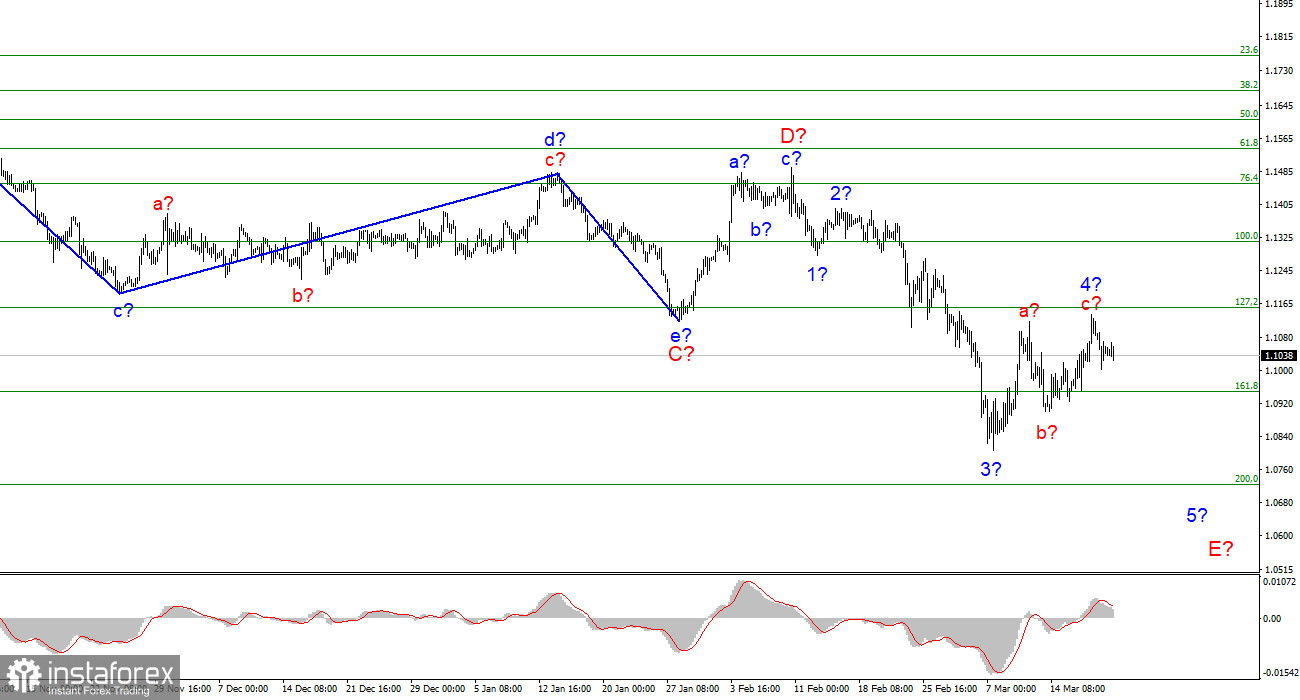

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. At this time, the construction of the proposed wave E is continuing, which should take a five-wave form. The low of the previous wave was broken, so the construction of a downward trend section continues. Since wave E has already taken on a sufficiently extended form, a scene appears in which the construction of this wave will soon be completed. However, so far, the internal wave marking of wave E indicates that only wave 4 has been completed now, and the construction of wave 5 has begun. Wave 4 has taken a clear three-wave form and is much more massive than the corrective wave 2. However, if it becomes even more complicated, this may cast doubt on a further decline in the quotes of the instrument. This wave can also take the five-wave form a-b-c-d-e, but in this case, it will be very much out of the general wave pattern. Therefore, I expect that the decline in quotes will resume this week with targets located near the 7th figure. I am not considering alternative options yet, since there are no serious violations in the current wave marking.

ECB President talks about inflation again

The euro/dollar instrument moved with a minimum amplitude of about 25 basis points on Monday. For the first time in a long time, the market showed very weak activity, although I would not jump to conclusions about this. From time to time, the market also needs time to think. And the current wave markup provides the necessary time now. ECB President Christine Lagarde gave a speech in Paris today, and Fed President Jerome Powell will give a speech a little later. I initially did not assume that Lagarde or Powell would say anything important during their speeches, and my expectations have already been met by at least 50%. Lagarde again talked about inflation, but this time she assessed the risks of stagflation. In her opinion, these risks are minimal. Stagflation is a combination of high inflation and economic stagnation. Stagnation, in turn, is a depressed state of the economy (lack of growth) and high unemployment. That is exactly what we are seeing in the European Union right now. Let me remind you that the unemployment rate in the EU is almost 7%, inflation is 5.9%, and the GDP growth rate in the 4th quarter is 0.3%. What is it if not stagflation? Moreover, the inflation rate will continue to rise, everyone is sure of it: from analysts to the ECB itself. Thus, the European economy may indeed look very weak in the coming years. Of course, it is not in danger of collapse, but it may face a new batch of problems that will be much more significant than those that existed during the two-year pandemic and the crisis associated with it. By the way, does anyone else remember about the "coronavirus"? I will also note that this week the European Union may introduce the fifth package of sanctions against itself and the Russian Federation. I say "against myself", because it is expected that it will contain a refusal to purchase Russian oil, on which the European Union is very dependent. It is not yet known for how long the European Union is going to "abandon" Russian oil, but I think by the end of the week we will know everything.

General conclusions

Based on the analysis, I conclude that at this time the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave layout still assumes the construction of wave 5 in E.

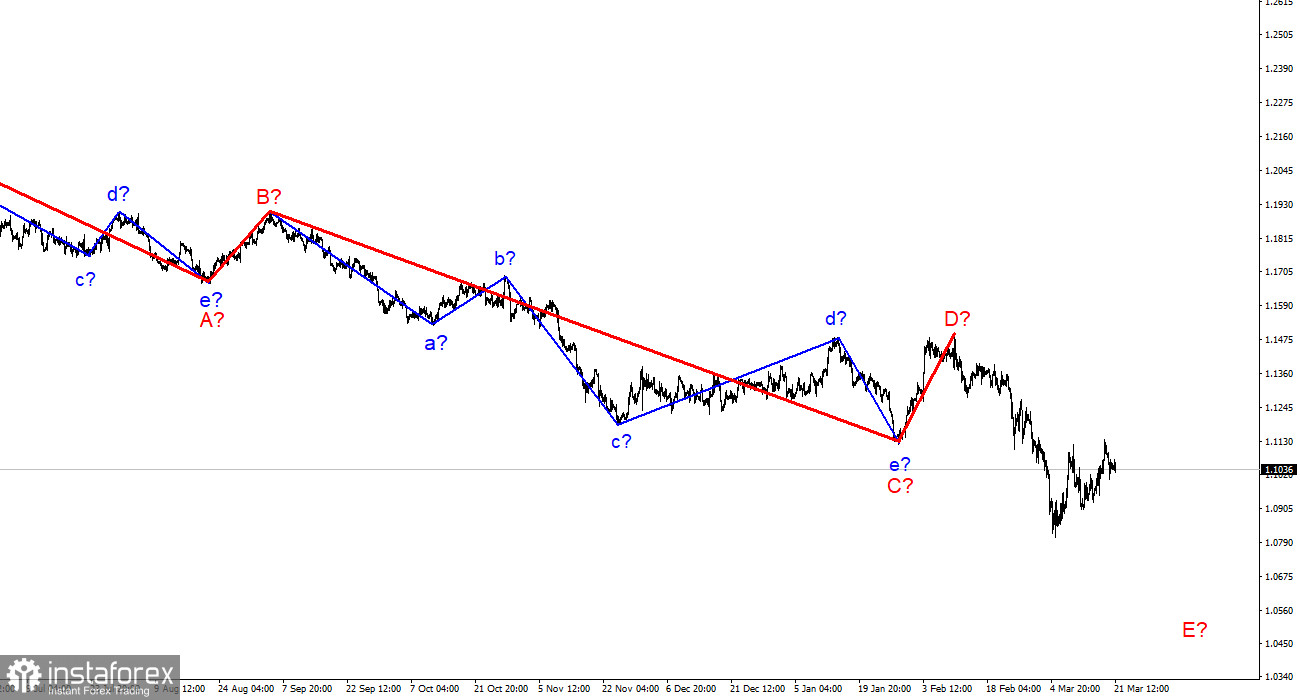

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.