Long-term perspective.

The EUR/USD currency pair has attempted to resume its downward movement during the current week. We have already said earlier that the critical line on the 24-hour TF is now of great importance for traders. If we managed to gain a foothold above it, then we could count on a more serious strengthening of the European currency. But this did not happen this week, so the chances of a new fall in the European currency are still higher. We believe that if the current fundamental and geopolitical background remain the same as they are now, then by the end of the year, it will be possible to see price parity between the euro and the dollar. We consider the factor of geopolitics and the factor of inconsistency between the monetary policies of the ECB and the Fed to be two reasons why the European currency will fall further. The Fed made it clear this week that it is ready not just to raise the rate at each subsequent meeting this year, but is also ready to increase the pace of monetary policy tightening. This was directly stated by Jerome Powell. One of the most famous "hawks" James Bullard said that he considers it a mistake to raise the rate in March by only 0.25%. At the same time, Christine Lagarde also said that the European economy is too weak, cannot chase the American one, and there can be no question of raising the rate in 2022. It is unclear how the European Union will deal with high inflation. This gap between the rates will lead to the fact that the profitability of safe assets will grow in America. At this time, it may not matter because of very high inflation, which eats up almost any yield. But in general, when the rates vary so much, it means that economic conditions are changing. That is, the European Union now looks more profitable for investment and lending, but at the same time less profitable for deposits and bonds.

COT analysis.

In the last two months, COT reports have signaled such changes in the mood of traders, which did not correspond to what was happening in the foreign exchange market. However, in the last two weeks, COT reports have at least begun to coincide a little with what is happening in the foreign exchange market. The major players in the last reporting week greatly reduced their net position, thanks to the meetings of the ECB and the Fed, the results of which were very eloquent. This week, professional traders opened 5,000 buy contracts and closed 38 sell contracts. That is, the net position has increased by 5 thousand contracts. Formally, the "bullish" mood, which remains exactly "bullish", has slightly intensified. But look at the chart of the pair's movement in the illustration above: the euro currency only does what it falls. In this way, the euro is now only capable of local technical corrections. Fundamental and geopolitical factors have a huge impact on the market, so we do not believe that traders now have a reason to buy the euro currency. Therefore, a group of "Non-commercial" traders can buy euros, sell euros, all the same, with the current "foundation" and "geopolitics", the US dollar will grow. This is because the COT report on the euro currency does not take into account changes in demand for the dollar itself. That is, it is reasonable to assume that the demand for the US currency is growing at a faster pace than the demand for the EU currency.

Analysis of fundamental events.

During the current week, perhaps the most important events were the speeches of Christine Lagarde and Jerome Powell. Although both heads of the Central Bank did not report anything fundamentally new, they strengthened the already strong sentiments regarding the monetary policy of their Central Bank. Apart from the speeches of these functionaries, there is practically nothing to highlight. All the reports were secondary. The indices of business activity in the services and manufacturing sectors of the European Union and the United States turned out to be as neutral as possible. Orders for long-term goods in the United States were worse than forecasts. The consumer sentiment index from the University of Michigan was even lower than last time. However, there was either minimal or no reaction to all these events. The volatility of the euro/dollar pair has sharply decreased this week, and the movement itself has begun to shift sideways. The market urgently needs new information on the military conflict in Eastern Europe. And preferably encouraging.

Trading plan for the week of March 28 - April 1:

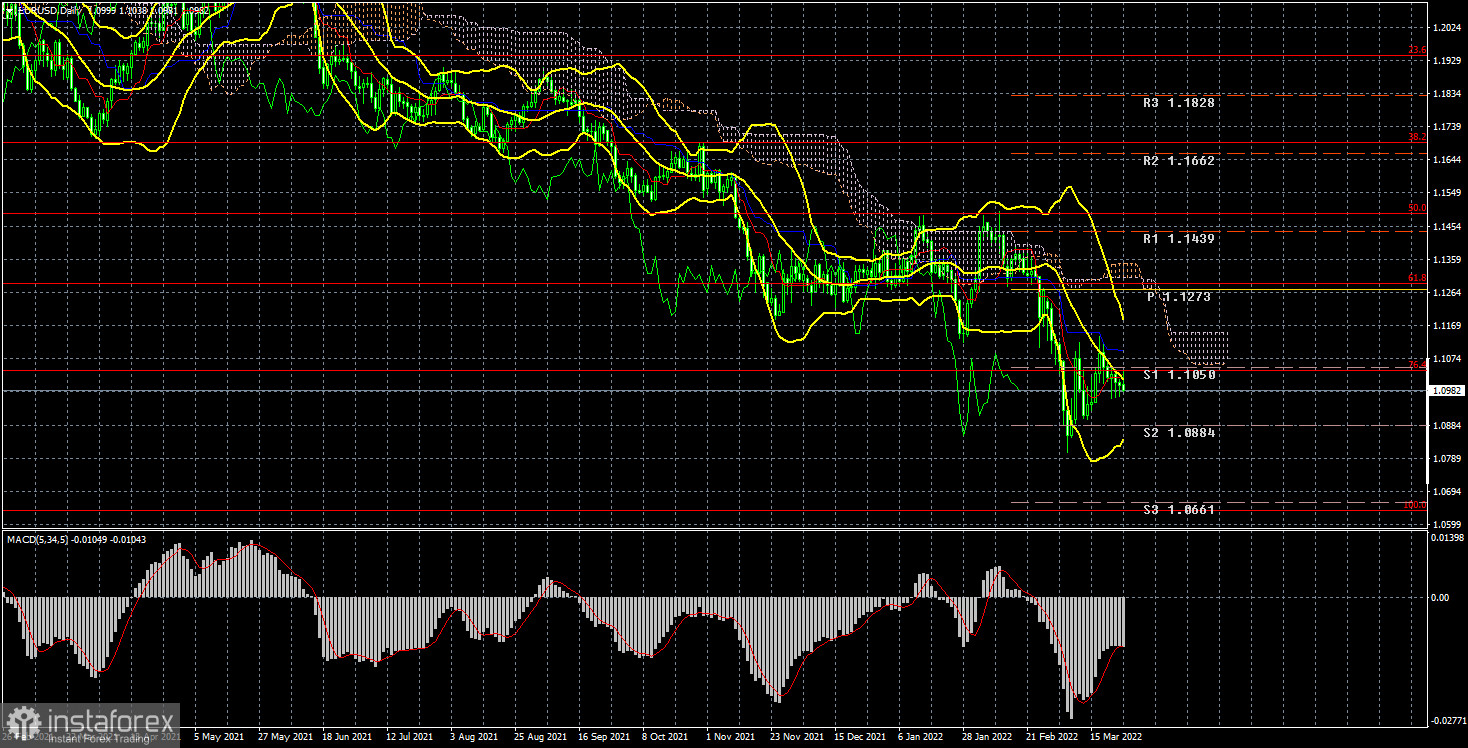

1) On the 24-hour timeframe, the pair adjusted to the critical line. And the fall of the euro currency could already resume, since almost all factors speak in favor of further growth of the dollar, and not vice versa. And above the Kijun-sen line, it was not possible to gain a foothold in any case. Therefore, the fall of the euro may continue with the targets of 1.0884 and 1.0661. So far, sales remain the most relevant.

2) As for purchases of the euro/dollar pair, they are not relevant now. First, there is not a single technical signal or sign that an upward trend may begin. Second, the "foundation" and "macroeconomics" continue to exert strong pressure on the euro. Third, "geopolitics" may continue to put pressure on traders and investors who still believe that in any incomprehensible situation it is necessary to buy the dollar. And even if the price still overcomes the critical line, it does not guarantee its further growth. Over the past 8 months, the price has failed to overcome the Senkou Span B line several times on the 24-hour TF.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.