US President Joe Biden will arrive in Brussels today to meet NATO and European leaders for an emergency summit. Sources said he will discuss a package that includes new measures against Russian MPs.

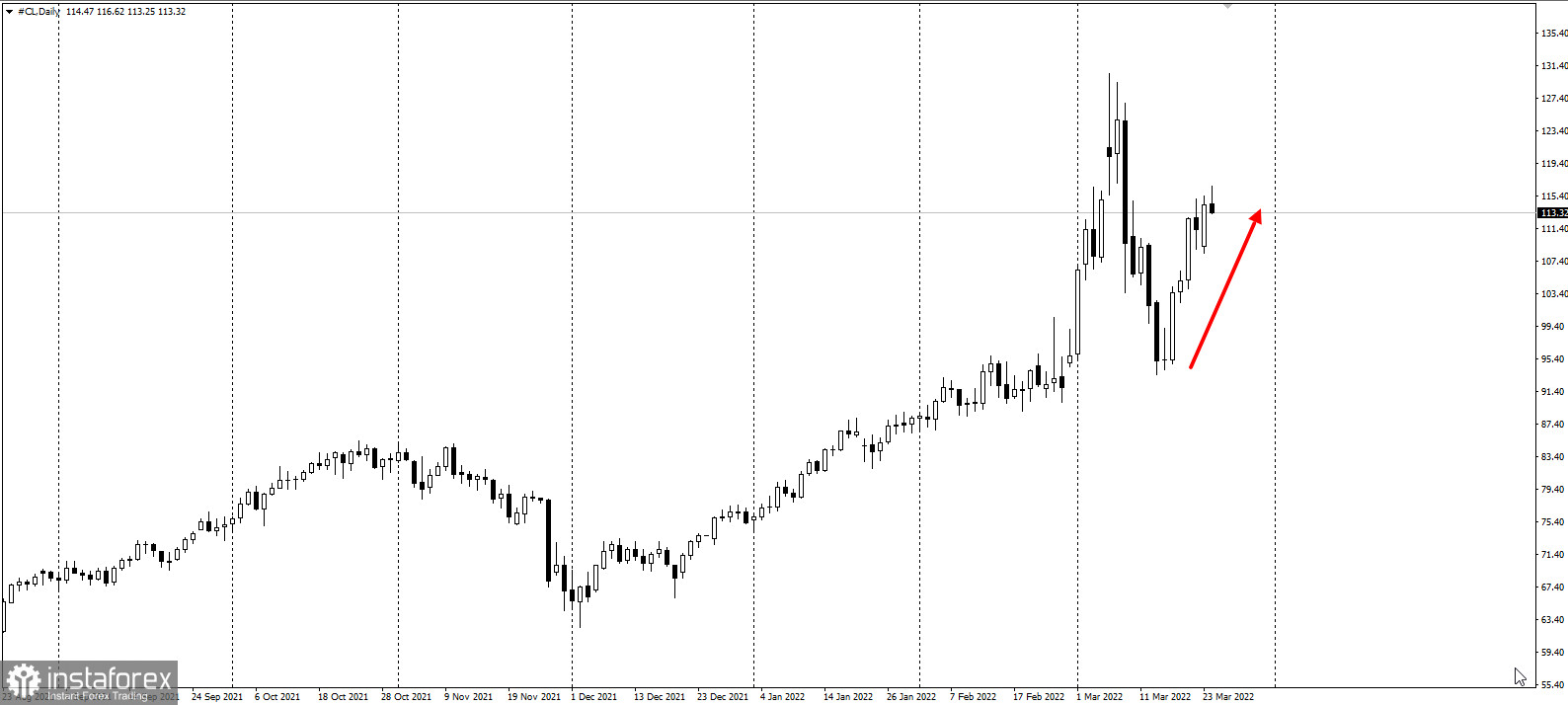

The ongoing tension in Ukraine has caused prices of commodities like oil and wheat to skyrocket, putting further pressure on the already high inflation. This prompted many central banks, including the Federal Reserve, to take action to contain prices, for example by raising interest rates.

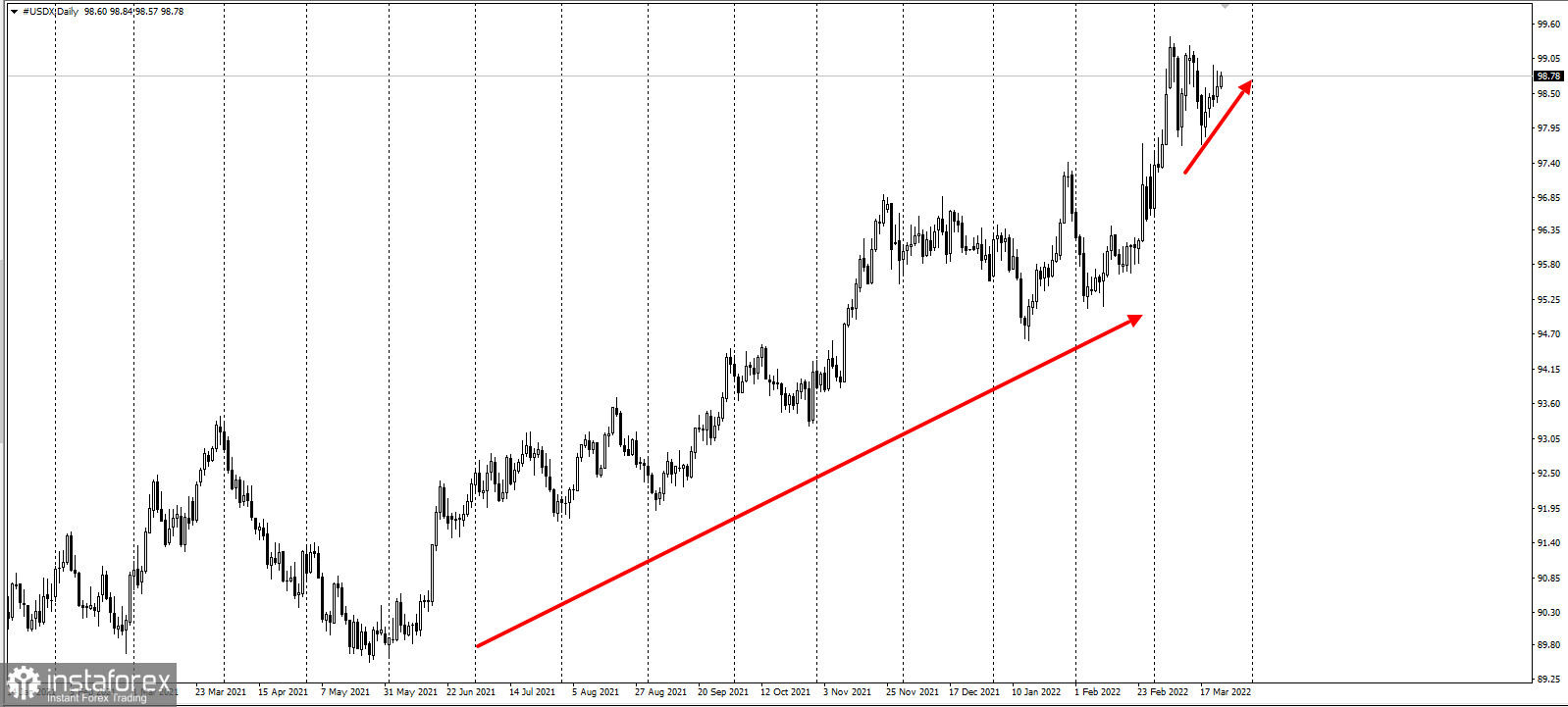

As such, the dollar index continues its bullish trend and rose 0.291% on Wednesday.

Crude oil prices also rose more than 4% amid disruptions in oil exports from Russia and Kazakhstan.

This is why it was not surprising that Fed Chairman Jerome Powell raised the possibility of seeing a more-than-25 basis points rate hike in upcoming meetings, which was also supported by other politicians. Dollar demand has also risen because of this, as well as the yield on 10-year US Treasury bonds by more than 2.4% .

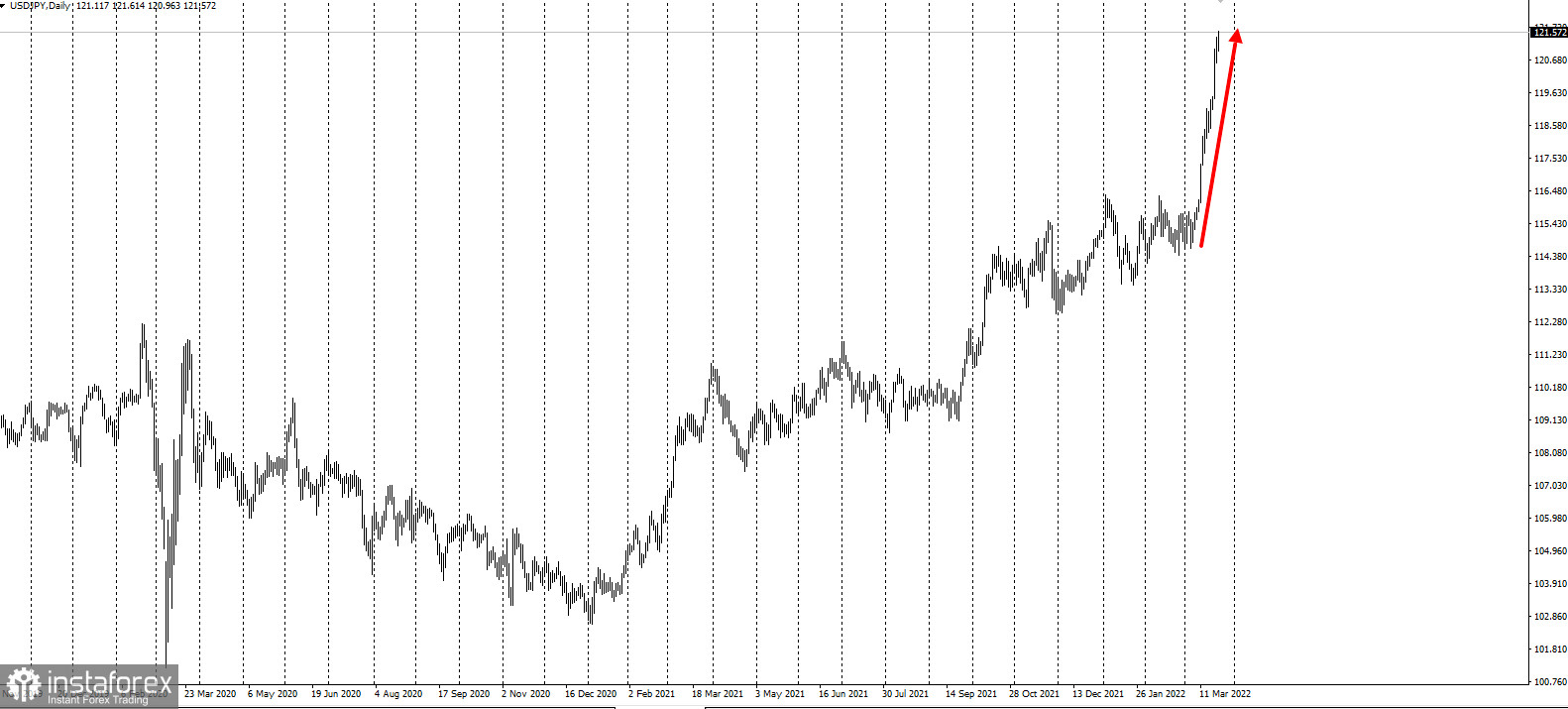

Meanwhile, the Bank of Japan maintained a loose monetary policy because according to Haruhiko Kuroda, recent inflation could hurt the economy. USD/JPY rallied amid this news.

As for the UK, inflation rose faster than expected last month, reaching a new 30-year high on an annualized basis. It jumped to 6.2%.

UK Treasury Secretary Rishi Sunak cut taxes on workers and reduced fuel duties in order to mitigate the severe drop in the cost of living, caused by soaring prices and slowing economic growth.