Daily closing below the critical 100 EMA will initiate a fresh downswing toward the bullish 50 EMA at 1.0591. The bullish 14-day Relative Strength Index (RSI) and double Bull Cross confirmation could overpower the rising wedge pattern, for now, allowing bulls some respite. Although the lower highs formed on the daily sticks so far this week warrant caution for Euro bulls.

On the upside, the EUR/USD pair needs a sustained move above the 50 EMA (above 1.0591) before attacking the 1.0673 barrier. Further up, bulls will aim for The next significant upside targets are aligned at today's high at 1.0625 and the 1.0591 psychological level.

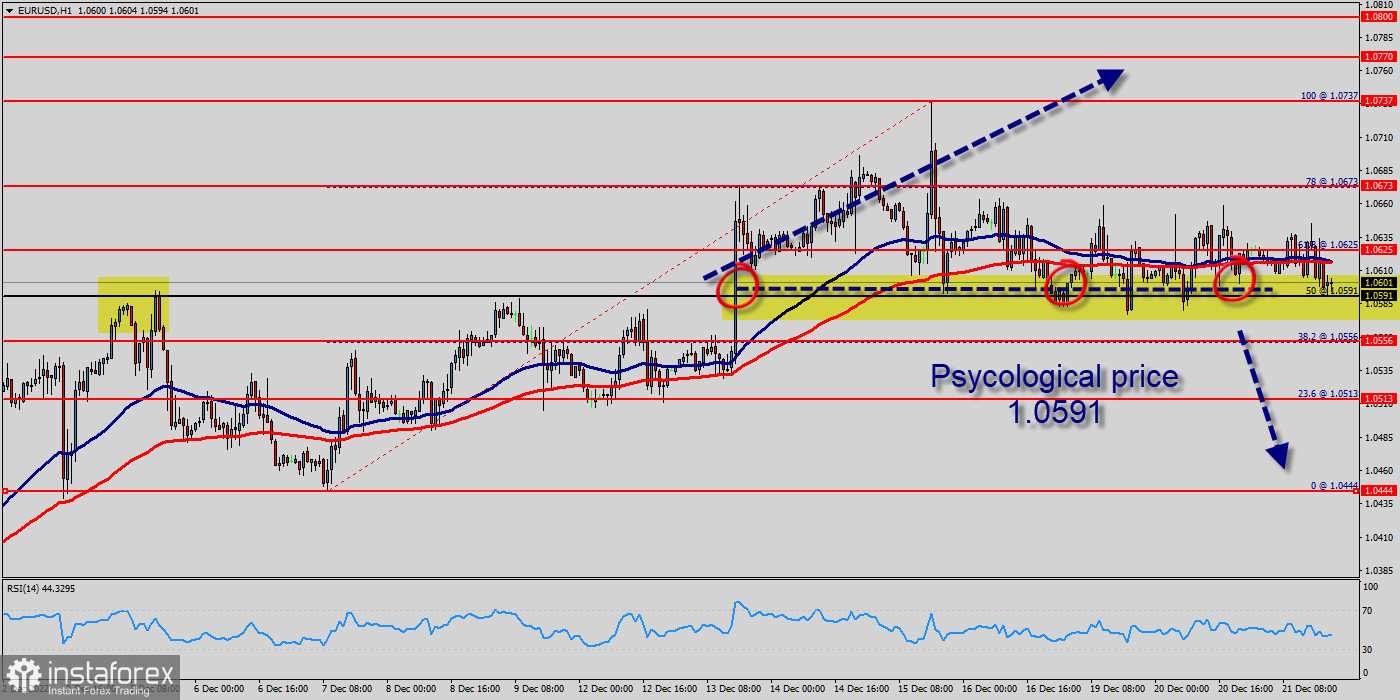

The EUR/USD pair will continue to rise from the level of 1.0591. The support is found at the level of 1.0591, which represents the 50% Fibonacci retracement level in the hourly chart.

Slightly bullish trend on the EUR/USD pair. It is difficult to advise a trading direction under these conditions. The first resistance is located at the price of 1.0673.

The Euro remained above the levels of 1.0591 and 1.0600, not far from the key 1.0591 evenness mark as more data is pointing out that a recession is looming. Final PMI figures confirmed the Euro Area private sector activity contracted for the first time since last week. Intraday bias in the EUR/USD pair remains upwards for the moment.

The first support is located at 1.0591. It could stay away while waiting for a more pronounced price movement on this instrument.

A new analysis could then be produced that would give clearer signals. The price is likely to form a double bottom. Today, the major support is seen at 1.0591, while immediate resistance is seen at 1.0673.

Accordingly, the EUR/USD pair is showing signs of strength following a breakout of a high at 1.0673. Range trading continues in the EUR/USD pair and intraday bias stays upwards at this point.

So, buy above the level of 1.0591 with the first target at 1.0673 in order to test the daily resistance 1 and move further to 1.0737.

Also, the level of 1.0737 is a good place to take profit because it will form a double top. Amid the previous events, the pair is still in an uptrend; for that we expect the EUR/USD pair to climb from 1.0591 to 1.0737 today.

At the same time, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.0556, a further decline to 1.0500 can occur, which would indicate a bearish market. Technical indicators (RSI) are indecisive in the very short term but do not change the general bullish opinion of this analysis.