Before Joseph Biden's visit to Europe, everybody had thought the purpose of that trip was to convince the European Union to impose an embargo on energy supplies from Russia. However, such a move would be fatal for the EU as it struggles to replace Russian gas and oil. For instance, the volume of the EU's gas supplies from Russia is so large that it simply cannot be replaced instantly. Other oil and gas exporters could probably increase production volumes, but the problem is neither they nor the EU have the appropriate infrastructure to reorientate supplies rapidly. Above all else, Saudi Arabia and the United Arab Emirates do not want to increase oil output. Yesterday, Qatar denied it had a long-term agreement on oil supply with Germany. The situation was further aggravated by Russia's decision to sell gas to a number of countries for rubles. President of the European Commission Ursula von der Leyen said it is unacceptable as it circumvents Western sanctions. So, the EU is now in an extremely difficult position. Apart from that, the possibility of an embargo spooked market participants. Meanwhile, the new sanctions have had little impact on Russia and mainly targeted certain individuals. In this light, the pound began to strengthen. Since it was modest growth, it will unlikely extend today. We are more likely to see the market becoming flat.

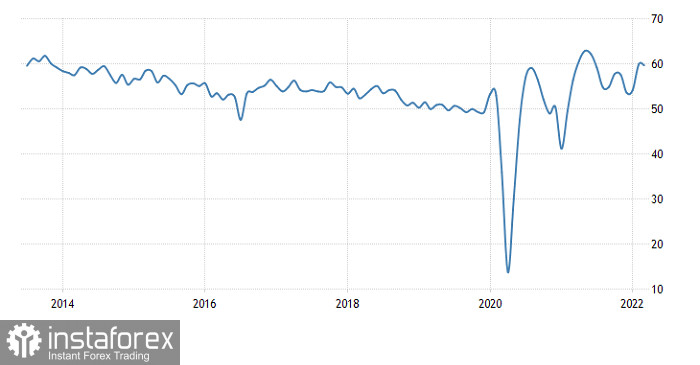

Against the current backdrop, the release of preliminary March business activity data in the United Kingdom came in unnoticed. However, the reliability of the latest statistics raises questions. Thus, the manufacturing PMI dropped to 55.5 versus 58.0 and well below the market consensus of 57.1. In the light of current developments, it makes perfect sense. Meanwhile, the services PMI, which was forecast to fall to 58.8 from 60.5, came in at 61.0. How is this even possible, especially amid a steep rise in fuel prices? The question is: can we trust the results? Given all that, the pound will feel pressure for quite a while. Finally, the composite PMI decreased to 59.7 versus 59.9 when it had been estimated to decline to 57.8.

United Kingdom Composite PMI:

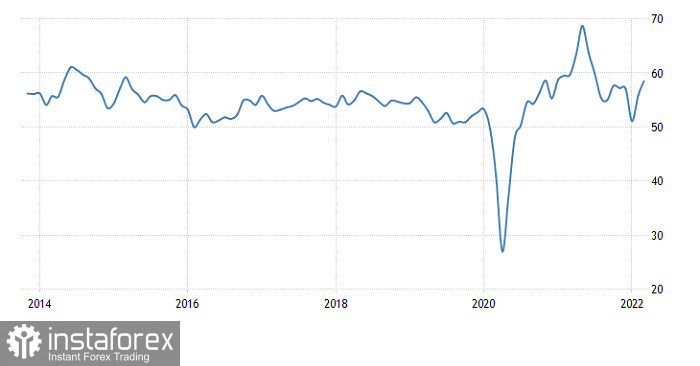

Similar data in the United States came in even more surprising. The manufacturing PMI rose to 58.5 from 57.3. The figure had been projected to drop to 56.8. Likewise, the services PMI increased to 58.9 when it had been expected to fall to 56.0 versus 56.5. Finally, the composite PMI saw an uprise to 58.5 from 55.9 and above the market estimate of 55.4. It is a mystery how business activity can expand at times like now and is contrary to common sense.

United States Composite PMI:

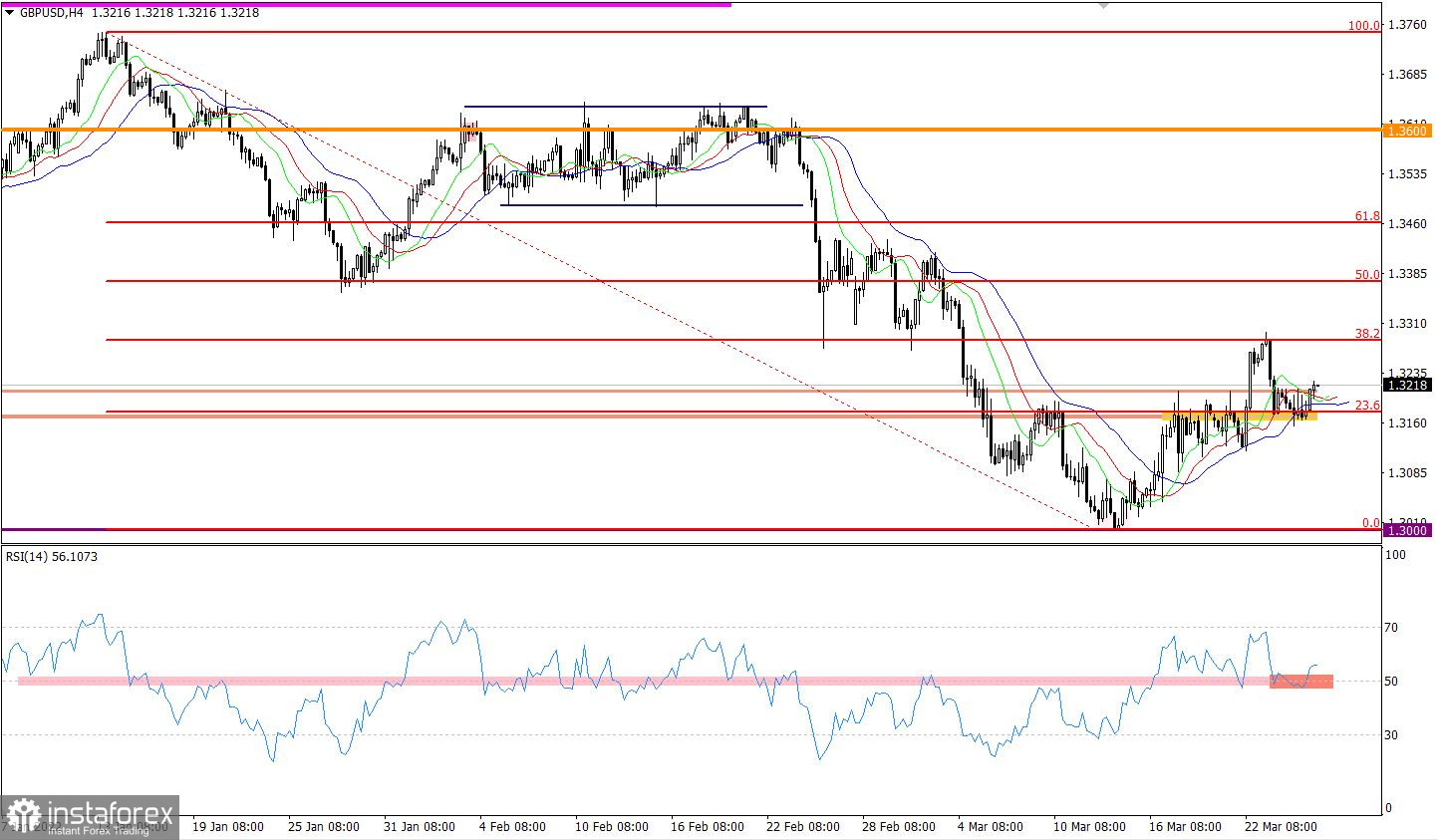

The GBP/USD pair has encountered support at 1.3175 on its way down, where it briefly came to a standstill and then pulled back.

The RSI indicator is moving in the range of 50 on the 4-hour chart, signaling a flat market. Perhaps this signal will soon fade.

Meanwhile, the Alligator indicator makes unclear signals on the 4-hour chart as its MAs are now crossing over. On the daily chart, the indicator shows a downtrend in the medium term as there has been no crossover of its MAs.

In the daily time frame, there is a downtrend with a 2-week corrective move from the psychological level of 1.3000.

Outlook:

After the recent rebound, the quote went up, and trading activity increased.

If the price consolidates above 1.3230, the pound may head towards resistance at 1.3300. Alternatively, the pair may go down and settle below 1.3150 on the 4-hour chart. If so, a signal to sell GBP/USD will be made.

In terms of complex indicator analysis, there is a buy signal for short-term and intraday trading because of a rebound from 1.3175. In the medium term, indicators are telling to sell the instrument because of the downtrend movement.