Bearish scenario most promising

Hi, dear traders!

First, let us have a look at the pair's performance last week, as well as its potential price dynamics in the future.

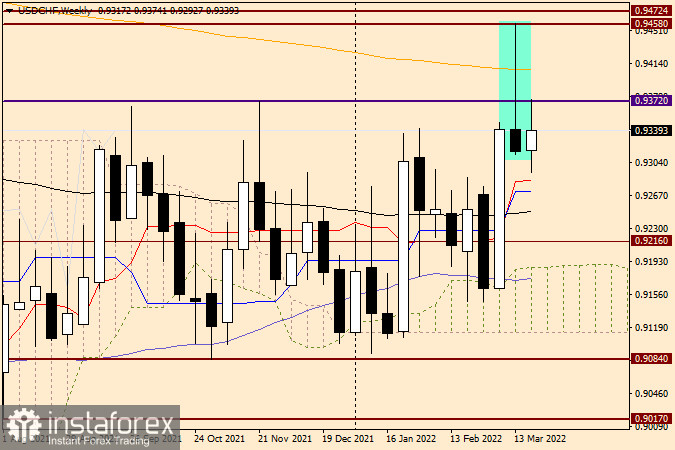

Weekly

Last week's candlestick had a very long upper shadow – the Gravestone reversal pattern indicates bulls have lost their advantageous position. As forecasted earlier, the pair failed to break through the orange 200-day EMA line, despite the efforts of bullish traders. The 200 EMA line determined the pair's price dynamic, despite USD/CHF briefly rising above it. The important technical area of 0.9458-0.9472 again served as a strong obstacle. It should be noted that the Gravestone pattern followed a sizeable bullish candlestick. That bullish candlestick indicated the pair shouldn't have faced any obstacles during its upward movement.

USD has lost its advantage over CHF due to the Fed's interest rate hike by 25 basis points, as well as its hawkish policy signals. 0.9372 is another noteworthy level – USD/CHF have performed a false breakout at this level and has faced significant bearish pressure in this area recently. Bullish traders would have to push the pair above very strong resistance in the 0.9458-0.9472 area. USD/CHF would have to settle above 0.9472 as well. Above it lies the key psychological level of 0.9500 which is also likely to serve as an obstacle for the quote. If USD/CHF continues to fall, its targets at this timeframe would be the red Tenkan-Sen line at 0.9283 and the blue Kijun-Sen line at 0.9271.

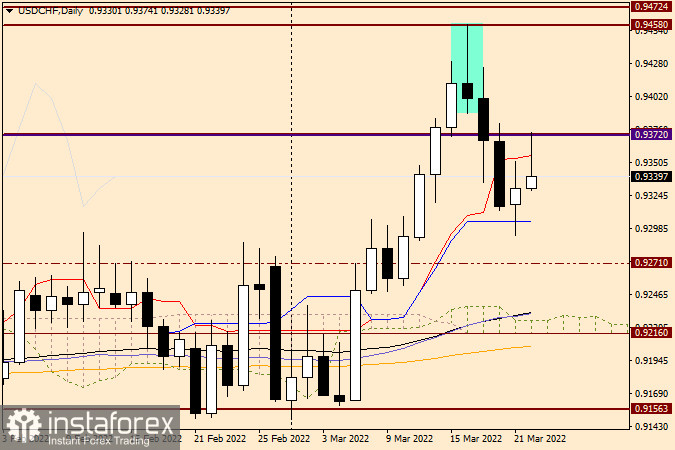

Daily

Bullish traders managed to come on top during yesterday's volatile trading. However, at the moment of writing they have failed to extend the pair's upside movement. This is indicated by the long upper shadow which appeared after the pair had performed a false breakthrough of 0.9372 and the red Tenkan-Sen line. The bearish scenario seems to be the most promising one at the moment. The main trading strategy for USD/CHF is opening short positions after the pair makes any upward corrections. Taking short positions could also be possible if the pair consolidates below 0.9350-0.9360 and rebounds towards it.

Good luck!