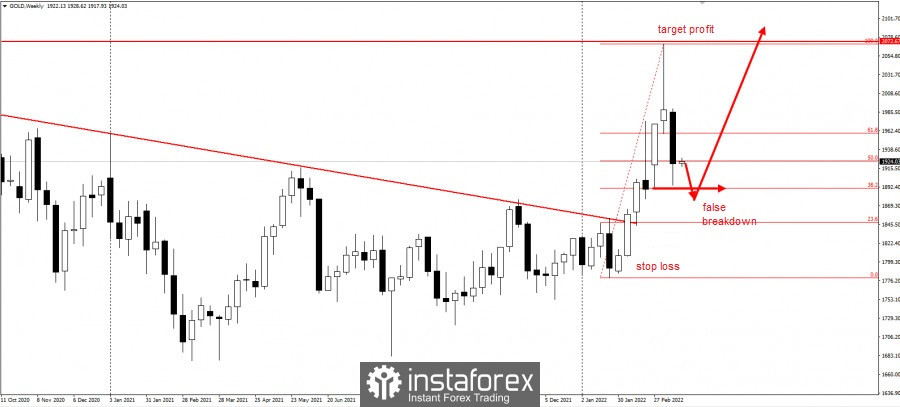

After a strong rally in early March, gold rolled back by 50%, trading just above $1,900. Since it did not update the 2020 high, buyers can set that level as target after the breakdown of $2,075.

There are two possible scenarios for the yellow metal.

The first one (Plan A) builds on the momentum that came at the Fed meeting, where the central bank announced a rate hike and held a press conference with Jerome Powell. Quotes have already rolled back by 50%, so traders can trigger a rally according to the following scheme:

Potential profit is 15,000 pips, while stop loss is up to 2,000 pips.

Meanwhile, the second scenario is a false breakdown of the two-week low at 1890.

Potential profit is 2,000 pips, while stop loss is up to 3,000 pips.

Both ideas are based on the Price Action and Stop Hunting strategies.

Good luck and have a nice day!