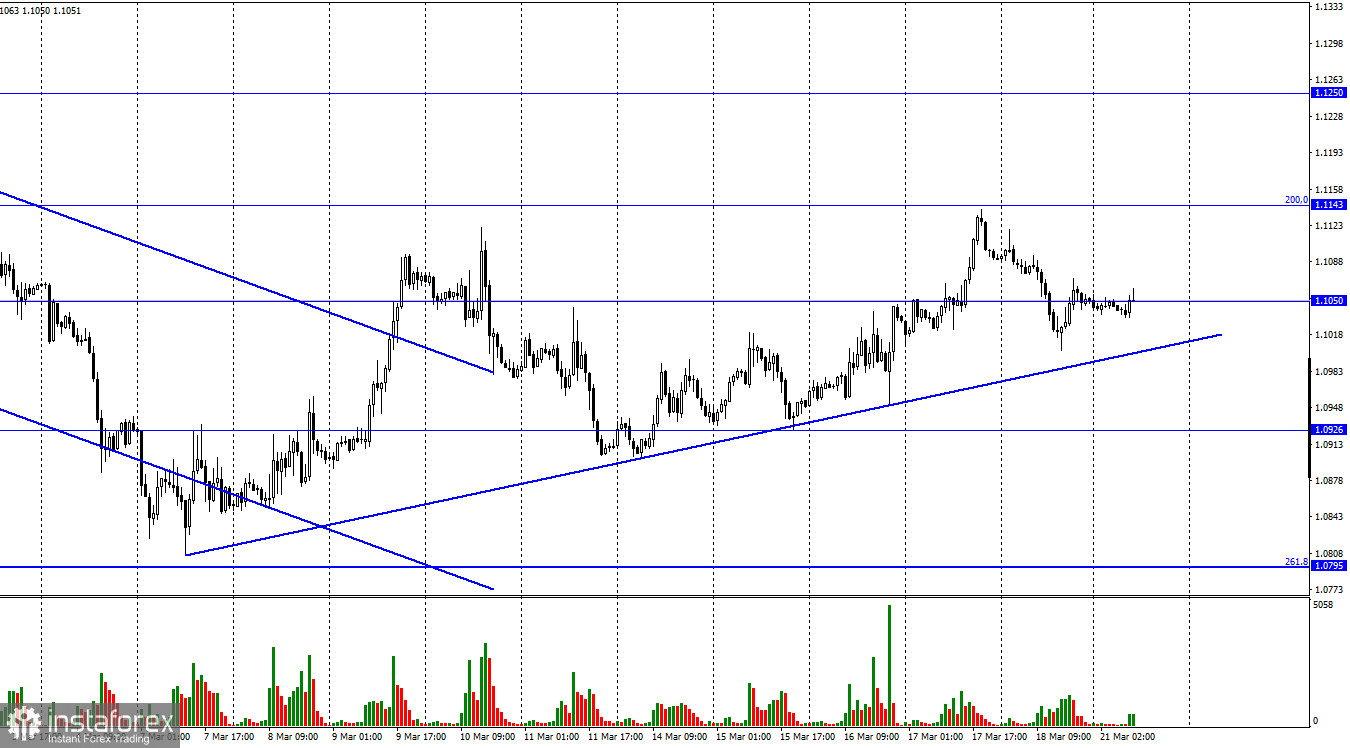

The EUR/USD pair performed a drop almost to the downward trend line on Friday. There was no rebound this time, so the mood of traders can still be described as "bullish". Nevertheless, the closing of the pair's quotes under the trend line will allow us to expect a new fall in the European currency. In my opinion, the European currency can start a new fall almost at any moment. The growth in the last two weeks looks too strained. The bulls seem to be trying their best, but they are not getting much. The information background remains not in favor of buyers. From my point of view, the information background now plays a key role for traders. And not even an economic, but a geopolitical information background. Let me remind you that the military operation in Ukraine continues, and judging by what statements Moscow and Kyiv are making, they are not going to stop and sign a ceasefire agreement yet. Every day, several dozen rockets arrive at Ukrainian cities. The Ukrainian military is on the defensive, and the advance of Russian troops is not observed.

At least that's what American and British intelligence reports. I try to study the data coming from neutral parties who are not directly involved in the conflict. If what London and Washington are talking about is true, then this whole conflict may last several months or even years. And this, in turn, will lead to a decline in the world economy, the European economy, the Russian, Ukrainian, American and in general will affect many countries of the world. Thus, there are no reasons for optimism now. And most of all they are not there for the euro currency. In addition to geopolitical problems, Europe is already facing economic problems, which are expressed by high gas prices, as well as strong pressure from the United States to refuse to import Russian oil and gas. The European Union is doing its best to sit on two chairs at the same time. On the one hand, its economy depends on energy resources from the Russian Federation, on the other - it supports Ukraine in this conflict.

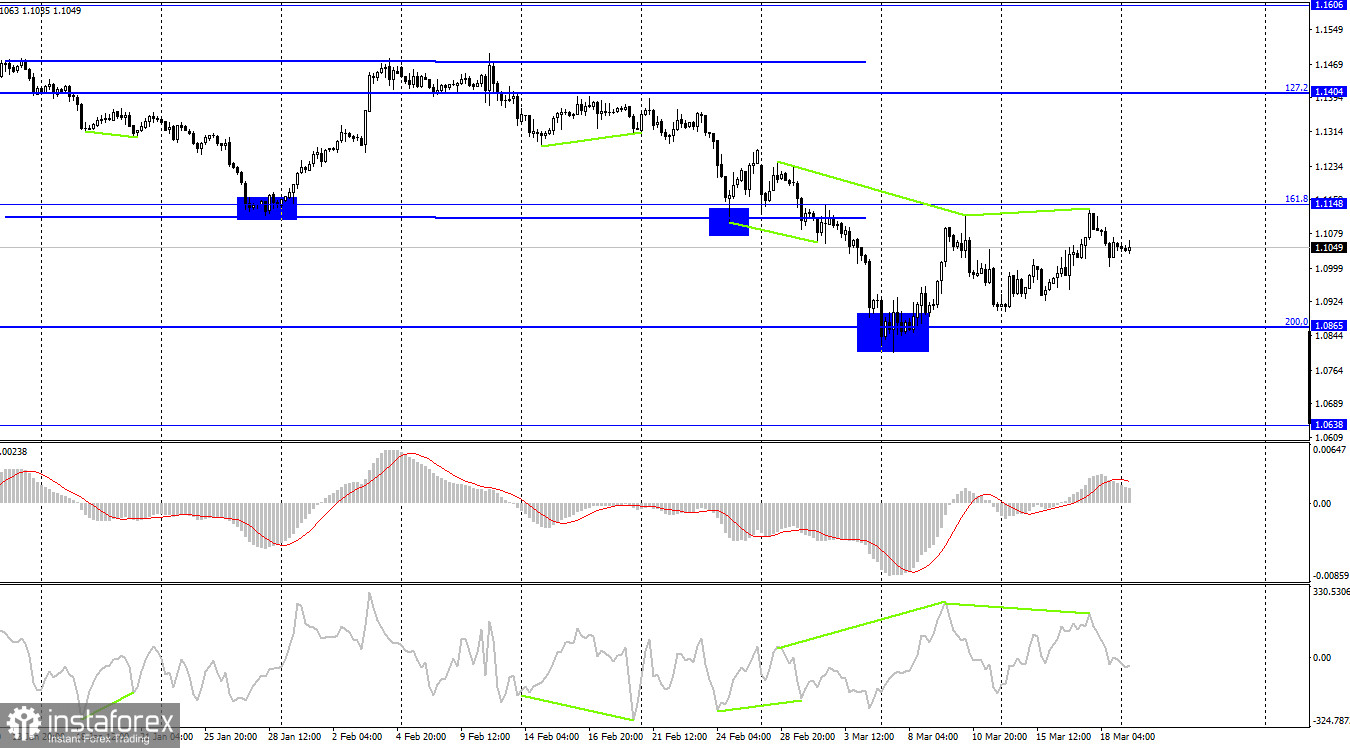

On the 4-hour chart, the pair performed an increase to the corrective level of 161.8% (1.1148), but there was no rebound from it. Nevertheless, a reversal was made in favor of the US currency, and a new process of falling in the direction of the corrective level of 200.0% (1.0865) was started after the formation of a bearish divergence at the CCI indicator. Fixing the pair's rate above the level of 1.1148 will increase the probability of further growth towards the next Fibo level of 127.2% (1.1404).

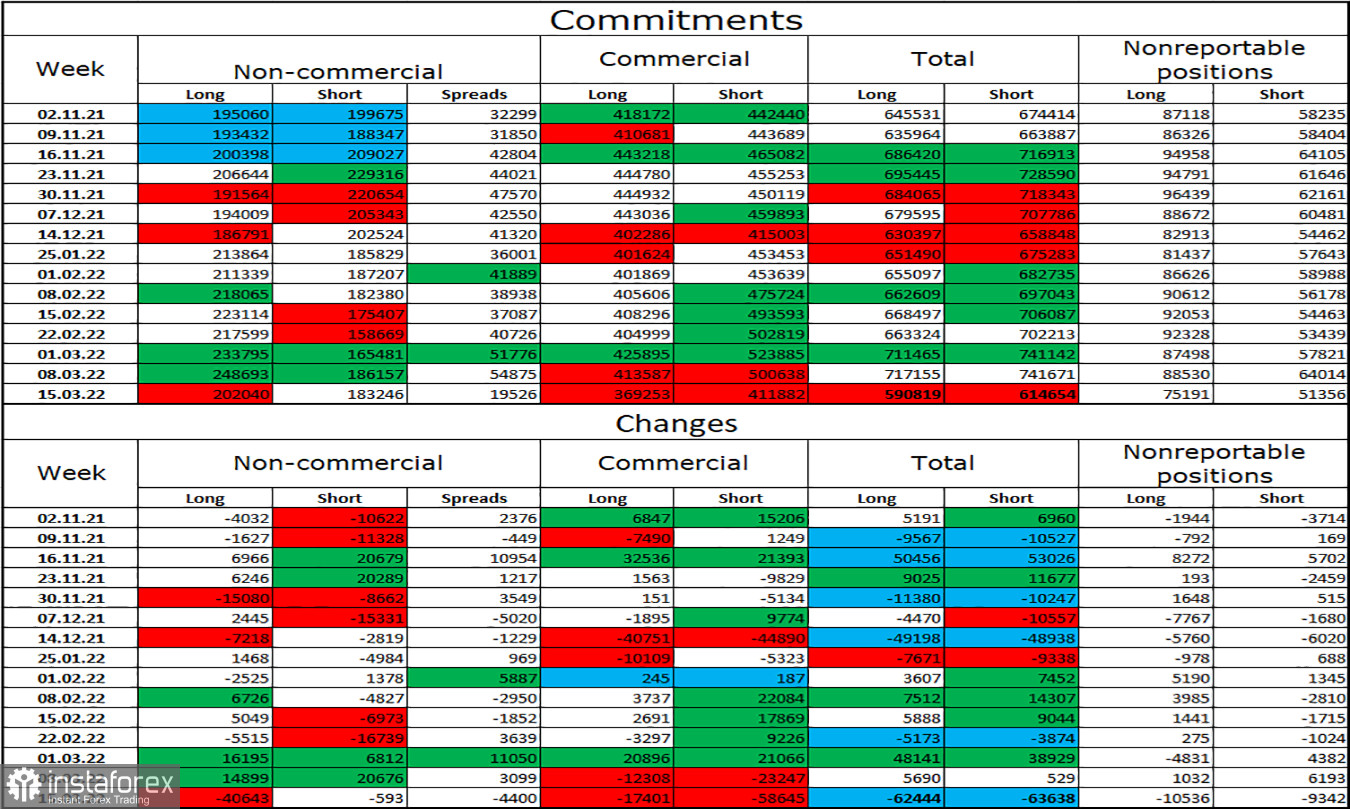

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 40,643 long and 593 short contracts. This means that the bullish mood of the major players has become much weaker. The total number of long contracts concentrated on their hands is now 202 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which now supports only the dollar. We are now witnessing a paradoxical situation: the bullish mood of major players has been maintained since January 25, but the currency itself is falling. And it falls quite heavily. Thus, geopolitics is now a priority.

News calendar for the US and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (07:30 UTC).

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (16:00 UTC).

On March 21, the calendars of economic events of the European Union and the United States contain one important entry each. Jerome Powell and Christine Lagarde will perform today. This is almost always interesting and can affect the mood of traders today.

EUR/USD forecast and recommendations to traders:

I would recommend new sales of the pair if the pair performed a rebound from the level of 1.1143 on the hourly chart, but there was no such rebound. Therefore, new sales are now possible with a target of 1.0926 on the hourly chart, if a close is made under the trend line. I recommend buying a pair if there is a rebound from the trend line with a target of 1.1143.