In today's article on the GBP/USD currency pair, as well as on the euro/dollar, I will start with the monetary policy of the two Central Banks. We all know that both the US Federal Reserve System (FRS) and the Bank of England have already begun the process of raising interest rates, and the British Central Bank has managed to do this more than once. A reasonable question arises - what's next? Will the British Central Bank run ahead of the entire planet and continue to actively tighten its monetary policy? Despite the unprecedented pace of the beginning of the tightening of its monetary policy, comparable to those observed already in the distant 1.1997, the further steps of the Bank of England leave more questions than they give answers. First of all, this is because it is necessary to find the right balance between high inflation and very weak economic growth. Nevertheless, the British Central Bank may intend to return the key interest rate to the levels at which it was before the COVID-19 pandemic. If so, then the probability of another BoE rate hike takes on very real outlines, and this may happen at the May meeting of the Bank of England. At the same time, such expectations may be very high, and their revaluation will put significant pressure on the British pound sterling paired with the US dollar and not only with it.

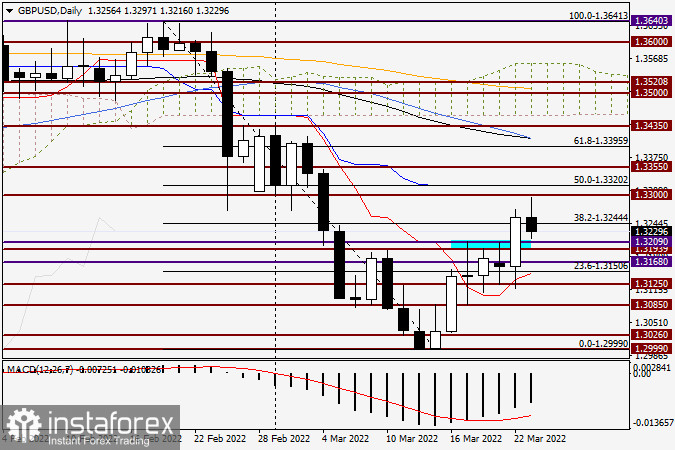

Daily

Meanwhile, important reports from the UK on the consumer price index have already been released today, and they turned out to be better than expected. Thus, monthly, consumer prices increased by 0.8%, although the forecast provided for an increase of 0.6%. And in annual terms, the indicator exceeded economists' expectations of 6.0% and grew by 6.2%. It would seem that these inflation reports will support the pound, as they will signal the Bank of England about the need to take measures regarding rising inflation, which means raising the interest rate again. Nevertheless, sterling reacted very ambiguously to such figures and at the time of writing is under little selling pressure. But if you look at the results of yesterday's trading, it should be noted a very impressive growth of GBP/USD, as a result of which the pair was able to break through a very strong resistance of sellers in the area of 1.3200. In general, in my personal opinion, this mark can become decisive regarding the further price dynamics of the British currency. If the pair gains a foothold above 1.3209, further growth will follow. And at the time of writing, such attempts have already taken place. The pair rose to 1.3297, that is, in fact, to another very important and strong technical level of 1.3300, where it met strong resistance from sellers and turned to the south. At the moment of the conclusion of the article, the pressure on the "Briton" increases. However, I do not exclude that the market gives a pullback to the broken support level of 1.3209, which means an opportunity to buy GBP/USD.

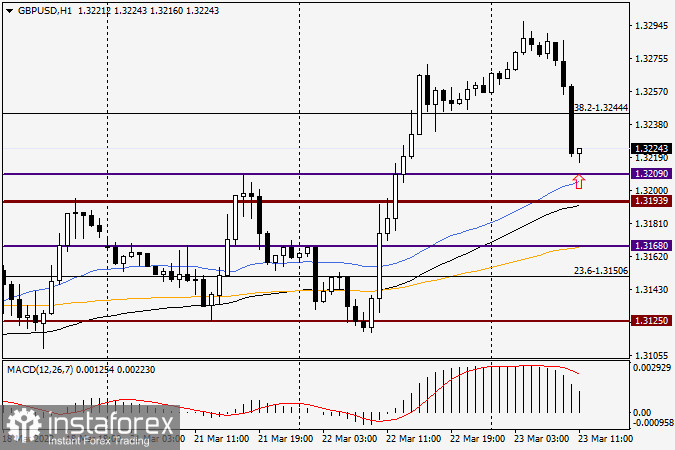

H1

On the hourly price chart, the current bearish candle looks pretty impressive. Nevertheless, given the often and sometimes suddenly changing market sentiment, I do not rule out that it is a pullback to the previously broken resistance of 1.3209 that is taking place. If we follow this conclusion and take into account the moving averages located immediately below this mark, then opening long positions on GBP/USD looks pretty good technically after falling into the price zone 1.3210-1.3195. Taking into account yesterday's growth and the breakdown of significant resistance, as well as good macroeconomic statistics, purchases from the selected zone seem to be the main trading idea at the moment.