Equity markets seem to remain confident in the sustainability of global growth, with many investors turning to equities as an inflation hedge. Bonds are bearing the brunt of the central bank's calls for tougher action to curb inflation, which has risen to 40-year highs as a military operation in Ukraine spurs commodity prices. Even dovish Fed policymakers echo Powell's claim that rates may need to rise faster, insisting that "the economy is strong enough" to handle higher borrowing costs. As such, US stock indices have been growing for 6 sessions in a row, with the S&P 500 and Nasdaq recovering half of their losses this year.

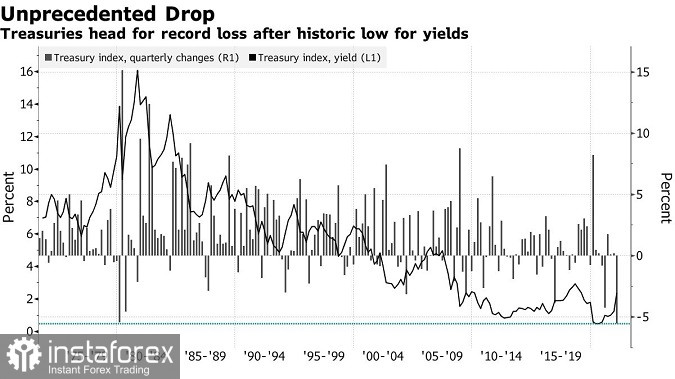

Meanwhile, Treasuries accelerated their decline on Monday amid signals from Fed Chairman Jerome Powell that a half-point rate hike could be possible at the next central bank meeting. Short-term US government bonds sank to their worst quarterly performance in nearly four decades, with yields rising to highs not seen since mid-2019.

Oil prices, on the other hand, rose higher amid prospect of new sanctions on Russia and a reduction in US crude oil inventories.

"We are positive about the stock market this year," said Seema Shah, chief strategist at Principal Global Investors. She also said that the US economy is "pretty good" in principle, despite the market becoming more challenging in 2023 and recession risks are rising. "Faster increases will clearly help inflation come down. That could lessen the need for a longer tightening campaign," Shah added.

Even so, fears are rising because of the conflict in Ukraine. US President Joe Biden already met with allies on Thursday to discuss further actions regarding the situation. The US and the UK have reached an agreement to cut tariffs on steel and aluminum, which could ease some inflationary pressures.

ECB President Christine Lagarde, Bank of England Governor Andrew Bailey and Fed Chairman Jerome Powell will speak at the BIS Innovation Summit on Wednesday.

Other important events for this week are:

- EIA crude oil inventory report (Wednesday);

- speech of UK Chancellor Rishi Sunak (Wednesday);

- NATO summit (Thursday);

- EU PMI report (Thursday);

- US jobless claims and durable goods report (Thursday).