The Australian dollar showed an increase of 5 points on Friday. It could not show a better result due to its unwillingness to give up the slack with the US dollar - the dollar index grew even by a symbolic 0.02%, but it was working off the daily loss by 0.39%.

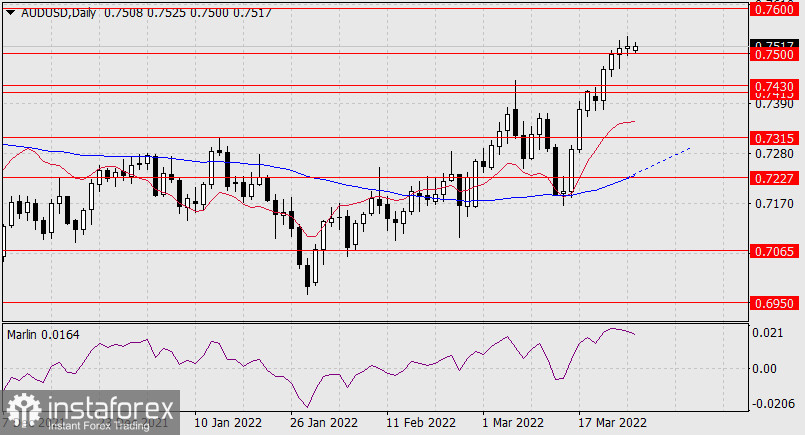

The price has settled above the target level of 0.7500 on the daily chart, but the Marlin Oscillator is turning down from the overbought zone, and it may very well be that the price above the level may be false. Consolidation below 0.7500 opens the target range of 0.7415/30 and then there may be a continuation of the decline to 0.7315, towards the area of the MACD line.

On the H4 chart, the extended unexpressed triple divergence is not broken, the Marlin Oscillator is already in the negative area. The MACD line has penetrated into the 0.7415/30 range, which indicates a potential strong decline in the price after overcoming this range, which was strengthened by this indicator line as support.