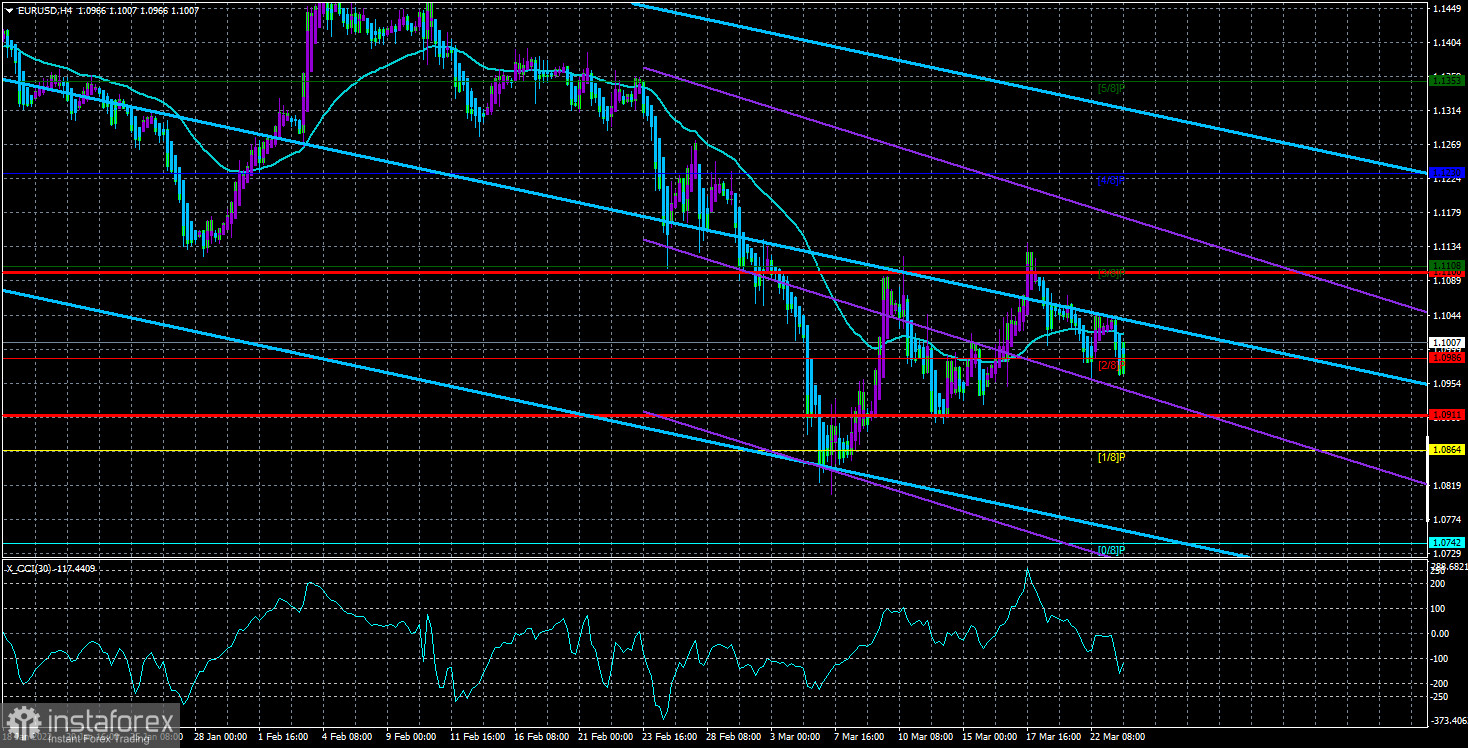

The EUR/USD currency pair resumed a slow decline during the third trading day of the week. After the price has twice worked out the Murray level "3/8" - 1.1108 and bounced off this level twice, the upward correction can be considered complete. From our point of view, now the "technique" is very interesting, especially if we consider both major currency pairs together. The pound sterling also tried several times to overcome the important Murray level, but the day before yesterday it eventually overcame it. Why can't the euro currency do this, you ask? This is a very interesting moment. The European currency is now under pressure from all possible factors. Simply put, it has nothing to show growth for. Of course, market participants can simply start buying euros, while getting rid of the dollar, but a currency pair is not a cryptocurrency or stock, we're a community of traders who can simply agree through forums and start moving the market in a certain direction. It is very difficult to even for the community of traders to influence any currency. Therefore, all factors still have to be taken into account here. And all the factors, as we have already said, speak in favor of continuing the fall of the euro. Let's consider the main ones.

In technical terms, the price has again consolidated below the moving average line, so the trend has changed to a downward trend for the second time in recent days. It is unlikely that the bulls will have enough strength for a third breakthrough to the level of 1.1108. Just this week, two important events have already taken place, which creates a common background for the pair. We are talking about the speeches of Christine Lagarde and Jerome Powell, who once again made it clear to traders that no one in Europe is even thinking about raising the rate. Moreover, the European economy may enter stagnation, since Christine Lagarde says that the chances of this are very low. Economic growth in the last quarter was minimal, while inflation is rising, the geopolitical conflict in Ukraine primarily puts pressure on the European economy. And at the expense of refugees, the expense of additional spending on assistance to Ukraine, and the expense of high oil and gas prices.

But in the States, everything is much better and calmer. First, the States are far from military operations. Second, they do not depend on either the economy of Ukraine or the economy of Russia. Third, the United States can get involved in a geopolitical conflict only through NATO and on its own, while many in Europe worry that the conflict will spread to the West. The Fed is ready not only to raise the rate at every meeting this year but also to raise it by 0.5% to cope with inflation. Thus, wherever you look, everything is in favor of the American dollar.

What can save Europe and the euro currency?

Since the macroeconomic picture is now so unambiguous that it does not even require discussion, we suggest thinking about what can save the euro currency and how long it will fall against the dollar. Everything is quite simple here. The longer the geopolitical conflict in Ukraine (which feeds Europe) lasts, the stronger the sanctions against Russia (which supplies gas, oil, and raw materials to Europe), the more the European economy will suffer. Imagine that you have a choice: invest your $ 100 in a successful business or an unsuccessful one, which would you choose? Successful. Investors think the same way when they prefer to invest in the American economy and in the currency of this country, which in no way participates in a military conflict. The most paradoxical thing about all this is that Washington is involved in this conflict, but it does it from afar, without jeopardizing its economy and its territories, but at the same time trying to actively influence all parties to the conflict in Eastern Europe. Therefore, the answer is simple: until the conflict in Ukraine ends, the euro will be under pressure. This year, the European currency may strive for price parity with the dollar. It has neither local nor global support and reasons for growth. The euro can only count on technical corrections.

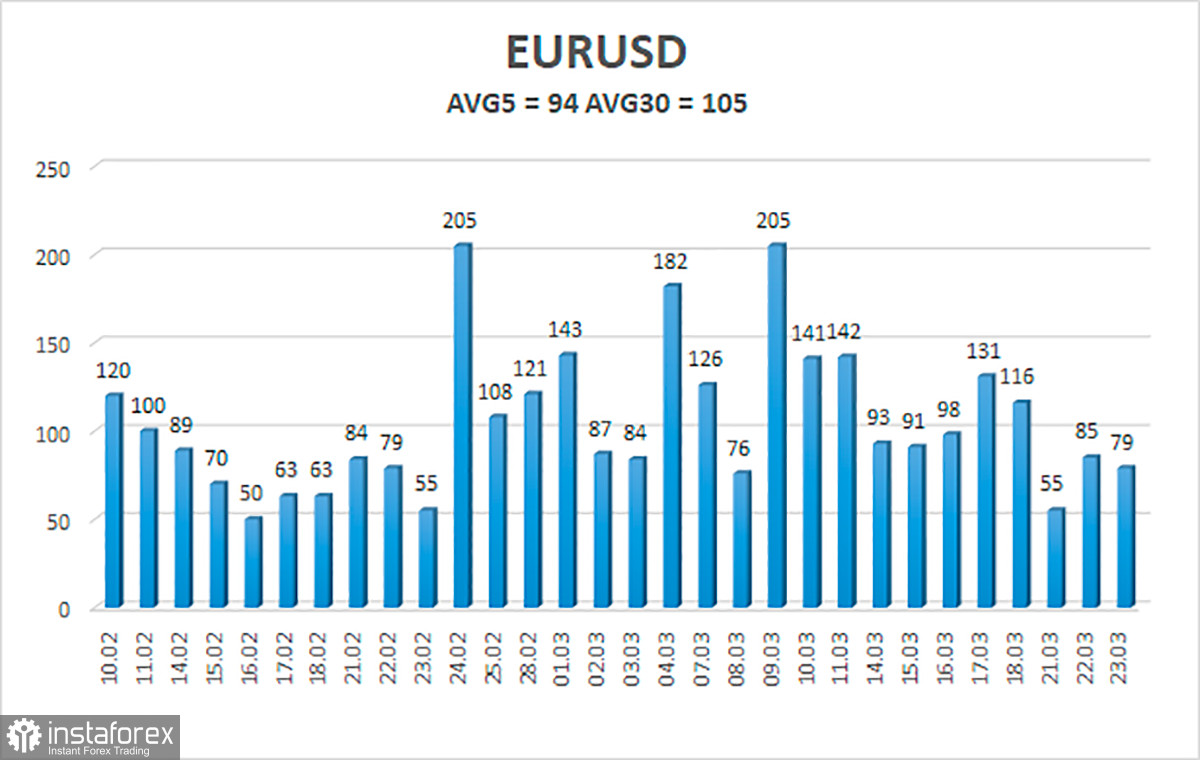

The volatility of the euro/dollar currency pair as of March 24 is 94 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0912 and 1.1100. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to be located near the moving average. Thus, new long positions with targets of 1.1108 and 1.1118 should now be considered if the price is fixed above the moving average. Short positions should be maintained with targets of 1.0911 and 1.0864 until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.