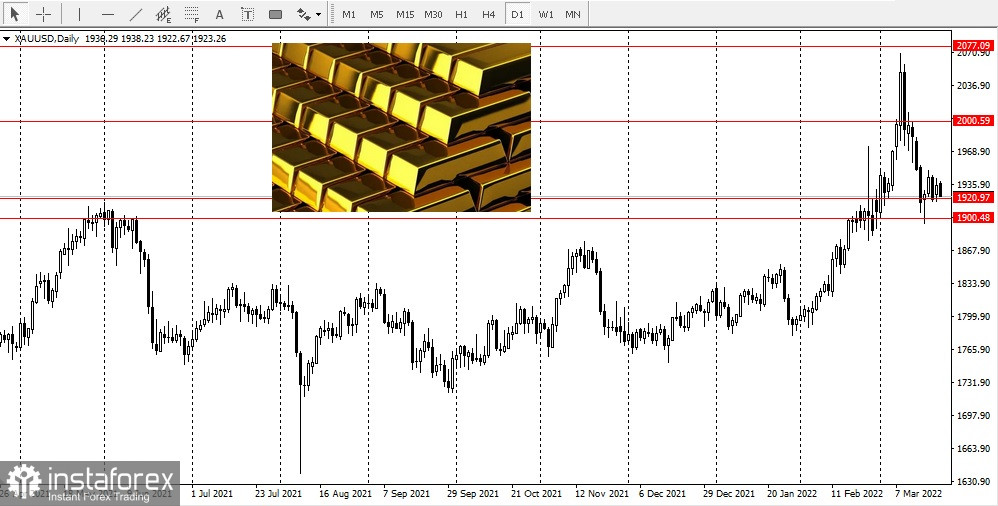

After dropping by more than $60 last week, gold has found solid ground and support at about $1,920.

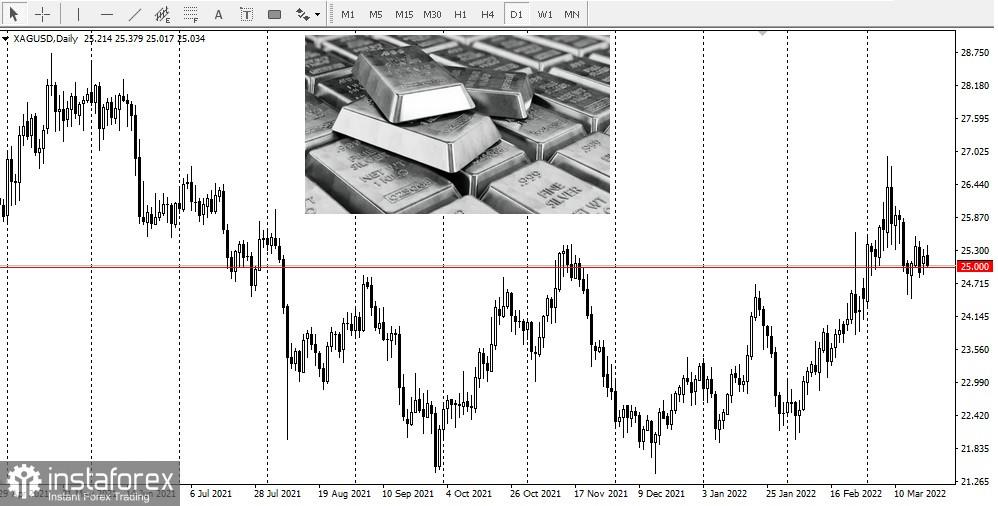

Analysts believe that interest in gold has not diminished. However, according to the latest data from the Commodity Futures Trading Commission, some hedge funds reduced their bullish positions on gold as investors prepared for a new round of the Federal Reserve's new tightening cycle.The CFTC disaggregated Commitments of Traders report for the week shows that Comex money managers lowered their speculative gross long positions in gold futures by 15,913 contracts to 165,597. At the same time, short positions rose by only 523 contracts to 39,060.Gold's net length now stands at 126,537 contracts, down by 11.5% from the previous week. However, bullish positioning is up by more than 150%.Daniel Briesemann, a Commerzbank analyst, said that bullish speculative interest in gold is also reflected in gold-backed exchange-traded products. He also noted that since early March, ETF stocks have added by more than 120 tons.Ole Hansen, head of commodity strategy at Saxo Bank, said that he also does not expect safe-haven demand for the precious metal to exhaust completely.Little wonder that some investors had cut their gold holdings before the Federal Reserve announced its monetary policy. Nevertheless, many analysts say gold now has a potential upward trend after the central bank released its interest rate plan.Last week, after raising interest rates by 25 basis points, the Federal Reserve lowered its forecast for economic growth and raised inflation expectations for 2022. Most likely, the central bank is going to raise rates at least seven times this year.As for silver, the latest trade data showed investors trimmed their overall positions.

The disaggregated report says that speculative long positions in silver futures on the Comex declined by 2,118 contracts to 62,249. At the same time, short positions decreased by 1,481 contracts to 14,206.Silver's net length stands at 48,043 contracts, relatively unchanged from the previous week.Notably, along with pressure from gold sellers, silver prices are also under pressure as global economic expectations are lowered.Weak economic growth expectations are also affecting sentiment in the copper market.

Copper's disaggregated report showed money-managed speculative gross long positions in Comex high-grade copper futures fell by 10,851 contracts to 60,685. At the same time, short positions rose by 1,872 contracts to 31,930.Currently, copper's net length is at 28,755 contracts, down by more than 30% from the previous week.Commodity analysts at TD Securities said that the copper market was also impacted by the massive disruption seen in nickel as significant volatility shut trading down worldwide.