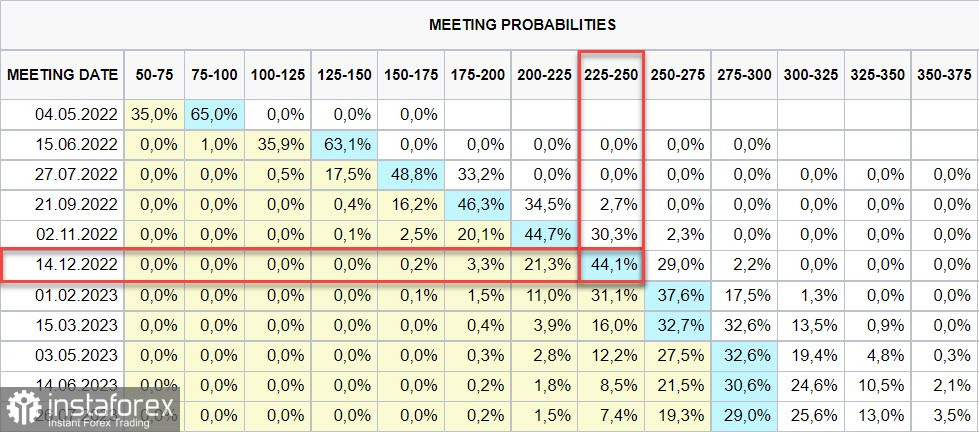

The speech of U.S. Federal Reserve Chairman Jerome Powell served as the most significant event on Monday, in which he unequivocally announced his readiness to raise the rate by 50 points at the next meeting on May 4. Before Powell's speech, Board of Governors member Christopher Waller spoke publicly about such a move on Friday, but his comment faded into a series of more cautious assessments. Well, Powell is being decisive, with rate futures on Tuesday morning seeing a 75% chance of a year-end rate hike in the 2.25-2.50% range, more than half a percent higher than forecast a couple of weeks ago.

For the dollar, this is definitely a bullish factor. The yield on 2-year bonds rose above 2.1%, 10-year bonds reached 2.34%, a three-year high. The rapid growth of yields makes investments in dollar assets more attractive, which is especially important against the background of the inevitable growth of the budget deficit.

The hawkish rhetoric also aims to bring down inflationary sentiment, but while there are no positive dynamics, some time is needed to assess how the Fed's determination will affect inflation.

It is also necessary to cancel the rapid rise in oil prices, Brent almost reached $119/bbl on Monday, the reason being Europe's readiness to abandon Russian oil. Such a step seems unlikely, since "pressure on Moscow," as history shows, will not lead to the expected consequences, but the economic situation of the European countries themselves will not be in the best way. Nevertheless, the next wave of growth in demand for oil and, in general, for raw materials will support commodity currencies.

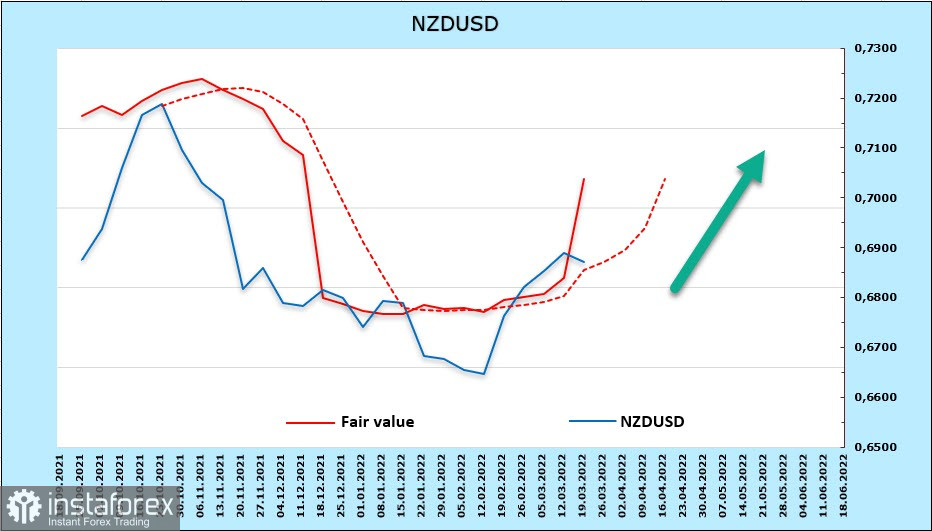

NZDUSD

New Zealand's economy grew by 3% in the 4th quarter, having almost completely won back the recession of the previous quarter, which happened due to the next covid restrictions. This is good news, others are either weak or neutral. There are still no signs of a slowdown in inflation, consumer sentiment fell from 99.1 to 92.1 in the 1st quarter, according to Westpac research, which worsens consumer demand forecasts.

As inflation is forecast to reach 7.4% in Q2, the RBNZ will act more decisively. ANZ bank predicts that the rate will rise by 50 at meetings in April and May, then in increments of 0.25% will reach 3.5% in April 2023. This is an even steeper rate increase than the Fed, which, on the one hand, will slow down economic growth and negatively affect households with a high level of debt, but, on the other hand, will curb inflation and create conditions for faster growth of the yield curve, which will attract new investments to the financial market. New investments, among other things, mean an increase in demand for NZD, which will lead to an increase in its market value.

The weekly change in NZD was +1.09 billion, a very strong bullish signal. The estimated price goes up, kiwi has good chances to continue growing.

The nearest target is the upper limit of the bearish channel, approximately in the 0.7050/70 zone, in the long term, we can expect an attempt to break out of the channel up to 0.7215.

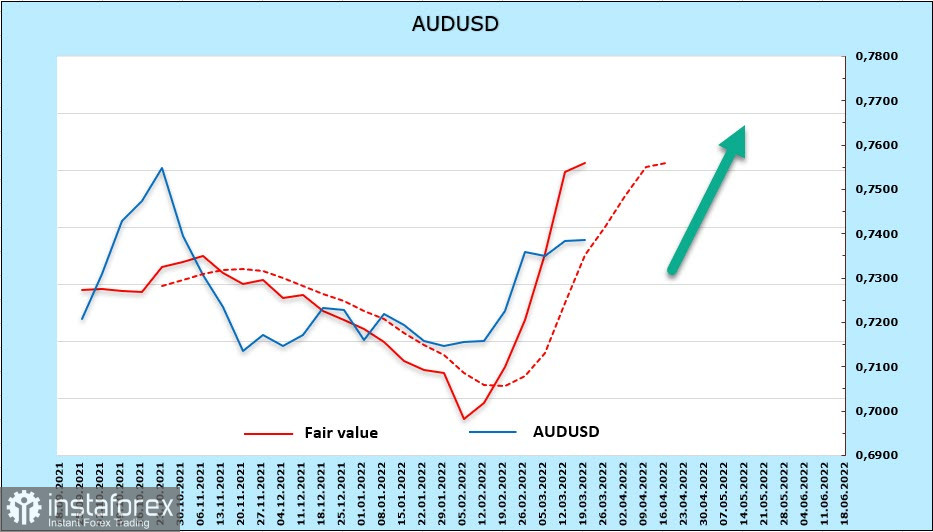

AUDUSD

The Australian dollar is benefiting from both rising commodity prices and a generally positive mood. Last week's labor market report came out strong, with unemployment down to 4%, the lowest level on record, so it's only a matter of time before the RBA hikes. Demand for labor remains strong, indicating strong economic momentum.

The net short position in AUD decreased during the week, according to the CFTC report, immediately by 2.456 billion, this is a very strong correction, reflecting changes in the mood of the players. The settlement price is above the long-term average and is directed upwards, the trend is bullish.

The Aussie managed to push off the support at 0.7180/7200, the nearest target is 0.7460/80, then 0.7560.