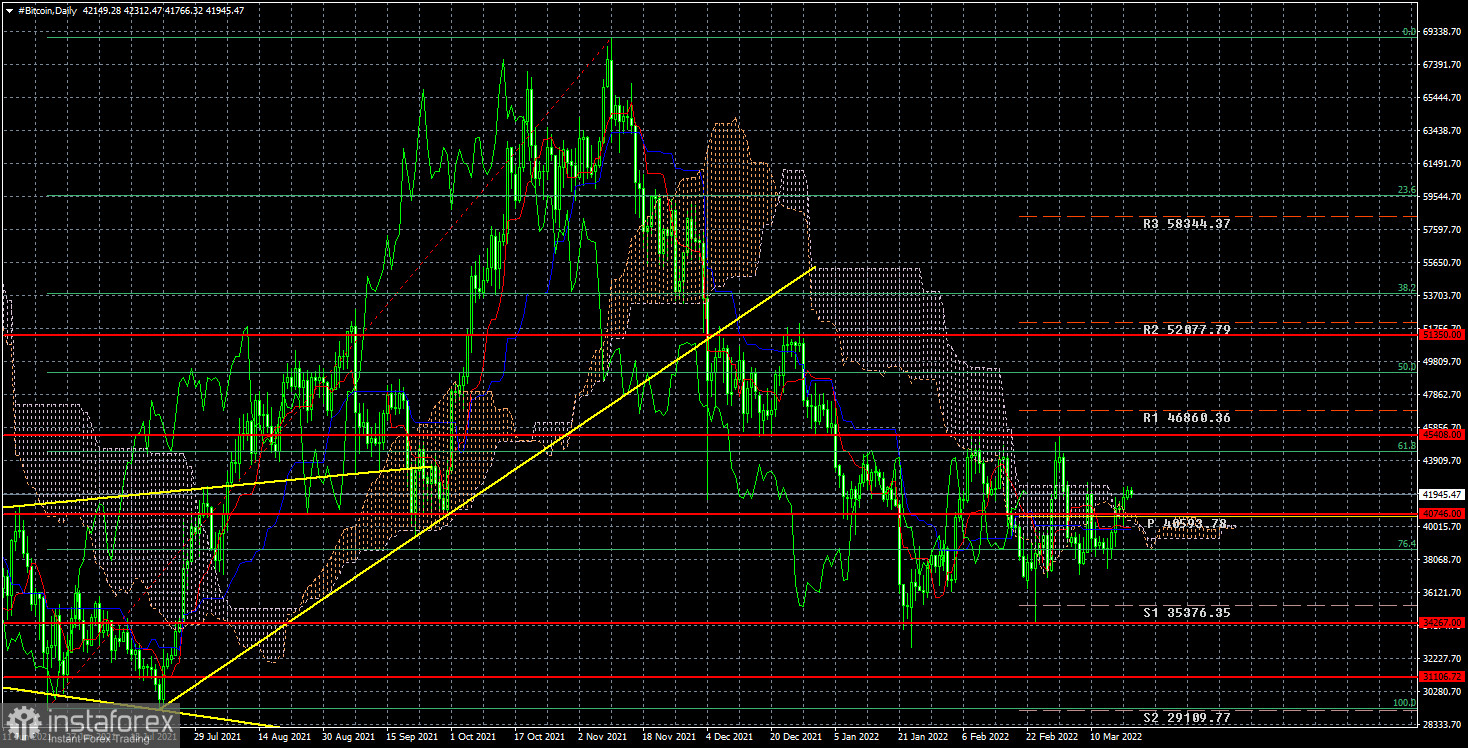

Over the past day, bitcoin has hardly changed in value. At the moment, the cryptocurrency is trading at $ 42,000 per coin and continues to be inside the side channel of $ 34,267 - $ 45,408. Thus, new technical conclusions cannot be made now. You either need to trade inside the side channel on short-term and intraday trends, or a rebound from any of the channel boundaries. It will be possible to talk about a new trend when the price leaves the side channel.

In recent weeks, we have repeatedly drawn attention to the fact that the fundamental background for bitcoin remains extremely weak. Now there are simply no factors other than those invented by "crypto experts" that could provoke a new "bullish" trend. Of course, bitcoin is very dependent on the mood of traders. If for any reason, most players start buying bitcoin again, then it will grow, regardless of the fundamental background. But we are still trying to link the "foundation" with what is happening in the market, otherwise, why pay attention to the news at all? Returning to the negative "foundation", at the moment, the Fed is raising rates, is going to start reducing its balance sheet, and the geopolitical situation in Ukraine remains very sad. From our point of view, these factors will continue to harm the mood of traders. This does not mean that bitcoin will start entering the $ 10,000 target right tomorrow. This means that in the medium and long term, the cryptocurrency may continue to fall. And the fact that it is the fall that continues now, there is no doubt if you look at the illustration of the 24-hour TF (below).

However, in addition to the already well-known factors, there is a new pressure factor on bitcoin. It's no secret that to mine bitcoin, a huge amount of electricity is required. However, with the beginning of the military operation in Ukraine, oil, and gas prices have risen very much. And along with them, electricity prices have also increased, at least in Europe, which is very dependent on Russian energy carriers. Thus, it becomes simply unprofitable for European miners to mine "bitcoin" coins at current electricity prices and at the current price of bitcoin itself. Of course, we are not talking about all miners, but only about those who use old equipment that is not too energy efficient. However, it should be understood that the more expensive electricity becomes, the less profitable it will be to mine bitcoin. And this moment can cause a new depreciation of the cryptocurrency.

By the way, the assumption that an increase in electricity prices can provoke a decrease in the price of cryptocurrencies is a double-edged sword. If bitcoin is mined less, then there may be a shortage of cryptocurrencies on exchanges. This can just lead to an increase in the cost. But at the same time, if bitcoin is mined less, it will also reduce its popularity and the desire of investors to deal with bitcoin. When the mining of all cryptocurrencies was banned in China, it provoked the fall of the "bitcoin", and not its growth.

In the 24-hour timeframe, the quotes of the "bitcoin" have not managed to overcome the level of $ 45,408 and continue to be inside the side channel of $ 34,267 - $ 45,408. If one of the boundaries is overcome, then we will get a new trend for the next few weeks. However, this has not happened in the last 2.5 months, so bitcoin should be traded now on lower timeframes according to local trends.