At yesterday's trading, the GBP/USD currency pair showed rather ambiguous price dynamics. More details about this will be noted in the technical part of this review. However, for now, let's briefly talk about the events and the external background that may affect trading on the pound/dollar pair. As already noted in today's article on the euro/dollar, in his speech yesterday, the chairman of the US Federal Reserve System (FRS) Jerome Powell not only retained the "hawkish" rhetoric but also, in my personal opinion, strengthened it. The main motive for such a tough tone is still high inflation, to combat which the Fed intends to continue the process of raising the federal funds rate. At the same time, Powell does not exclude at all that the next rate hike may occur immediately by 50 basis points, as well as the fact that at its next meeting the Fed may decide to reduce the balance sheet. In general, the Fed's position is clear and understandable, the markets expect the most decisive actions from the US Central Bank.

If we touch on the topic of the COVID-19 pandemic, a booster vaccination is starting in the UK, which can be used by about 5 million people. A booster vaccination is a repeated administration of the drug, and here the special risk group is represented by citizens of the United Kingdom whose age is 75 years and older. In England, this approach to reducing the number of cases of coronavirus is considered very effective, and booster vaccination has already begun in Wales and Scotland.

If you look at today's economic calendar, data on net public sector borrowings have already been received from the UK, which turned out to be better than the forecast value of minus 8.1 and amounted to minus 13.1. At 11:00 (London time), the report on the balance of industrial orders of the Confederation of British Industrialists will be lowered from the UK. There are no important releases scheduled from the USA for today, but FOMC members William and Daly will make speeches. All the details on these and other events can be found in the economic calendar, and we proceed to the consideration of price charts.

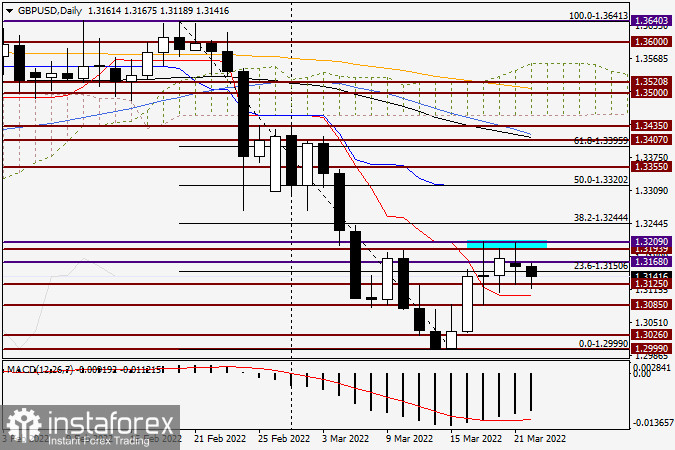

Daily

So, as can be seen on the daily chart, yesterday's trading on GBP/USD was quite volatile. The pair then took off, then fell, but eventually ended Monday's session at 1.3161, that is, not far from the opening price of trading. It is necessary to pay attention to the strength of resistance when trying to break through the important technical mark of 1.3200. And again, from 1.3208, there was a strong rebound down, as a result of which a rather big upper shadow remained at the top. At the same time, Monday's minimum values were at the level of 1.3125, from where there was also a fairly strong rebound. Today, at the end of this article, the pair is under selling pressure and has already started testing yesterday's support received at 1.3125 for a breakdown. If today's trading closes below this level, and even more so under the strong technical mark of 1.3100, the road to lower prices will open, among which 1.3080, 1.3050, 1.3020 and the round psychological level of 1.3000 can be noted. To implement the bullish scenario, a true breakdown of the resistance level of 1.3209 is necessary, with an indispensable consolidation above this mark.

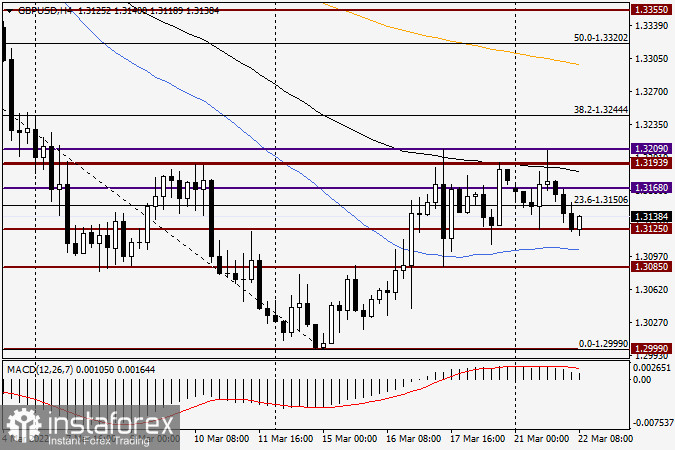

H4

On the four-hour chart, the pair is trying to adjust and show growth. What will come out of this will show the course of the auction. Turning to trade recommendations, it is necessary to remember yesterday's daily candle, which, by and large, did not give an advantage to any of the opposing sides. Thus, for the GBP/USD pair, it is worth considering positioning in both directions. The resistance is represented by the black 89 exponential moving average, which runs at 1.3186. If bearish candlestick patterns begin to appear on the approach to the 89 EMA, this will be a signal to open short positions for the pound. I recommend following the same strategy, but already for opening purchase deals, in case the pair drops to 50 MA, which passes at 1.3103. When bullish candlesticks appear here, you can try to buy sterling.