Hi, dear traders!

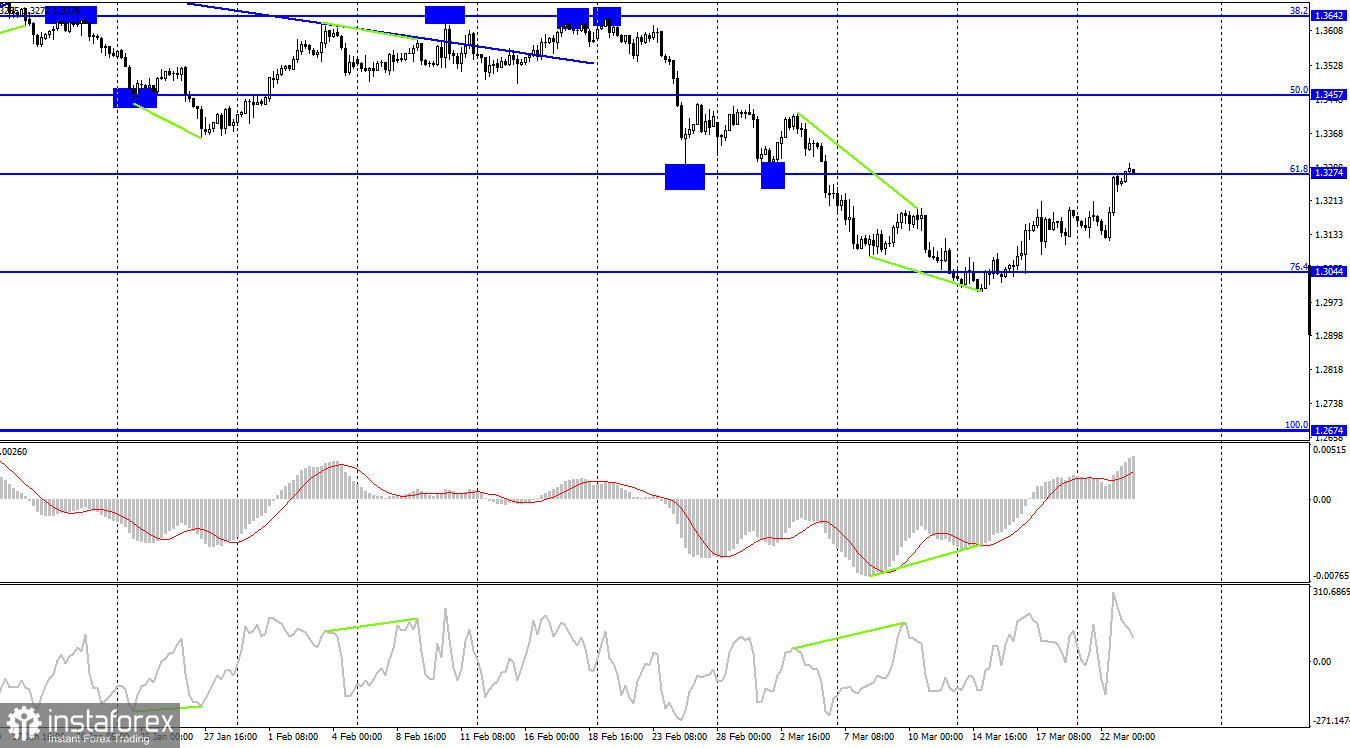

According to the H1 chart, GBP/USD reversed upwards below 1.3181 and rebounded strongly towards the retracement level of 127.2% (1.3279). The new rising channel suggests the mood of traders is now clearly bullish. If the pair bounces off 1.3279, it would fall slightly towards the Fibo level of 161.8% (1.3181). If GBP/USD settles above 1.3279, it is likely to lead to greater momentum for the pair. There are several possible explanations for yesterday's 160 pips rally. GBP/USD might have found support in end-of-year borrowing data by the UK government - the U.K. budget deficit was running 26 billion pounds below official forecasts in the first 11 months of the fiscal year. However, it is unlikely to have had a serious effect on the pair, as the previous report did not boost the pound sterling.

Traders might have also anticipated today's UK CPI data. According to today's report, inflation in the UK increased to 6.2% in February from 5.5% in January. The higher the inflation, the greater the chances of more aggressive monetary tightening at the next Bank of England meeting. However, the pound has decreased today, even though the report should have given it support. Today's inflation data was possibly leaked to major market players in advance. Further policy measures were expected to be announced by BoE governor Andrew Bailey today.

According to the H4 chart, GBP/USD rose towards the retracement level of 61.8% (1.3274). A bounce off this level would send the pair down towards the retracement level of 76.4% (1.3044). If the pair settles above the 61.8% level, it could possibly increase towards the next Fibo level of 50.0% (1.3457). Today, the indicators show no sign of emerging divergences.

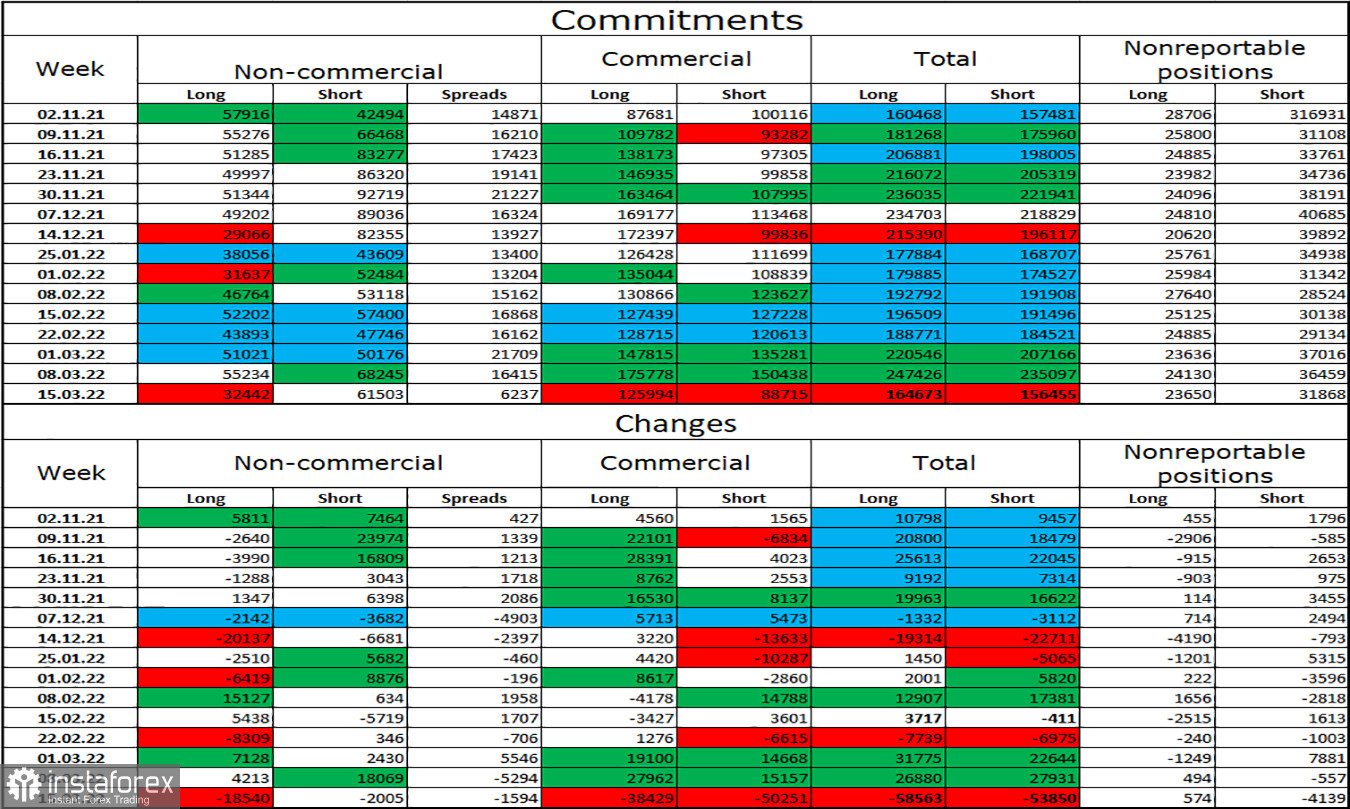

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders changed significantly in the last week covered by the report. The number of opened Long positions fell by 18,540, while the number of Short positions decreased by 2,005. The mood of major market players has become increasingly bearish. The balance between open Long and Short positions now fits the situation in the market - GBP is falling, and major players are opening more Short positions. The difference between the total number of open Long and Short positions is twofold, and GBP could continue to slump in the future.

US and UK economic calendar:

UK - CPI data (07-00 UTC).

UK - Speech by Andrew Bailey, governor of the Bank of England(12-00 UTC).

US - Speech by Jerome Powell, chairman of the Federal Reserve (12-00 UTC).

There are several noteworthy events today in both US and the UK. Traders have largely ignored the UK CPI data.

Outlook for GBP/USD:

Previously traders were recommended to open new short positions if the pair bounced off 1.3279 on the H1 chart with 1.3279 being the target. New long positions were recommended if GBP/USD surpassed 1.3181, with 1.3279 being the target. These targets have been reached. New long positions can be opened if GBP/USD closes above 1.3279, targeting 1.3357.