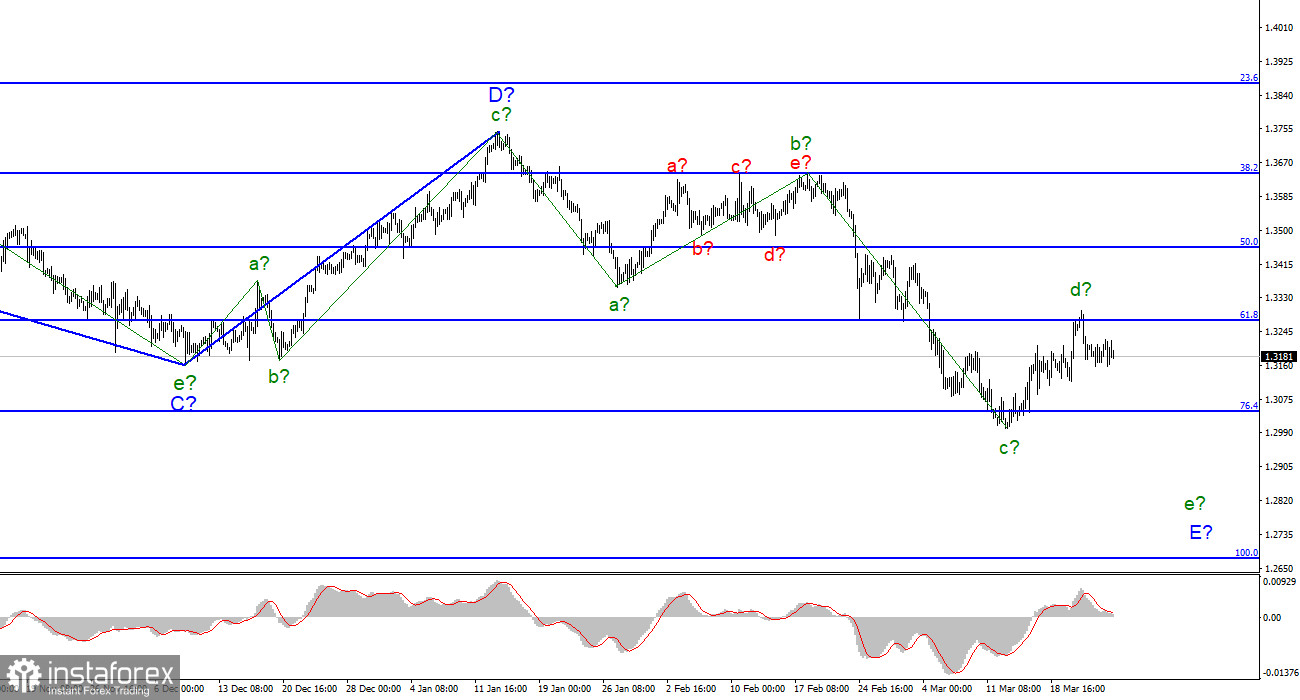

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The expected wave d in E is probably already completed, and there should be five waves in total inside wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction. The instrument made an unsuccessful attempt to break through the 61.8% Fibonacci level, which may mean the completion point of wave d. If this assumption is correct, then the decline in quotes will continue with targets located around the 27th figure within the wave e in E. I note that there are enough reasons for wave E to take an even more extended form. Or the entire downward section of the trend has taken a more extended form. It will depend on how bad the news background will be for the Briton. And the most important thing is the geopolitical background. I have almost no doubt that the recent decline in the pound lies exclusively in the plane of the Ukrainian-Russian military conflict. And this conflict is not over.

The market has not decided on a trading strategy today.

The exchange rate of the pound/dollar instrument did not change by a single point during March 25. On Thursday and Friday, the exchange rate of the instrument did not change by a single point. These days, there were several reports in Britain and the USA, but they did not arouse any interest in the market. One can even assume that there was some market reaction, but the instrument has been moving horizontally these days. A weak report on retail trade in the UK, which was released on Friday morning, could cause a decrease in demand for the Briton, which caused it to fall by 50 points. But in the afternoon, the demand for the British began to grow, and then fall again. The most important conclusion I can draw now is that the market has calmed down after a month-long panic caused by the conflict between Ukraine and Russia. Now only wave analysis indicates a possible continuation of the fall of the British pound. And the news background at the same time can support the horizontal movement for some time.

The geopolitical conflict between Ukraine and Russia is also extremely important for the pound/dollar instrument. The macroeconomic consequences of the sanctions imposed against Russia by the UK or the EU will be visible much later. I wouldn't be surprised if the oil and gas market is going to be redeveloped in the next year and a few years the market situation will change beyond recognition. In this case, capital flows will also be redirected. All these changes will affect the GDP of many countries. But at the current time, it is much more important when the conflict between Ukraine and Russia will end, since it is these two countries that provide many other countries of the world with food raw materials. In Europe, they have already stated that due to the disruption of the sowing campaign in Ukraine, a food crisis may begin. But it is even more important to understand now that a military conflict will not break out of Ukraine, and it is impossible to exclude the possibility of this now. Relations between Poland and Russia are deteriorating, America continues to put pressure on both the Russian Federation and the European Union to abandon Russian oil and gas as soon as possible, and only Hungary, Germany and Austria resist.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. I propose to consider the wave d in E completed until the instrument makes a successful attempt to break through the 1.3273 mark, which equates to 61.8% Fibonacci.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.