EUR/USD

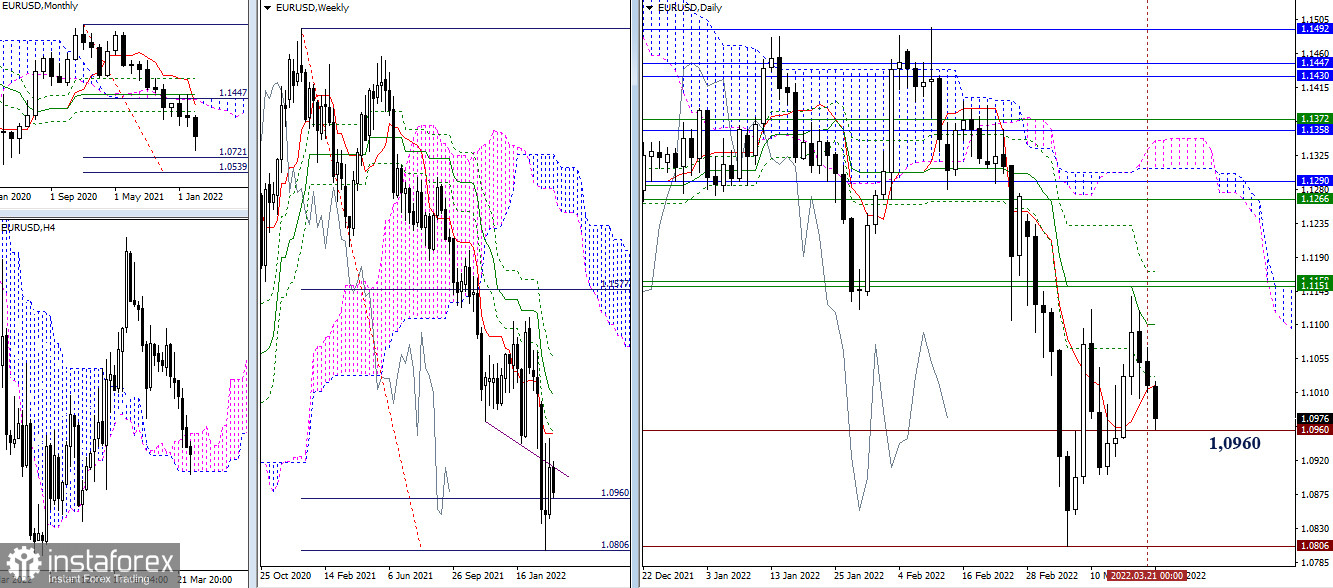

Sellers had the initiative yesterday, but they still failed to develop the decline and go down under the daily supports 1.1031-14. Today, the market preferences remain, and bearish players are currently testing the first target of the weekly target for the breakdown of the Ichimoku cloud (1.0960). The tasks and interests of bears in this area are now reduced to going beyond the support of the weekly target (1.0960 - 1.0806). After that, the monthly target for the breakdown of the cloud (1.0539 - 1.0721) will become a downward reference point.

The prospects and targets for the bulls were outlined in more detail during yesterday's analysis of the situation (the first stage 1.1101 - 1.1151-58 - 1.1171 and the second stage 1.1266 - 1.1290 - 1.1308 - 1.1348 - 1.1358 - 1.1372).

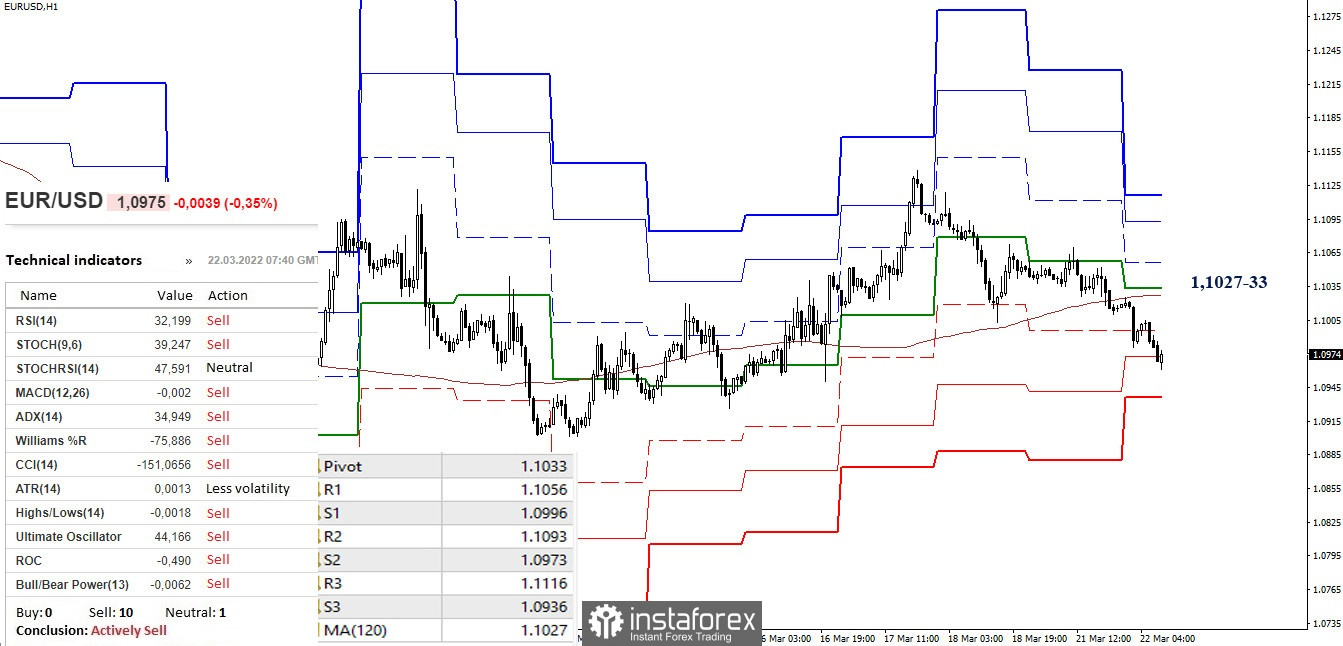

Meanwhile, in the lower timeframes, the preponderance of forces descended to the side of the bears, as they managed to leave behind the key levels, which today are consolidating their efforts in the area of 1.1027-33 (central pivot point + weekly long-term trend). Working below the key levels strengthens the bears, consolidation and working above the levels gives preference to the development of bullish sentiment on H1 and lower timeframes. Now the support of S2 (1.0973) is being tested, further attention within the day will be directed to S3 (1.0936). Upward targets today are located at 1.1056 – 1.1093 – 1.1116 (resistance of classic pivot points).

***

GBP/USD

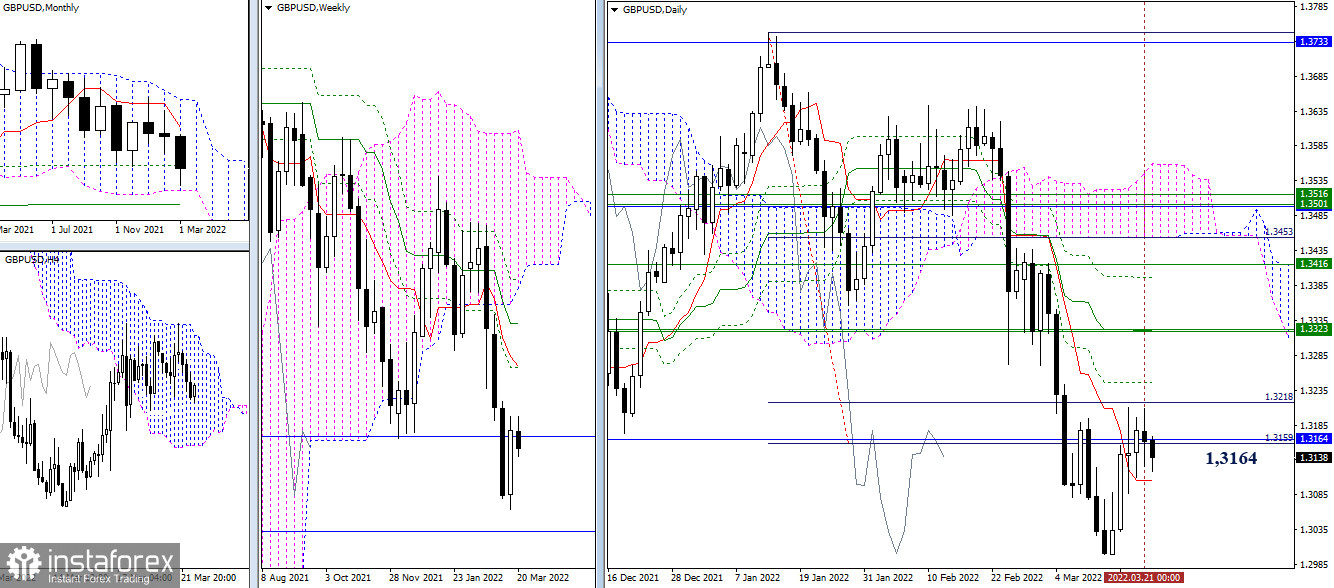

Yesterday there was no effective movement. The pair remained within the movement of the previous days, being located in the zone of attraction and influence 1.3159-64 (target + monthly Fibo Kijun). The main landmarks in the current conditions retain their location. For bulls, this is 1.3245 (daily Fibo Kijun) and 1.3323 (weekly levels + daily medium-term trend). For bears, 1.3105 (daily short-term trend) and 1.3000 (minimum extremum).

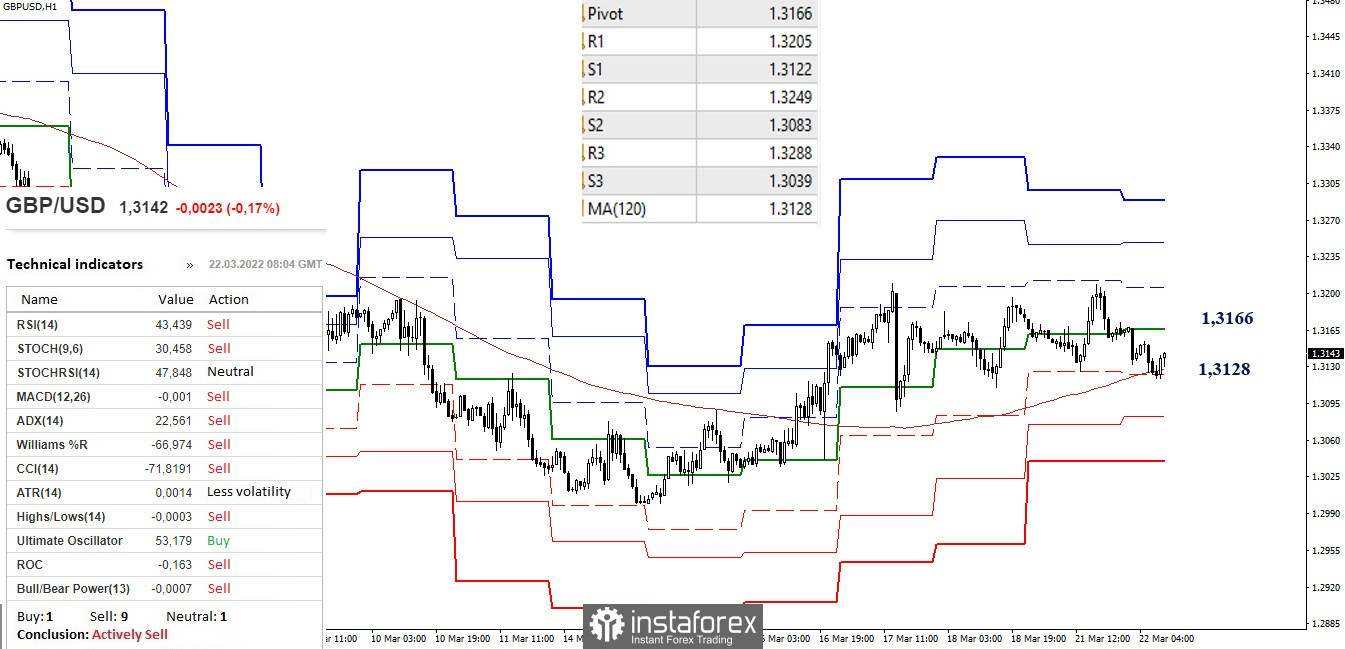

Sideways movement is developing on the lower timeframes. At the same time, bearish players are now testing support for the weekly long-term trend (1.3128). Securing below will affect the current balance of power. In this case, 1.3083 and 1.3039 (support of the classic pivot points) will serve as additional reference points for the decline within the day. The center of the sideways movement is now 1.3166 (the central pivot point of the day). Upward references for the continuation of the rise with the activity of the bulls are at 1.3205 - 1.3249 - 1.3288 (resistance of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)