To open long positions on EUR/USD, you need:

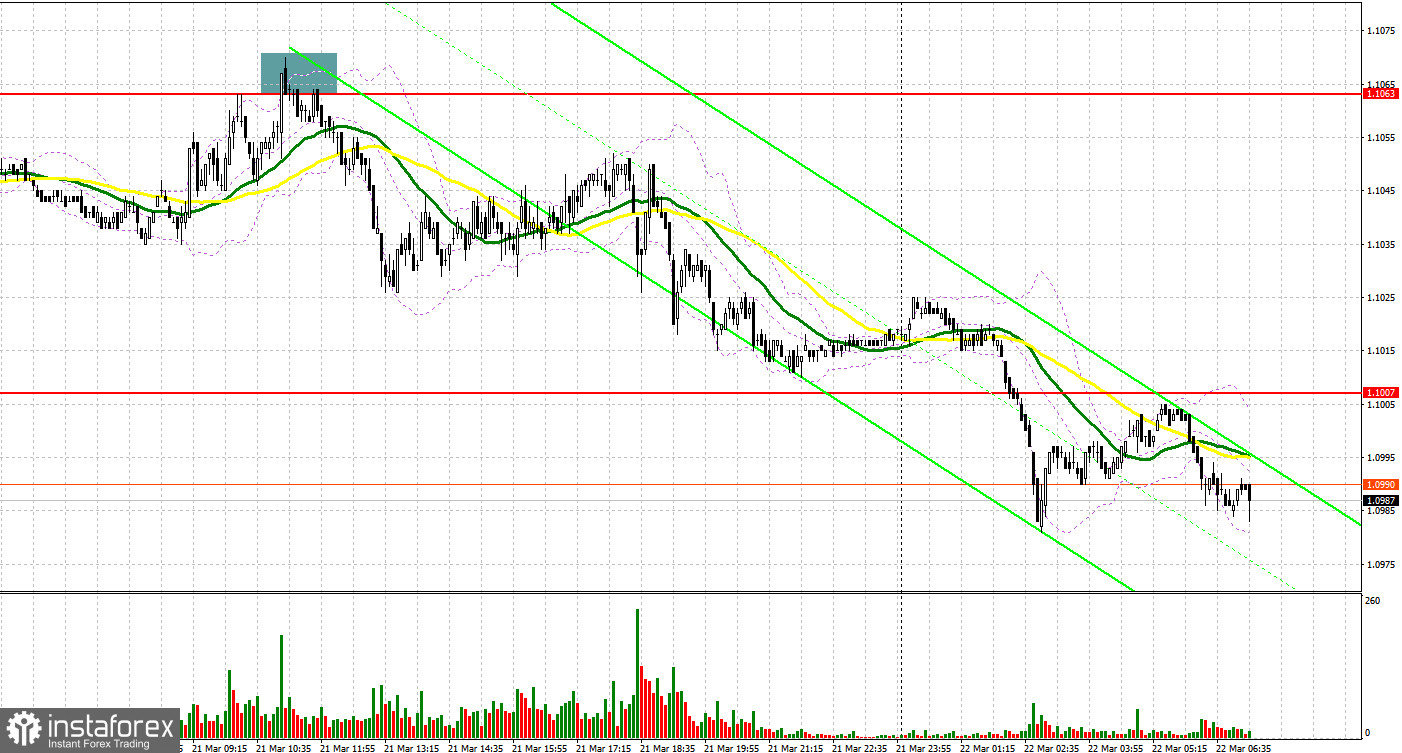

Yesterday, only one signal was formed to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1063 level and advised you to make decisions on entering the market. Euro bulls did not really show themselves in the first half of the day. The lack of important fundamental statistics and the inability to break above 1.1063 resulted in forming a false breakout and created a signal to sell the euro. The pair gradually moved down throughout the day, which led to an update by the support at 1.1007, making it possible to take more than 55 points of profit from the market.

Before we talk about the future prospects of the EUR/USD movement, let's look at what happened in the futures market and how the positions of Commitment of Traders have changed. The Commitment of Traders (COT) report for March 15 showed that both long and short positions have decreased. However, if you look at the figures, you can see that the reduction of short positions was minimal, unlike bulls, who became much smaller – it is not surprising, against the background of Russia's military special operation on the territory of Ukraine. The Federal Reserve meeting was the central event of last week. As a result, the Committee raised interest rates by 0.25%, which did not lead to serious changes in the market, as many expected such decisions. Another thing is that Fed Chairman Jerome Powell took a wait-and-see attitude during his speech, without signaling a more aggressive policy, which was the reason for building up long positions in risky assets. However, at the beginning of this week, the head of the Fed changed his approach, noting in an interview a fairly high probability of an interest rate increase by 0.5% points at once at the Fed's next meeting – this is a strong bullish signal for the US dollar, which is sure to continue its growth against the euro. However, it is worth remembering that the European Central Bank also recently held a meeting at which President Christine Lagarde announced plans to more aggressively curtail measures to support the economy and raise interest rates – this is good for the medium-term prospects of the European currency, which is already heavily oversold against the US dollar. The COT report indicates that long non-commercial positions decreased from the level of 242,683 to the level of 202,040, while short non-commercial positions decreased from the level of 183,839 to the level of 183,246. At the end of the week, the total non-commercial net position decreased to 18,794 against 58,844. The weekly closing price rose slightly from 1.0866 to 1.0942.

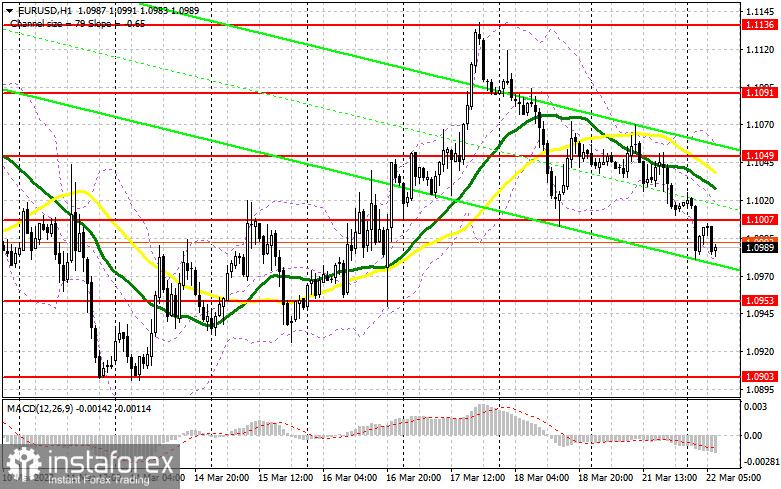

Today will be a very quiet day, as there are no fundamental statistics. The benchmarks for further strengthening of the US dollar clearly now open up a new opportunity for EUR/USD to resume the bearish trend, so it will be very difficult for bulls in the current conditions. Given that they have nothing to rely on, most likely the pressure on the pair will continue. The optimal scenario for opening long positions, which I highly recommend not to do in the current situation, is when the euro falls to the area of 1.0953 in the morning. Forming a false breakout there will lead to a signal to open long positions in hopes of the continuation of the upward correction of the pair. But, in addition to a false breakout, it is also necessary for the euro to actively rise. If the bulls are not able to offer anything at the time of the 1.0953 test, it is better not to rush with long positions. A breakthrough of this level may lead to another large sale of risky assets. In this case, I advise buying EUR/ USD only after updating the next support at 1.0903. However, I advise you to enter the market there only if a false breakout is formed. You can immediately open long positions for a rebound from 1.0855, or from the next annual low in the area of 1.0810 with the goal of an upward correction of 30-35 points within the day.

An equally important task is to regain control of the 1.1007 level that was formed yesterday afternoon. A breakthrough and consolidation above this range will certainly increase the appetite for risks, which will create an excellent entry point for long positions in order to recover to the high of 1.1049, where the moving averages are playing on the bears' side, so it will not be very easy to break above this range in the current conditions. Going beyond this range will maintain a bullish correction and lead to an update of 1.091, where I recommend taking profits.

To open short positions on EUR/USD, you need:

The bears are in control of the market until the moment when trading is conducted below 1.1007, and the observed downward correction may result in a new bear market – there is simply no information reason for this yet. The aggravation of the geopolitical situation may become the real reason for a new fall in the euro against the US dollar, since no one is going to put an end to the current medium-term bearish trend yet. It is better not to take risks and sell the euro as high as possible with each upward correction.

The optimal scenario for selling the euro in the morning will be when a false breakout forms at the level of 1.1007. This creates an excellent entry point into short positions with the prospect of further decline to the level of 1.0953, which was formed at the end of last week. The absence of statistics on the eurozone can preserve the bear market formed after yesterday's statements by the Fed chairman, which I mentioned above. A breakthrough and a reverse test from the bottom up of 1.0953 will create another signal to enter the market, which will push the pair to a low of 1.0903 and open a direct road to 1.0855, where I recommend taking profits. A test of this level will return the euro to a bearish trend. A more distant target will be the 1.0810 area. If the pair recovers during the European session and bears are inactive at 1.1007, the optimal scenario will be selling when a false breakout is formed in the area of 1.1049. It is possible to open short positions on EUR/USD immediately for a rebound from the highs: 1.091 and 1.1136 with the goal of a downward correction of 20-25 points.

I recommend to read:

GBP/USD: plan for the European session on March 22. Commitment of Traders COT reports (analysis of yesterday's trades). The pound is preparing for a new fall

Indicator signals:

Trading is below 30 and 50 moving averages, which indicates that bears have regained control of the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0988 will lead to a fall in the euro. A breakthrough of the upper border of the indicator in the area of 1.1050 will lead to an increase in the euro.

Description of indicators:

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.