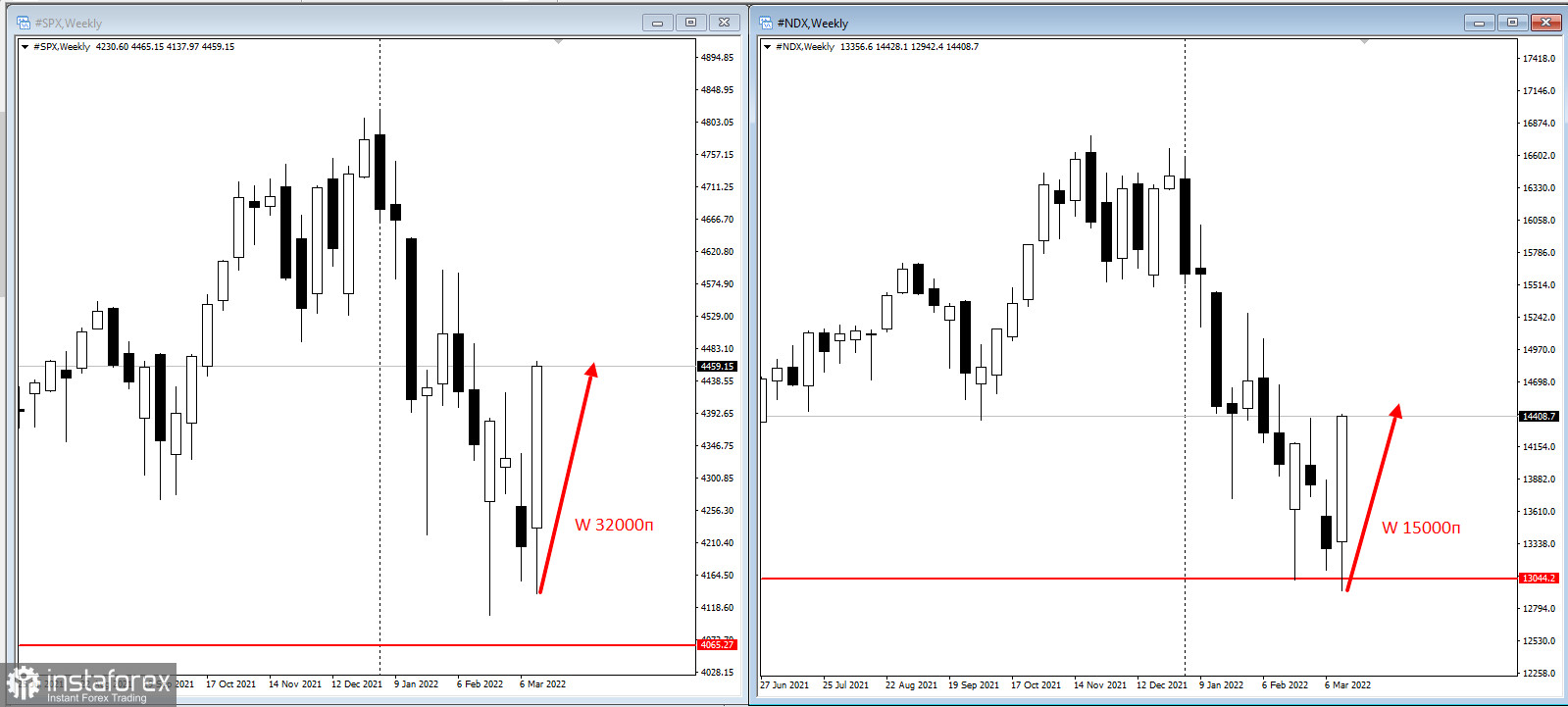

Last week, the S&P 500, Nasdaq 100 futures posted their biggest gains this year, rising to 32,000 and 15,000 respectively. This is the biggest increase not only this year, but in the last few years.

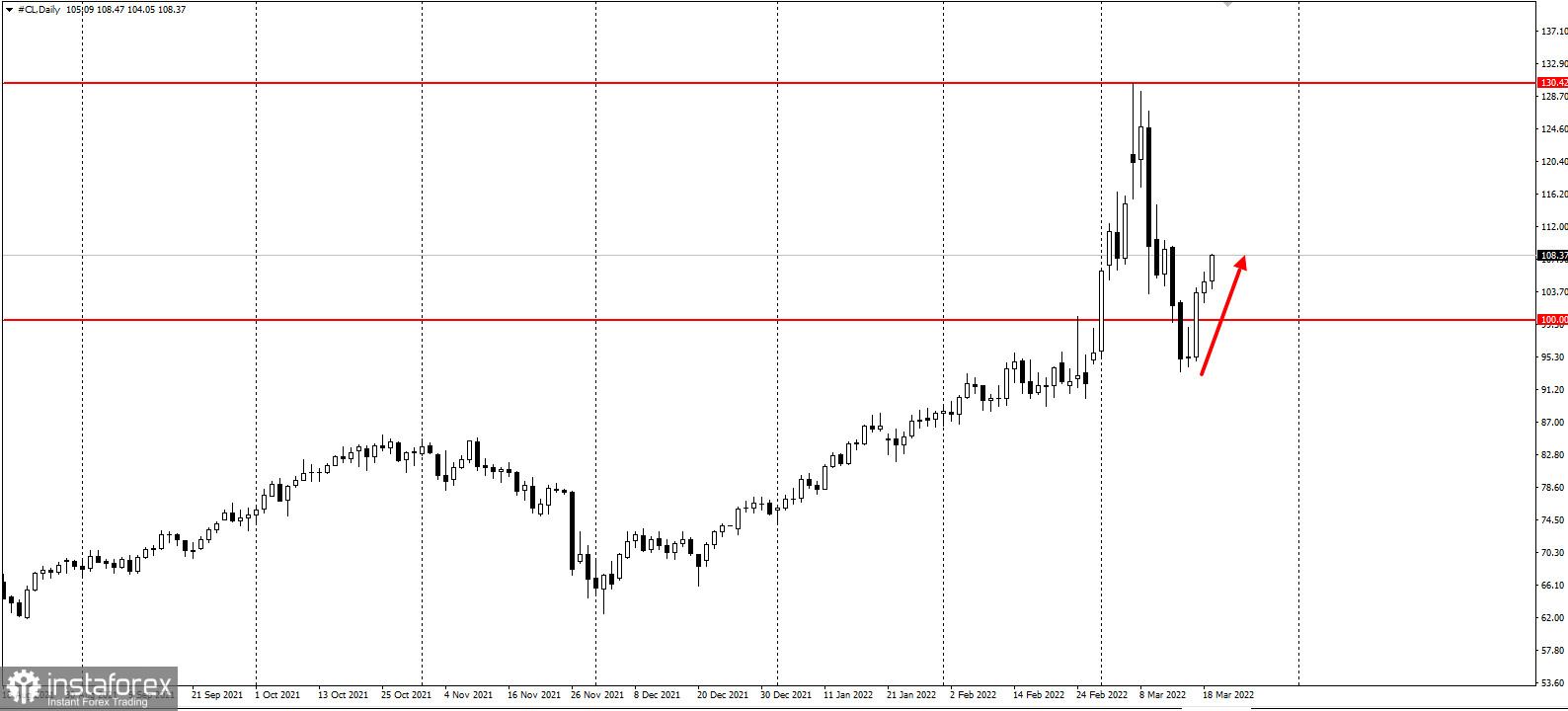

West Texas Intermediate (WTI) crude rose above $108 a barrel as investors assessed the war as well as tensions in the Middle East. Australia's ban on exports of alumina to Russia caused a rise in aluminum.

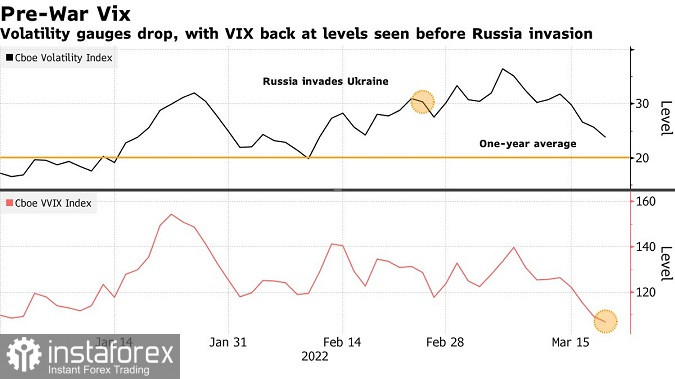

Russia is continuing a military sting operation in Ukraine that has spurred inflation by pushing up the prices of key commodities such as oil and wheat. Turkey said Moscow and Kyiv are moving closer in ceasefire talks.

The bond market continues to be cautious about the risks of war and rising U.S. interest rates. The Treasury yield curve is flattening and parts are inverted, which for some is an indication of an impending economic downturn. Treasury futures fell. There is no cash trading in Asia due to a holiday in Japan.

Today, traders are waiting for Federal Reserve Chairman Jerome Powell's speech, less than a week after he and his colleagues launched a campaign to raise interest rates to fight the highest inflation in a generation. Markets expect the Fed to raise its target rate to around 2% by the end of this year.

"Our concern is that the Fed is tightening into an economic slowdown as it prioritizes high inflation," said Sue Trinh, head of Asia macro strategy at Manulife Investment Management. "It will balance that trade-off of slower growth, higher inflation by lagging the market pricing in terms of the pace, the magnitude and the duration of this tightening cycle."

Here are some key events this week:

- Federal Reserve Chairman Jerome Powell and Atlanta Fed President Raphael Bostic's speech, Monday

- European Central Bank President Christine Lagarde among central bank speakers at the BIS Innovation Summit, Tuesday-March 23

- EIA Crude Oil Inventory Report, Wednesday

- Bank of England Governor Andrew Bailey, Fed Chairman Powell speech, Wednesday

- British Chancellor Rishi Sunak's "Spring Statement" on the budget, Wednesday

- U.S. President Joe Biden attends the emergency NATO summit in Brussels, Thursday

- Eurozone Markit PMI, Thursday

- U.S. Initial Jobless Claims, U.S. Durable Goods, Thursday