Fed Chairman Jerome Powell said on Monday that the central bank could move to a more active process of raising interest rates, thereby causing a decrease in US stock indices, rise in Treasury yields and an increase in dollar. He said they could immediately set a 0.50% increase because the level of inflation is already unacceptable. "We will take the necessary steps to ensure a return to price stability," Powell explained.

This statement is a contradictory to the Fed's recent decision to raise rates by a minimum of 0.25%, making investors confused on Powell's true stance. Many think that the Fed chief said that because US senators are concerned about high inflation, so in order to remain in his post, Powell "played along" with them.

The fact that inflation jumped to 7.9% was known even before the Fed meeting, which means that nothing prevented the central bank from taking action and immediately raising rates by half a percent. But it did not happen because there is an understanding that such a move could plunge the US economy into a recession, especially since the ongoing geopolitical situation is already affecting markets. There is a chance that the US will not be able to withstand a turndown, and that will become a prologue to large-scale upheavals, unrest and the loss of Congress by the Democrats, which they really do not want.

Many believe that Powell's words were only his personal initiative, at least for now.

In any case, while futures for the three major stock indices show negative dynamics, the dollar posted a smooth rally. The growth in treasury yields also began to slow down, and it is possible that the mood of markets today will shift from negative to positive.

Forecasts for today:

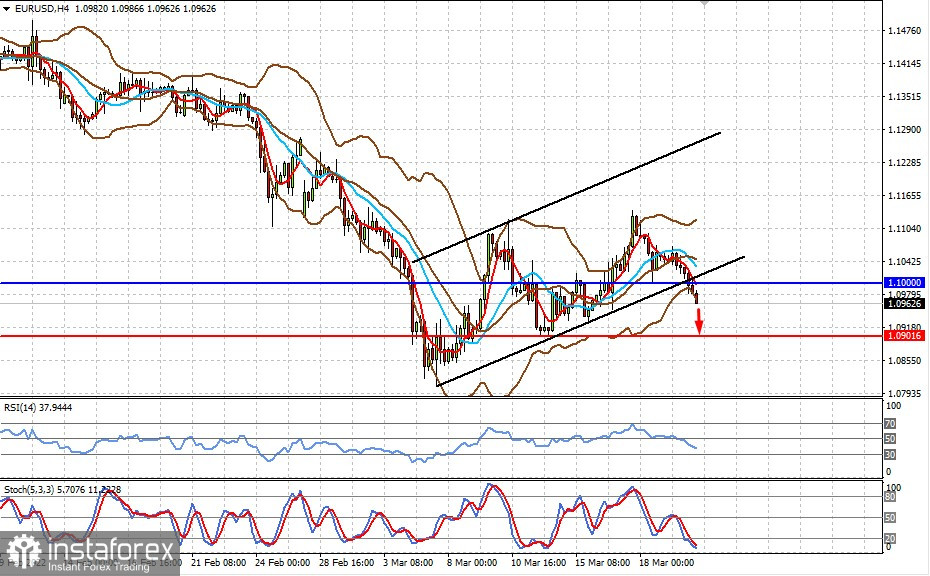

EUR/USD fell below 1.1000 amid fears that the Fed will increase rates more vigorously, while the ECB, on the contrary, will keep them unchanged. From a technical point of view, the pair is showing a bearish pattern and may drop to 1.0900.

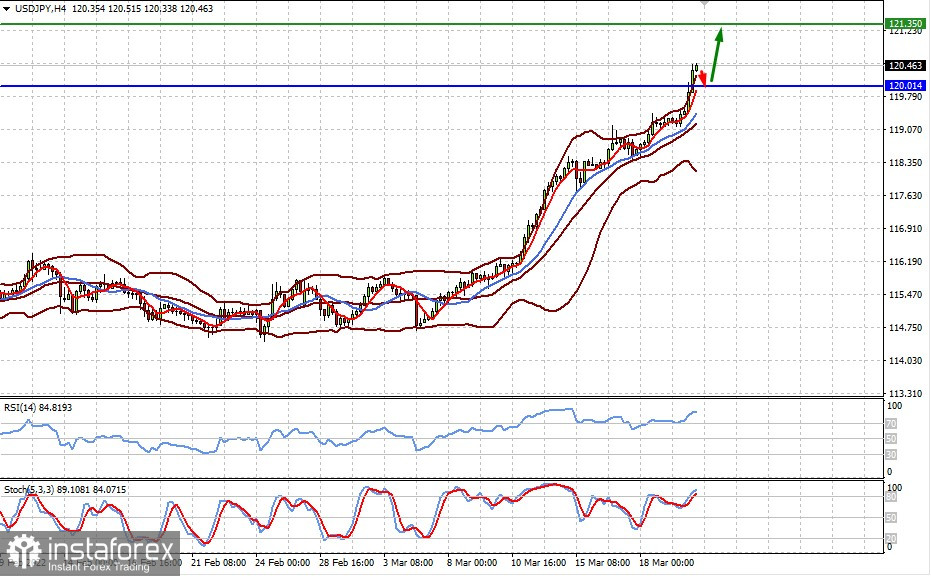

USD/JPY broke above 120.00. However, it will dip to 120.00 before rising further to 121.35.