Risk appetite in global markets remains strong. Most stocks are in the green, while bonds are being sold as investors have to take into account the aggressive mood of the central banks. There is a high chance that trends will stay bullish, with commodity currencies being the market favorites. USD may also see growth, while euro is likely to stay as is.

USD/CAD

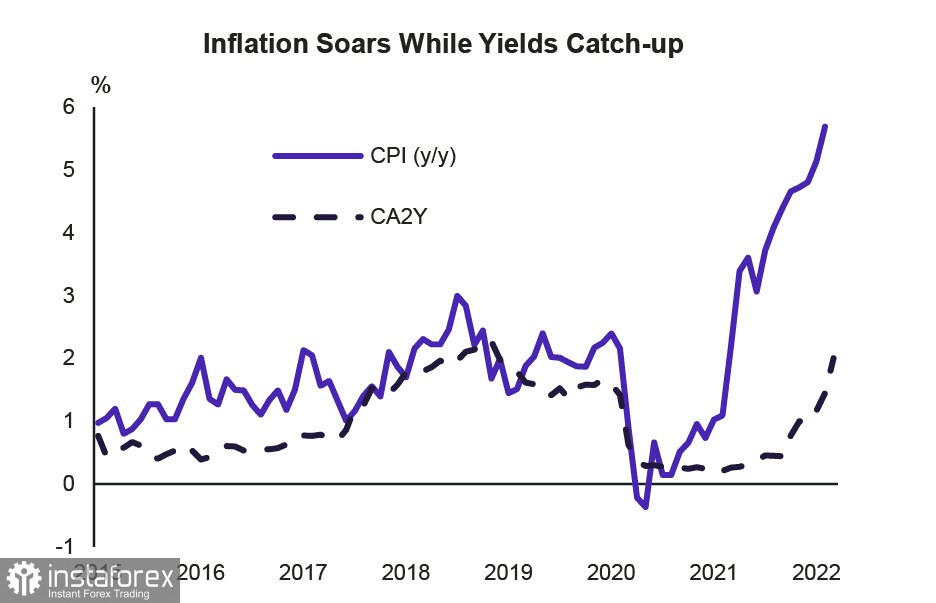

The resumption of stock rally, rise of commodity prices and easing of geopolitical threats are favorable for the Canadian dollar. That is why GKO yields have risen to the highest levels since 2018, albeit below inflation, which is currently the biggest problem.

According to reports, inflation in Canada accelerated to 5.7% y/y in February, a 30-year high. That made markets anticipate a rate of 2% over the next 12 months, which is about 0.5% lower than the Fed's rate expectations. Given slightly lower inflation, real returns will be neutral for USD/CAD.

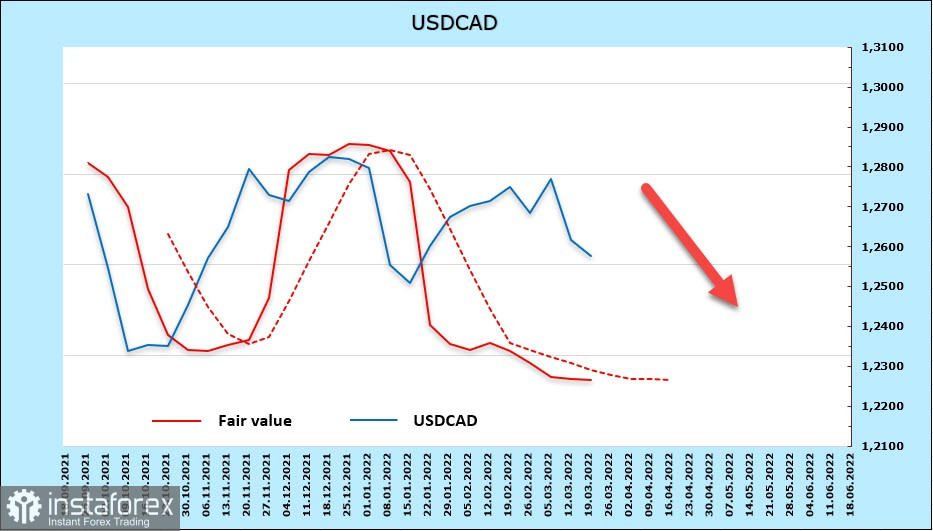

As of now, net long positions in the pair increased during the reporting week, reaching 1.30 billion. The margin is not high, but the trend is in favor of CAD. Meanwhile, the estimated price is below the long-term average, directed downwards, which gives grounds for a downward movement.

As suggested a week ago, USD/CAD dropped to 1.2580. In order for the pair to dip lower, traders must break the trend line and head to 1.2450. A rollback to 1.2630/40 is possible, followed by a downward reversal.

USD/JPY

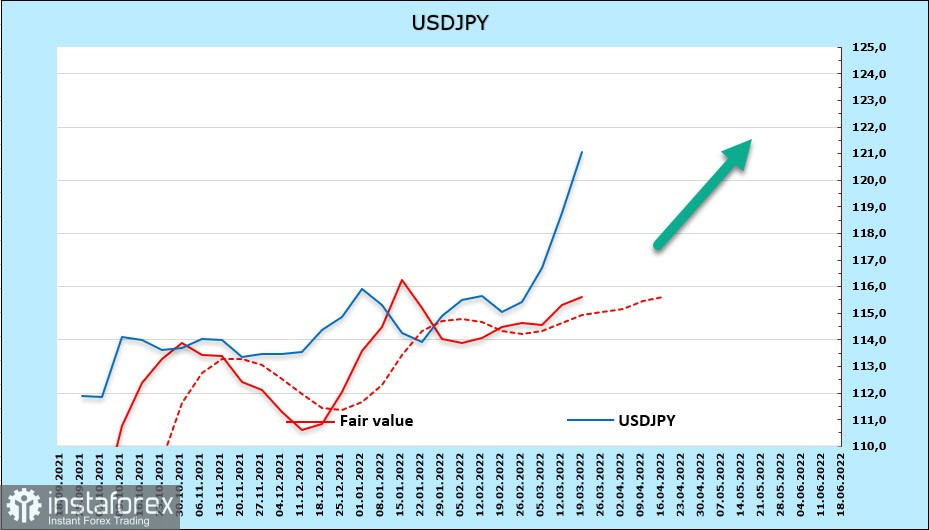

Yen continues to decline, primarily due to rising prices for oil and other raw materials, as well as higher import costs, which reduces consumer spending and small business profits. It also reached 122 because of the growing trade deficit, which will not begin to narrow until commodity prices go down. The statement of Bank of Japan Governor Haruhiko Kuroda was a factor as well because he said during the press conference last March 18 that a weaker yen is good for the economy.

Accordingly, net short positions rose again, indicating that the market is very bearish. The settlement price is also above the long-term average and is directed upwards, which means that there is no reason to expect an increase in the USD/JPY.

The pair is nearing 125.90, but it is unlikely that it will reach on the first try. A rollback is also likely, where 118.60 can act as support.