To open long positions on GBP/USD, you need:

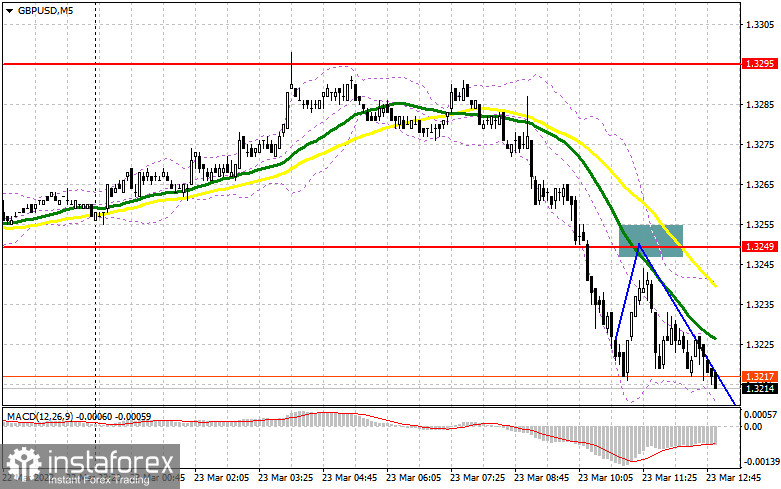

In my morning forecast, I paid attention to the level of 1.3249 and recommended deciding on entering the market. Let's look at the 5-minute chart and figure out what happened. The decline of the pound in the area of 1.3249 and its breakdown occurred quite quickly. It's all the fault of the inflation data in the UK, which exceeded the forecasts of economists. And although there was a breakthrough of this level, there were a couple of points missing before the reverse test from the bottom up. For this reason, I was unable to get a good entry point into short positions. No other signals were generated. In the afternoon, the technical picture has completely changed. And what were the entry points for the euro this morning?

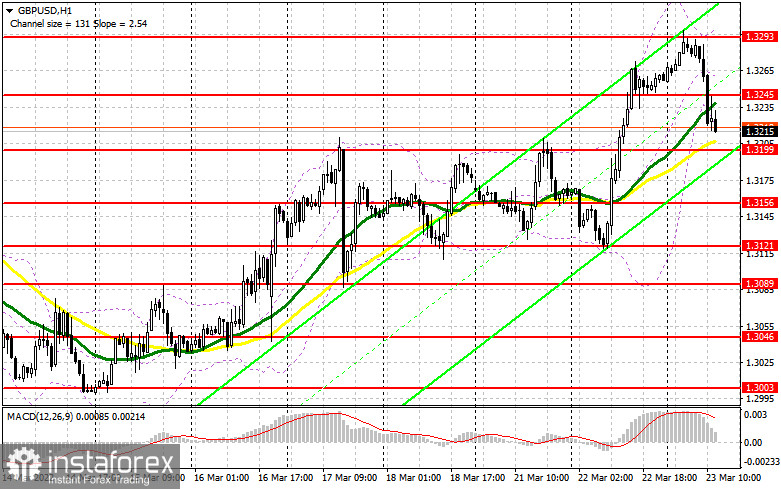

As I noted above, the inflation data exceeded economists' forecasts, which is very bad for the British pound. The risk of a more active increase in interest rates in the UK against this background would normally lead to a strengthening of the GBP/USD pair, but at the moment, when the economy is gradually slowing down and the standard of living in the UK is rapidly falling, belt-tightening by raising interest rates will only worsen the situation. To return the bullish momentum, it is very important today to bring the new resistance of 1.3245 back under control. Otherwise, the bears will quickly dump the pound back to 1.3199. Below this level, jokes are bad, since the probability of a downward trend return will grow exponentially. The release of fundamental statistics on the US is likely to support the US dollar, so the priority is to protect the nearest resistance of 1.3199. Long positions from it can be considered only after the formation of a false breakdown. But, as I noted above, the return of 1.3245 will be an equally important task for the bulls. Fixing above this range with an update of this area from top to bottom will allow buyers to return to a new high of 1.3293. It is unlikely that there will be those who want to buy further, so I recommend fixing the profits. The 1.3340 area will remain a longer-range target. In the scenario of a decline in GBP/USD during the US session and the absence of bulls at 1.3199, it is best to postpone purchases against the trend until the next support of 1.3156. But I also advise you to open long positions there only when a false breakdown is formed. This should be done in order not to get into the opposite situation from yesterday when the pair was growing all day. You can buy GBP/USD immediately on a rebound from 1.3121, or even lower - from a minimum of 1.3089, counting on a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears coped with the task set in the morning and are now one step away from updating the important support 1.3199, which apparently will not have to wait long. The priority goal of sellers for today will be a breakthrough and consolidation below this range. Strong data on the volume of home sales in the primary market in the United States, as well as hawkish statements by FOMC members Mary Daly and James Bullard, will help in this. Let me remind you that yesterday, Fed Chairman Jerome Powell hinted at a more aggressive increase in interest rates, without ruling out its growth by 0.5% already at the May meeting this year. In case of a breakdown and a reverse test from the bottom up of 1.3199, I recommend opening short positions to reduce to the support of 1.3156. A breakout and a reverse test from the bottom up and this range will form an additional sell signal, which will give a direct road to the lows: 1.3121 and 1.3089, where I recommend fixing the profits. A lot will also depend on the speech of the US Treasury Secretary and on the market reaction to the annual budget of the UK, which will be published in the afternoon. In the case of GBP/USD growth during the US session, only a false breakdown at 1.3245 will lead to the formation of a sell signal for the pound. If there is no activity there, and after testing this area, the pressure on the pound should return as quickly as possible, it is best to postpone sales until the next major resistance of 1.3293. I also advise you to open short positions there in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3340 or even higher - from a maximum of 1.3390, counting on a correction of the pair down by 20-25 points within a day.

The COT reports (Commitment of Traders) for March 15 recorded a sharp reduction in long positions and only small changes in short ones. The last meeting of the Bank of England reflected badly on the British pound. Despite the increase in interest rates, which was expected, the regulator did not signal an increase in aggressive policy, preferring more dovish rhetoric despite inflation, which is breaking long-term records in the UK. The discontent of the country's population complicates the life of the British regulator, although more aggressive actions in the current difficult geopolitical conditions may harm the economy more than help it. Now everything depends on how to cause her the least harm, because the fight against inflation is just beginning, and what will happen this spring is a mystery to many. Against this background, traders are in no hurry to buy the British pound, which shows a rather large weakness in a pair with the US dollar. The Federal Reserve meeting was also the central event of last week. As a result, the committee raised interest rates by 0.25%, which did not lead to serious changes in the market, as many expected such decisions. Against this background, I recommend continuing to buy the dollar, since the bearish trend for the GBP/USD pair has not gone away. The only thing that now saves the pound from a major sell-off is high inflation in the UK, which will eventually force the Bank of England to act more actively. The COT report for March 15 indicated that long non-commercial positions decreased from 50,982 to 32,442, while short non-commercial positions decreased from 63,508 to 61,503. This led to an increase in the negative value of the non-commercial net position from -12,526 to -29,061. The weekly closing price dropped to 1.3010 against 1.3113.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the average border of the indicator in the area of 1.3255 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.