The EUR/USD currency pair was actively correcting against that weak upward trend during the last trading day of the previous week. Despite the fact that on Friday it was still possible to overcome the Murray level of "3/8" - 1,1108, which we considered "iron-concrete", the price could not go far up. Therefore, we are still inclined to the option that the upward movement is completed or will be completed soon. We still see no reason for the euro's growth. At least for strong growth. The fundamental background, the macroeconomic background, the geopolitical background, all speak in favor of the fact that the US dollar will continue to grow, and not vice versa.

The fundamental background is very simple now. It is expressed by the results of the meetings of the European Central Bank and the Federal Reserve. As we have repeatedly said in recent months, the EU and the US are now facing a similar problem of high inflation. However, in the United States during 2022, at least they will try to solve it by reducing the Fed's balance sheet and raising rates. But the ECB may be ready to say goodbye to quantitative stimulus programs by the end of the year, and there is no question of raising the key rate or selling bonds from their accounts now. This means that, in fact, the ECB will not take any measures to contain inflation. ECB President Christine Lagarde almost openly stated that she would hope for a reduction in inflation due to falling energy prices and the restoration of logistics chains. However, even the phrase "in the medium term" sounded from her lips. That is, in the coming months, inflation will continue to rise, and Lagarde did not say when the "medium-term perspective" will begin.

Everything is extremely simple in the macroeconomic background. The US GDP growth rate in the fourth quarter was more than 6%. The GDP growth rate in the European Union for the same period of time was 0.4%. This is all you need to know about the state of the economies at this time. Moreover, the United States will relatively painlessly transfer the rejection of oil and gas from Russia, but the European Union will suffer greatly from the increase in energy prices. Thus, their economy will face an additional increase in prices for almost everything, and the budget will incur additional costs. Moreover, several million refugees from Ukraine will also require serious budget expenditures. Therefore, the American economy now looks a head stronger than the European one.

As for the geopolitical background, it's even easier. The longer the Ukraine-Russia conflict persists, the more the euro could potentially fall. The euro looks like a less stable currency than the dollar, and this is all due to it. Of course, there have been several reports recently that could have brought a drop of optimism to the market. For example, the statement that Kiev and Moscow have made progress on some important issues. Or the message that the military potential of Russia for the offensive will be enough for another 7-10 days. However, both in the first and in the second case there are counter-explanations. Many experts consider the negotiations between Kiev and Moscow to be a "screen". They give the impression that the parties are trying to resolve the case peacefully. In fact, the positions of Kiev and Moscow are so polar (at least on the issue of belonging to Crimea and Donbass) that it is completely unclear how an agreement can be reached. And the fact that the military potential will last only for ten days is offset by reports about the readiness of the Belarusian army to enter the conflict on the side of Russia and the readiness of the Libyan military to serve under the contract of Russia.

Two meaningless speeches by Lagarde

There will be an absolute meager amount of macroeconomic and fundamental events in the European Union this week. Lagarde is set to speak on Monday and Tuesday, however, what can she tell traders that is considered new? We are all already familiar with her personal position and the central bank's position regarding the economy and monetary policy. Therefore, we believe that these events will "pass by" the market. And in addition to these events, business activity indices in the service and manufacturing sectors for March will be published during the week, which in the current circumstances are unlikely to interest anyone at all.

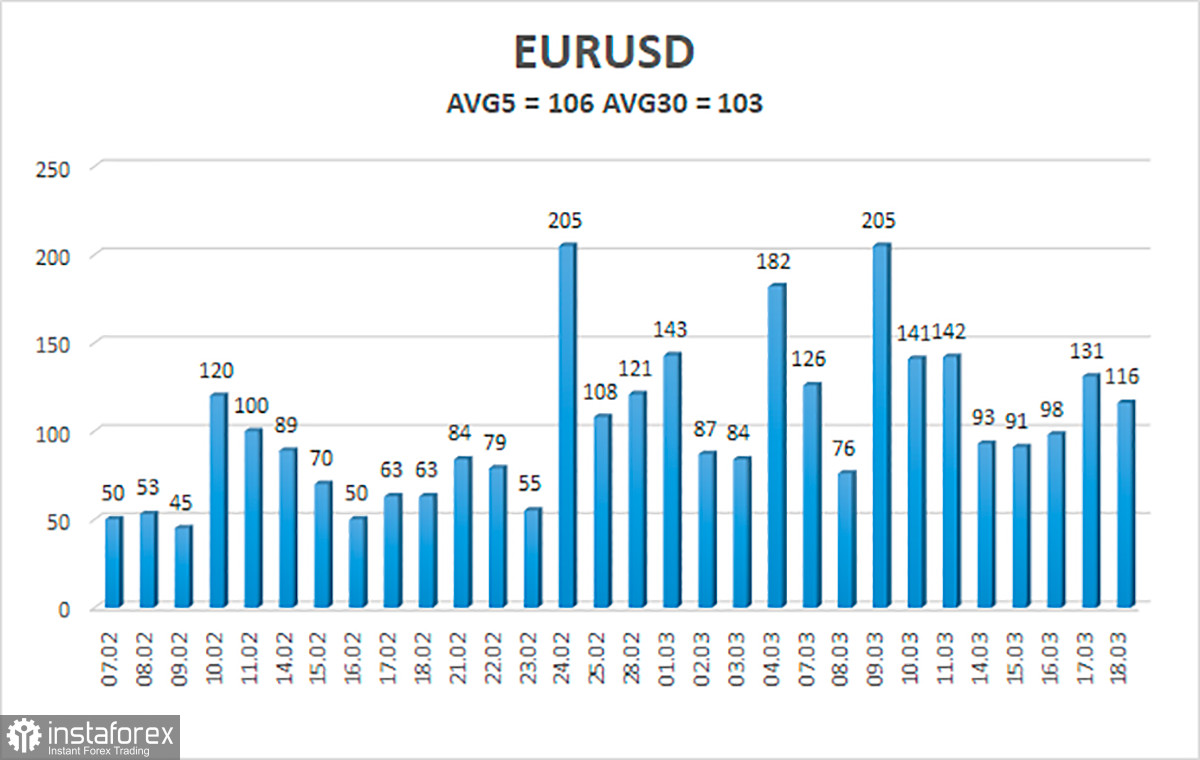

The volatility of the euro/dollar currency pair as of March 21 is 106 points and is characterized as "high". Thus, we expect the pair to move between the levels of 1.0944 and 1.1156 today. The reversal of the Heiken Ashi indicator up will signal a new round of upward movement.

Upcoming support levels:

S1 - 1.0986

S2 - 1.0864

S3 - 1.0742

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1230

R3 - 1.1353

Trading recommendations:

The EUR/USD pair continues to be above the moving average. Thus, now we should consider new long positions with the targets of 1.1108 and 1.1156 in case of a rebound from the moving average line. Short positions should be opened no earlier than the price taking below the moving average line with the targets of 1.0944 and 1.0864.

We recommend to familiarize yourself with:

Overview of the GBP/USD pair. March 21. The British pound also feels unsweetened.

Forecast and trading signals for EUR/USD for March 21. Detailed analysis of the movement of the pair and trading transactions.

Forecast and trading signals for GBP/USD for March 21. Detailed analysis of the movement of the pair and trading transactions.

Explanations for the chart:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should now trade.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) - a likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.