Hello, dear colleagues!

Yesterday, the most popular currency pair in the forex market traded mixed. Speaking of the fundamental background, no events are expected today. Unfortunately, the Russia-Ukraine conflict keeps weighing on the market. The military operation is ongoing and could end only when all demands of the parties involved are met. In this light, President Zelensky calls on European companies to quit the Russian market. Meanwhile, the West contemplates a new package of sanctions against Russia.

President of the European Council Charles Michel said the sanctions have been harmful to Russia's financial sector and leading sectors of the economy. Mr. Michel promised pressure on Russia would only build up. In my view, his message was meant for the US administration as people in Europe are not so happy about the ban on gas and oil supplies from Russia. Thus, Hungary said it would not stop using Russian hydrocarbons. Meanwhile, Germany is reluctant to decide anything right now. In this light, NATO, EU, and G7 summits are of the first importance. US President Biden will event travel to Europe to attend them.

At the same time, the European Commission is looking for ways to minimize the damage from ever-rising energy prices. Ursula von der Leyen says EU 27 must pledge to "work together on joint purchases of gas and hydrogen". So, the European Commission is preparing to search for alternatives to Russian oil and gas. Speaking of today's macroeconomic calendar, it contains important releases such as business activity in the manufacturing and services sectors of Germany, the eurozone, and the United States. Data on durable goods orders and initial jobless claims will be published in the US. The Fed's Evans and Bostic will speak by the end of the day.

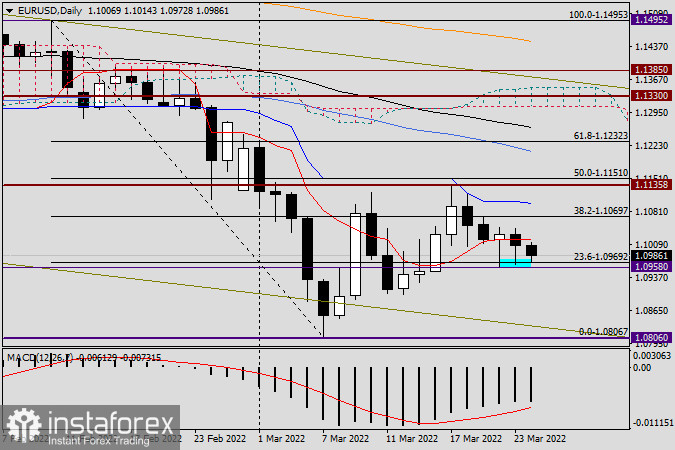

Daily

Due to geopolitical developments in Ukraine and the hawkish Federal Reserve, the euro will hardly show stable growth versus the US dollar, which is in high demand as a safe haven. Moreover, market participants expect the American regulator to take an even more hawkish stance on monetary policy. Technically, the euro/dollar pair has traded in the 1.0964/61 range for two days, which confirms the unwillingness of market players to go further down. Anyway, the pair has limited upside potential as it may encounter resistance near 1.1045. In the past two days, EUR bulls unsuccessfully tried to push the price above the mark. Today, the euro/dollar pair is still feeling pressure. At the moment of writing, it already trades below the psychological level of 1.1000.

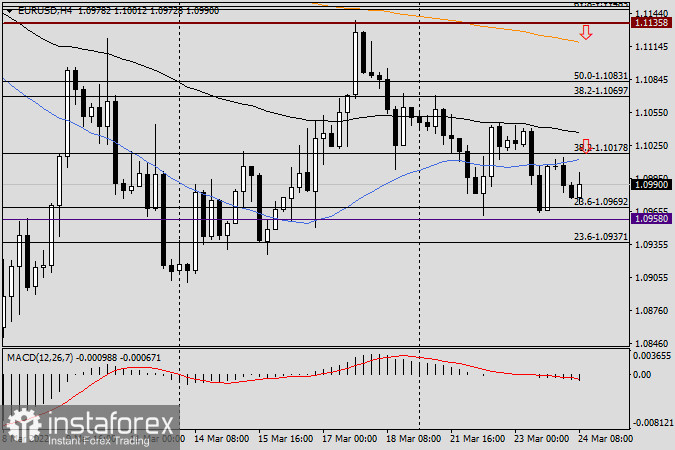

H4

In my view, it is wiser to go short on EUR/USD today. In the H4 time frame, the blue 50-day simple moving average and the black 89-day exponential moving average stand as resistance. They both are in the 1.1012-1.1036 price zone. Therefore, you could go short from there. If any bearish candlestick patterns emerge, they will confirm bearish bias. You could also consider selling EUR/USD at higher prices if the quote goes up to the 1.1100-1.1130 resistance zone. However, the price is highly unlikely to go there against the current backdrop. In spite of clear bearish bias, you could go long today if the pair encounters support at 1.0960 and the bullish reversal candlestick pattern emerges as this would produce a buy signal. In conclusion, I'd like to mention that amid current market uncertainty, setting higher targets could be risky in any case.

Best of luck!