The price of Gold is trading at 1,819 at the time of writing. The bias is bullish in the short term as the DXY is still in the corrective phase. As you already know from my previous analysis, XAU/USD reached a resistance zone, so we need confirmation.

The yellow metal continues to stay higher, even though the Canadian CPI reported a 0.1% growth versus the 0.0% growth expected, while the US CB Consumer Confidence came in at 108.3 versus 101.0 expected.

Today, the US data could have an impact. The Final GDP is expected to report a 2.9% growth, while Unemployment Claims could jump from 211K to 221K in the last week.

XAU/USD At Resistance!

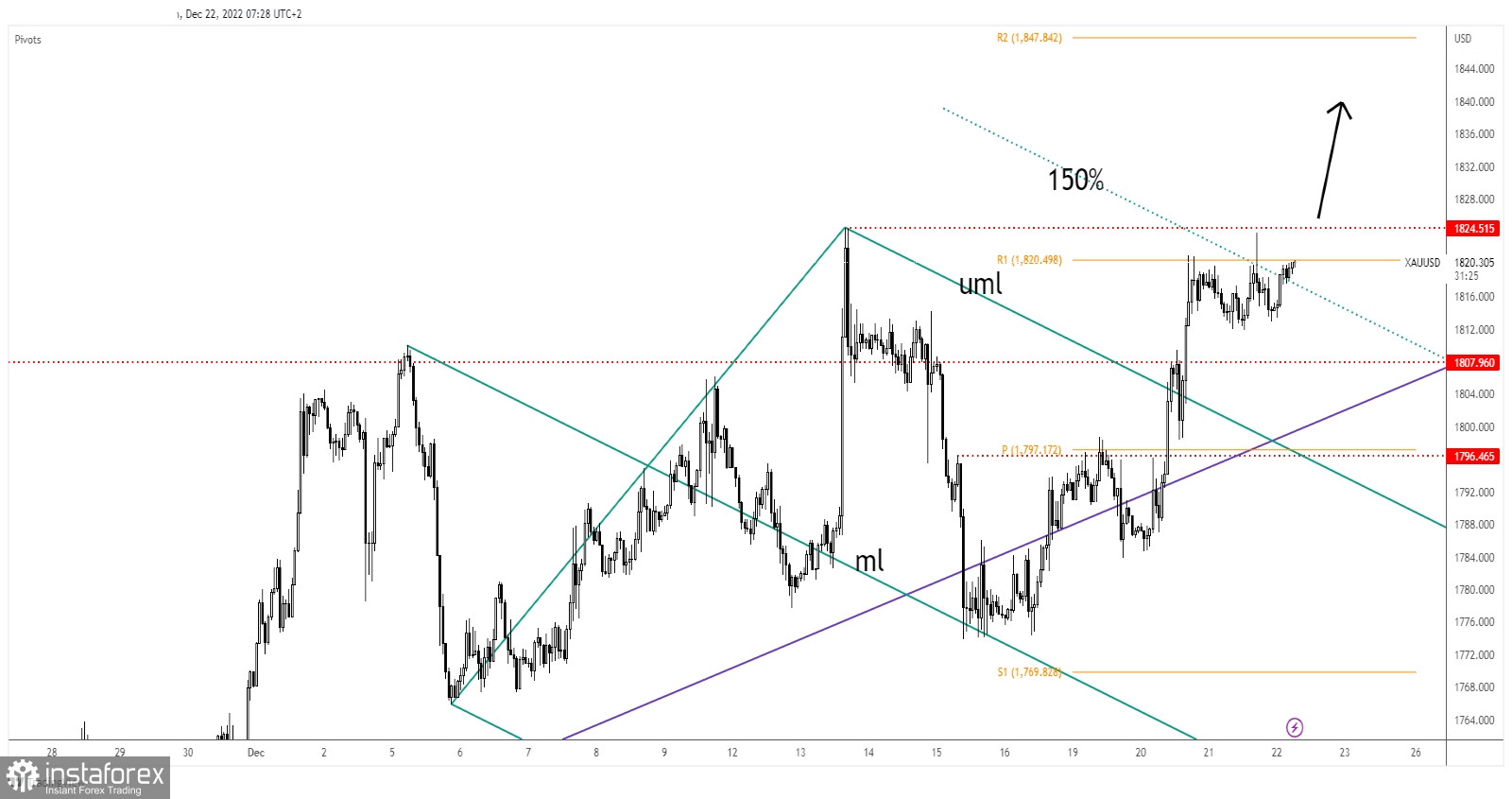

XAU/USD continues to challenge the R1 (1,820) after jumping and closing above the 150% Fibonacci line. The rate failed to come back to test and retest the 1,808 static support and now it tries to resume its growth.

As you already know from my previous analysis, the 1,824 high represents an upside obstacle as well. The bias remains bullish as long as it stays above 1,807 and above the uptrend line.

XAU/USD Forecast!

A new higher high, valid breakout through 1,824 activates further growth. This is seen as a new buying setup. Also, coming back to test and retest 1,807 and the uptrend line could bring new long opportunities.