Markets often go from the calm before the storm to the storm itself. How strong it will be, no one knows. The busy economic calendar of the week of April 1 only suggests that after marking time in one place, EURUSD will finally move into action. However, when the U.S. dollar fails to develop an advantage and the euro does not want to force things, there is a big risk of expanding consolidation.

With talks between Russia and Ukraine stalled, hostilities continue; FOMC members using pronounced hawkish rhetoric, and divergent U.S. and Eurozone business directions hinting at a divergence in economic growth, the fate of the EURUSD pair seems to be predetermined. And if the willingness of St. Louis Fed President James Bullard to raise rates to 3%, and Cleveland Fed President Loretta Mester to exceed the neutral level of 2.5% as quickly as possible, surprises no one, then the aggressive speeches of yesterday's doves, Mary Daly and Charles Evans, indicate that the Fed is determined. The derivatives market gives an almost 75% chance of a 50 basis point increase in borrowing costs in March. In such conditions, the U.S. dollar should grow by leaps and bounds. However, it is not growing.

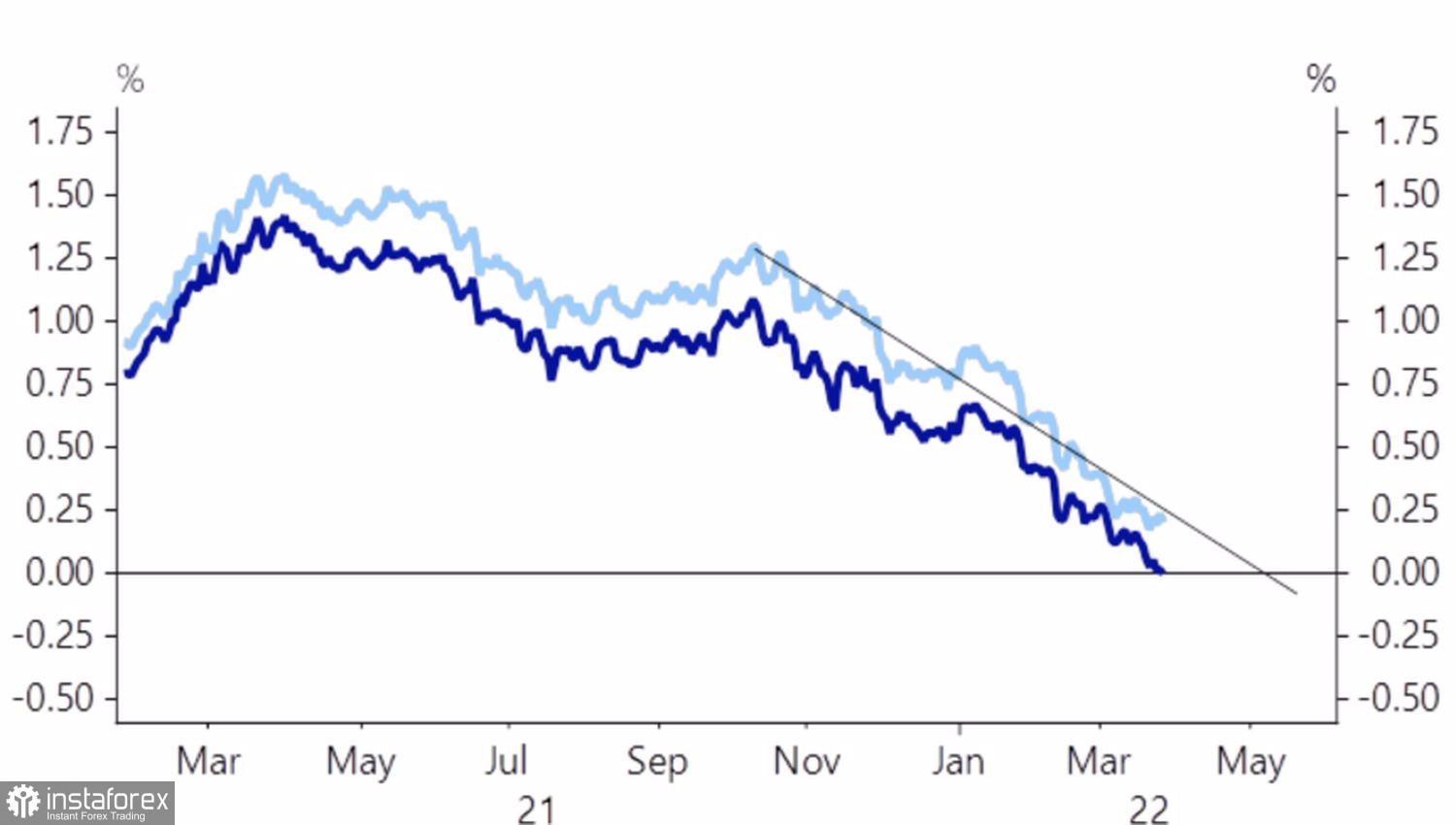

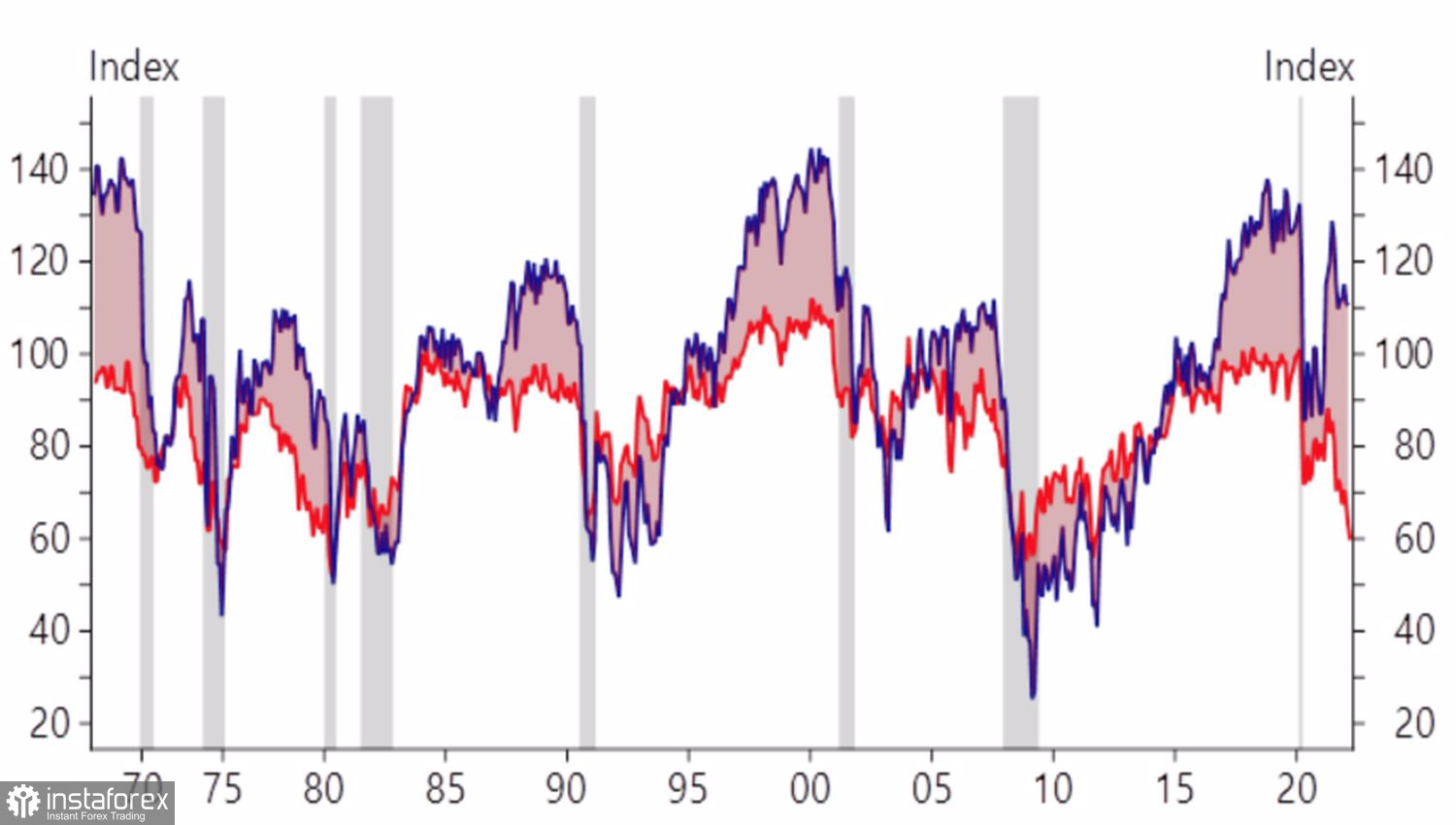

For some reason, investors are confident that a recession will happen in the United States faster than in the eurozone. They are not impressed either by the latter's proximity to the war zone or by the weakness of the German economy. The market is looking closely at the willingness of the yield curve to invert and at the widening spread between consumer confidence and sentiment. The first indicator focuses on employment, the second shows a pronounced sensitivity to prices.

U.S. yield curve dynamics

Trends in U.S. Consumer Confidence and Sentiment

It is curious that a clear understanding of the intentions of the Fed, no matter how terrible they may seem for the economy, leads to an increase in the yield of U.S. Treasury bonds and to the flow of capital into the stock market. Investors are dumping debt and buying equities, fueling a rally in stocks. The associated improvement in global risk appetite allows EURUSD bulls to counterattack.

This is how the U.S. dollar weakening scheme works during the Fed's monetary tightening cycle. The problem is that the euro is currently so weak that it simply cannot fully realize it. As a result, other G10 currencies are strengthening against the U.S. dollar. For example, its Australian and New Zealand namesakes.

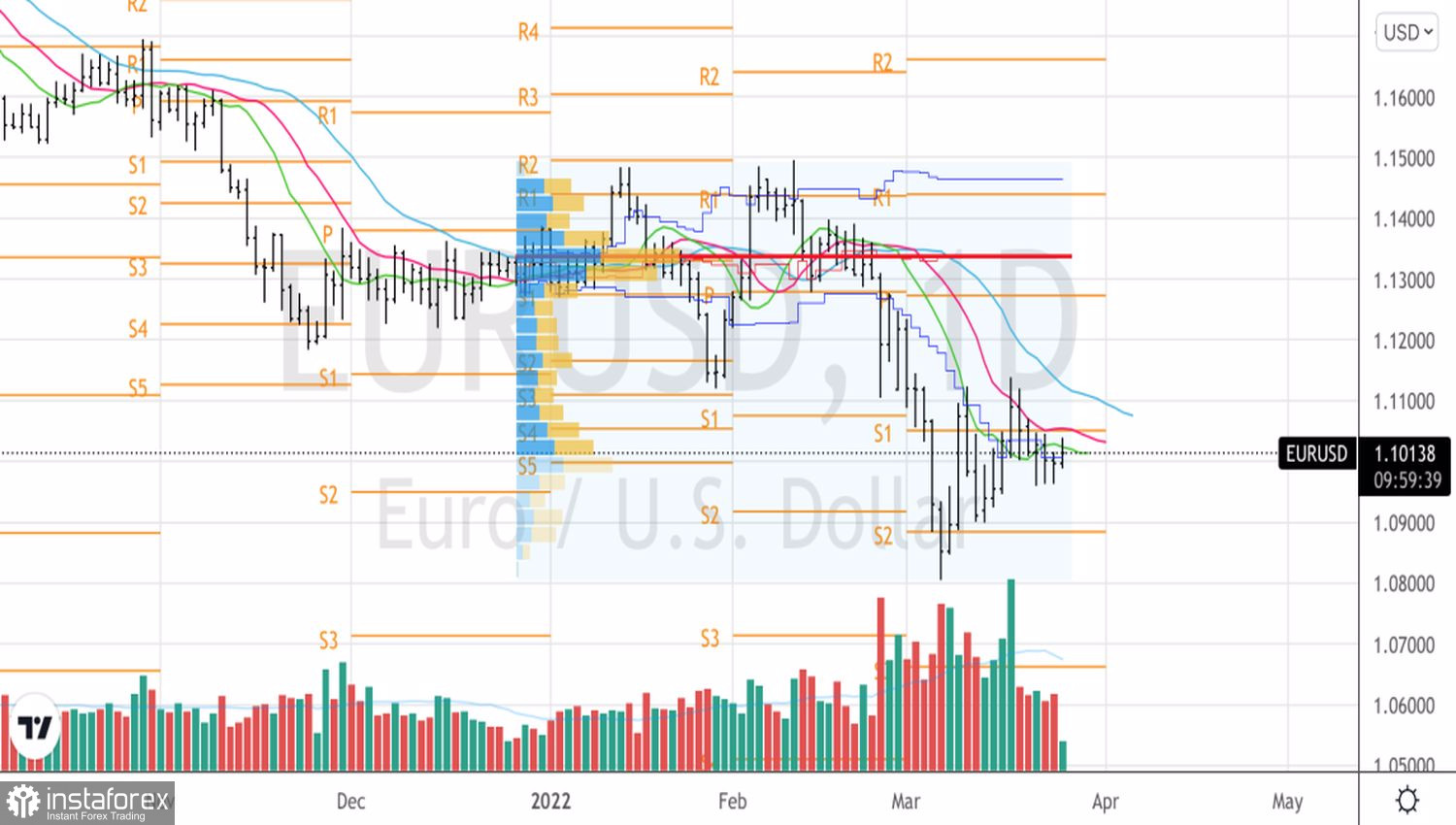

Theoretically, data on German and European inflation, as well as disappointing statistics on the index of personal consumption expenditures and the U.S. labor market, can support the bulls on EURUSD in the week to April 1. Consumer prices in the euro area are at risk of accelerating to a new record peak of more than 6%, which will further scare the members of the Governing Council of the ECB. However, I would not regard the break of resistance at 1.105 as the start of an upward trend.

Technically, the EURUSD fell into a consolidation in the range of 1.09-1.114. In my opinion, it can expand it, so it makes sense to sell the euro on the rebound from the resistance at 1.116 and 1.122, or buy it in case of an unsuccessful assault on the supports at 1.092 and 1.088.

EURUSD, Daily chart