to the illogical behavior of the market after the Fed meeting. Recall that the rate was raised by 0.25%, which should have provoked at least a slight drop in risky assets and at least a slight strengthening of the US currency. But we did not see either the first or the second. Perhaps this is not too important for bitcoin, since it is still inside the side channel. But something else is important. It has not been able to start a new upward trend for 2.5 months, which is constantly being repeated by various "crypto experts" and "industry people". Recall that in the last two years, bitcoin has been growing first against the background of huge QE programs conducted by central banks, and then against the background of rising inflation, because investors began to use it as a hedging tool. However, now inflation around the world continues to grow and, most likely, will continue to grow in the next few months. In addition, it can be assumed that Russian and Ukrainian investors have increased their demand for cryptocurrencies to withdraw capital from countries, the first of which is in a state of military conflict, and the second is in a state of military conflict and under more than 6,000 different sanctions from around the world. But even all this now does not help bitcoin to overcome the level of $ 45,408 and set a course for its classic goal of $ 100,000. Thus, we continue to expect the fall of the first cryptocurrency in the world with a target of $ 31,100.

We believe that the "bearish" trend has not been completed, and there are no grounds for starting a "bullish" trend now. Even if investors ignored the Fed's rate hike, they are unlikely to be able to ignore six more rate hikes this year. They are unlikely to be able to ignore the reduction of the Fed's balance sheet, the start of which may be announced at the next meeting, which means the withdrawal of excess liquidity from the economy.

In the 24-hour timeframe, the quotes of the "bitcoin" have not managed to overcome the level of $ 45,408 and continue to be inside the side channel of $ 34,267 - $ 45,408. If one of the boundaries is overcome, then we will get a new trend for the next few weeks. However, this has not happened in the last 2.5 months, so bitcoin should be traded now on lower timeframes according to local trends and trends.