GBP/USD

Analysis:

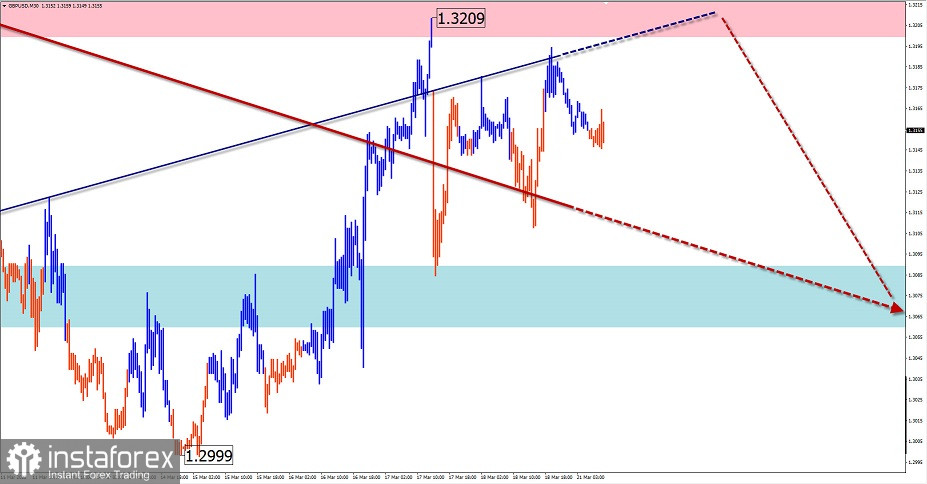

On the chart of the major British pound pair, the downtrend is dominant since last February. The incomplete section dates back to January 13. The price has been moving mostly sideways, forming a corrective plane in the last two weeks.

Outlook:

In the current day, the completion of the upward movement vector is expected. A formation of the reversal is possible in the limits of the calculated resistance. A downward movement is likely to resume at the end of the day or tomorrow.

Potential reversal zones.

Resistance:

- 1.3200/1.3230

Support:

- 1.3090/1.3060

Recommendations:

There are still no suitable conditions for buying the British pound. It is recommended to monitor the emerging reversal signals to sell the pair in the area of calculated resistance

AUD/USD

Analysis:

The current upward wave of the major Australian dollar dates back to January 28. A week ago, the final part (C) formed upwards. The pair has reached the boundaries of the large scale resistance zone.

Outlook:

In the near term, the price is expected to move sideways between the closest encounter zones. The initial decline to the support zone, followed by the reversal and growth to the resistance zone is most likely. Then the decline may resume.

Potential reversal zones

Resistance:

- 0.7440/0.7470

Support:

- 0.7370/0.7340

Recommendations:

Today, trading activity in the pair's market is possible only within individual trading sessions with small lots. It is more preferable to buy the pair. It is advisable to close trades at the first reversal signals.

USD/CHF

Analysis:

On the chart of the Swiss franc, a downward wave has been forming since the middle of last year. Currently, the structure of the wave resembles a shifting plane, lacking its final part. The downward section from March 16 has a reversal potential.

Outlook:

In the next 24 hours, the price is expected to move in the calculated range from the resistance zone to the area of calculated support. A change in direction is more likely by the end of the day.

Potential reversal zones

Resistance:

- 0.9350/0.9380

Support:

- 0.9280/0.9250

Recommendations:

Today, short-term sales from the area of calculated resistance will be possible after formation of appropriate trading signals in the pair's market.

USD/CAD

Analysis:

The Canadian dollar in the major pair has been moving upwards since last May. The incomplete section dates back to January 13. The price forms a corrective downward zigzag within its framework during the last two weeks. Currently, the price has reached the lower boundary of a strong potential reversal zone. There are no signals of immediate change of movement on the chart.

Outlook:

Today, a flat movement is most likely in the pair's market. After a probable pressure on the support area, a reversal and growth of the rate up to the resistance area is possible. Then, the decline may resume.

Potential reversal zones

Resistance:

- 1.2670/1.2700

Support:

- 1.2590/1.2560

Recommendations:

Today, trading in flat conditions may lead to deposit losses. It is advisable not to enter the pair's market until the upward reversal completes. It is recommended searching for reversal signals to sell the instrument in the area of calculated resistance.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!