Analysis of Friday's deals:

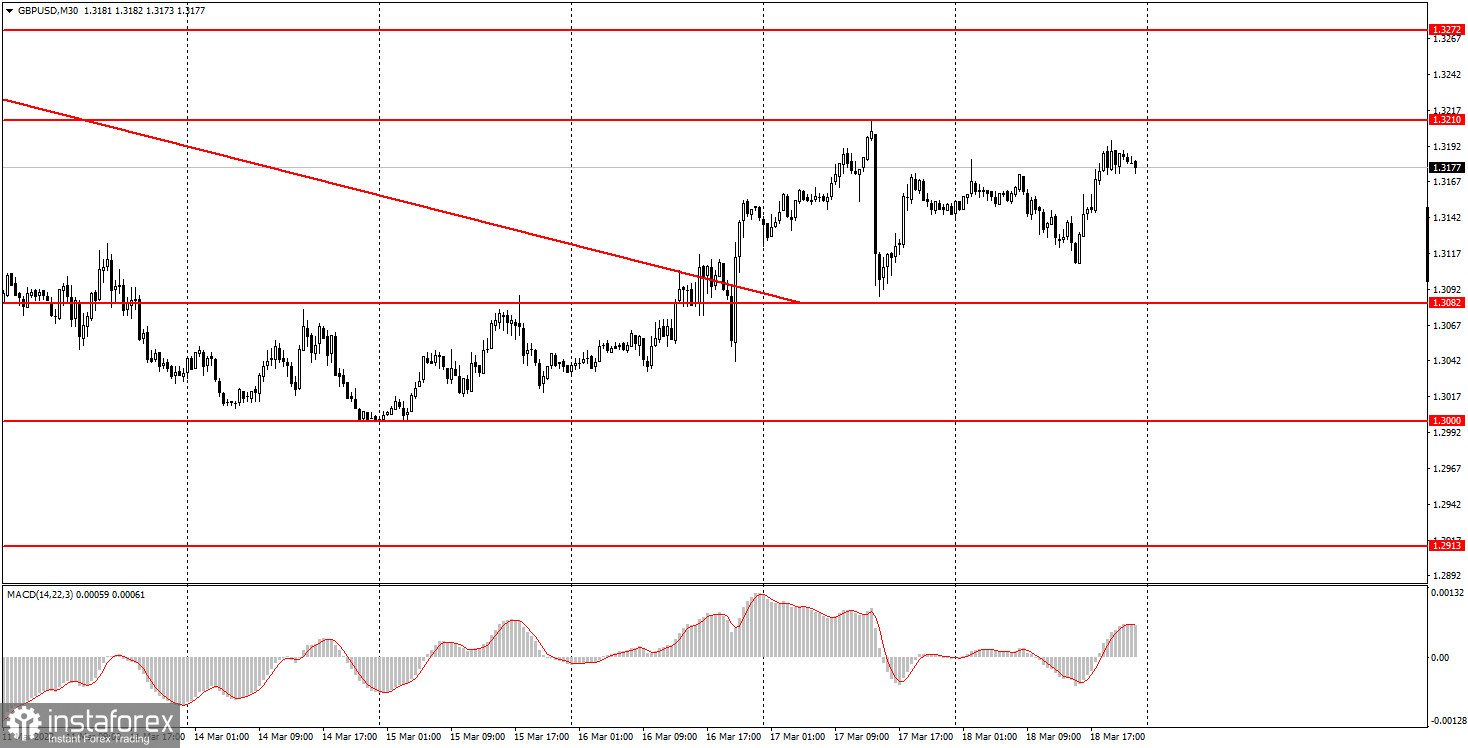

30M chart of the GBP/USD pair.

The GBP/USD pair traded in different directions on Friday, but at the same time, it is quite similar to the EUR/USD pair. In the first half of the day, the bears tried to take the initiative into their own hands, but in the second half, the bulls returned to the market and kept the pair from falling again. At the same time, neither the minimum of the previous day nor the maximum was broken. That is, so far there is a rather weak upward trend, but at the same time, it can end at any moment. Recall that this week two meetings of central banks took place at once, which are directly related to the pound/dollar pair. And both of these meetings were followed by a rather strange reaction of the market. If in the case of the Fed, the dollar first rose and then collapsed, then after the meeting of the Bank of England, the pound sterling already collapsed. And this is although both central banks have raised the key rate. That is, at this time, the technical picture is most similar to the fact that the pair is simply correcting against a rather strong downward movement that has been observed in recent weeks. There were no important macroeconomic statistics on Friday in either the UK or the US. There were no important geopolitical events or news either.

5M chart of the GBP/USD pair.

On a 5-minute timeframe, the technical picture is very similar to the movements of the euro/dollar pair. The pound/dollar also generated exactly three signals, the first two of which were false. Accordingly, they did not bring profit to traders, and after the formation of the third signal, which was just strong, but it should not have been worked out, the price went in the right direction 35 points. Similarly, the Friday morning movement could not be caught, since no sell signal was formed. In general, the movement and trading signals on Friday were as uncomfortable as possible for novice players. Unfortunately. The levels of 1.3124 and 1.3134 were removed at the end of the day, as their price overcame as it wanted, and they did not carry any resistance. A new level of 1.3110 was also added, which is Friday's low. We can only hope that next week's movements will be more tradable. However, according to many experts, the military Ukrainian-Russian conflict is moving into a very important stage, after which either the process of de-escalation or a new escalation will begin. Therefore, geopolitics may once again have a strong influence on the pair's movement in the near future.

How to trade on Monday:

On the 30-minute TF, the pair overcame the descending trend line and continued to move up. Although the pair has been actively trading this week, it cannot yet be said that an upward trend has been formed. A trend line can be formed, but it is not the most accurate and clear. However, consolidation below it may indicate a resumption of the downward trend. On the 5-minute TF tomorrow, it is recommended to trade by levels 1.3042, 1.3082, 1.3110, 1.3210, 1.3241. When the price passes after opening a deal in the right direction, 20 points should be set to Stop Loss at breakeven. Nothing interesting and important is planned for tomorrow in the UK, and Jerome Powell, the chairman of the Fed, will give a speech in the USA. We do not believe that Powell will report anything important, we got very familiar with his opinion and the direction of the Fed's monetary policy last week.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to generate the signal (rebound or overcoming the level). The less time it took, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the period between the beginning of the European session and the middle of the American session when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as a support or resistance area.

What's on the chart:

Price support and resistance levels - target levels that are the targets when opening purchases or sales. Take Profit levels can be placed near them.

Red lines - channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

MACD indicator (14,22,3) is a histogram and a signal line - an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

Beginners to trade in the forex market should remember that every transaction cannot be profitable. Developing a clear strategy and money management is the key to success in trading for a long period.