Details of the economic calendar of March 25

Retail sales in the UK show a slowdown in growth rates from 9.1% to 7.0%.

It is worth considering that the data was published for February, and given the current situation, they are no longer considered informative, since the March figures may turn out to be more deplorable.

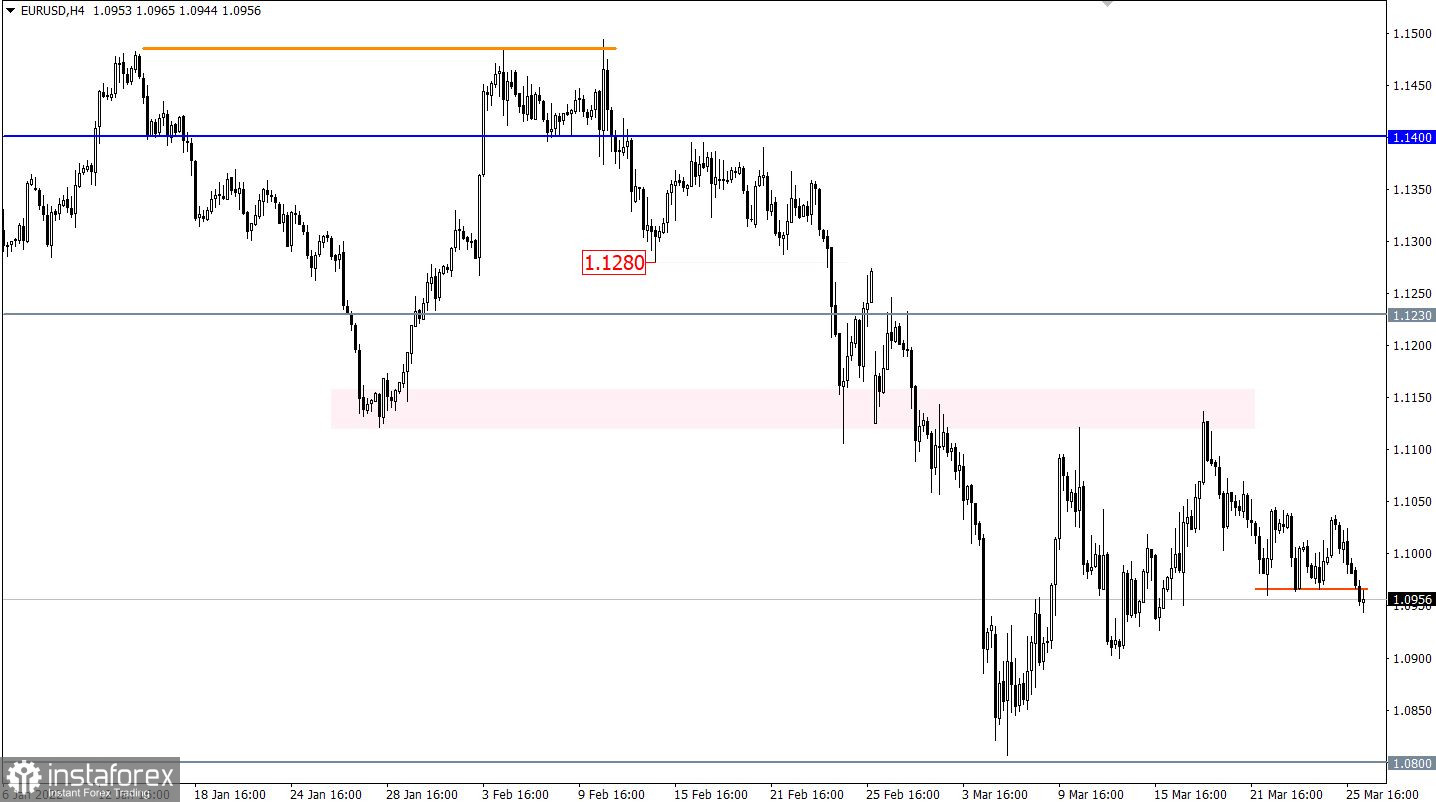

Analysis of trading charts from March 25

The EURUSD currency pair, after several days of stagnation in the range of 1.0960/1.1050, managed to overcome its lower limit. This led to an increase in the volume of short positions and a restart of the price recovery process relative to a three-week correction.

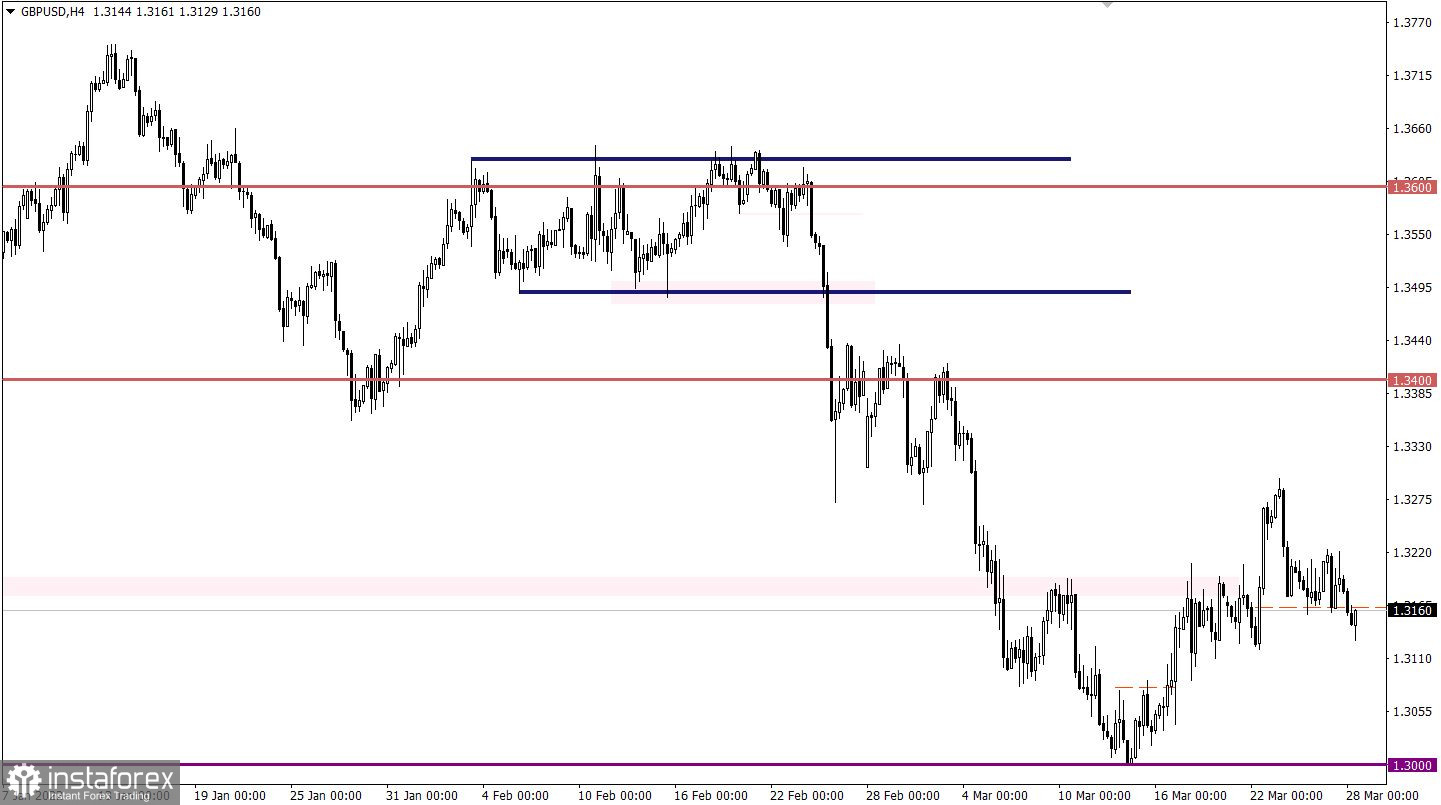

The variable pivot point 1.3175 for the GBPUSD pair was passed by the sellers. This led to an increase in the volume of short positions and keeping the price below 1.3150. As a result of these steps, there was a signal of restoration of dollar positions relative to the recent correction.

March 28 economic calendar

Monday is traditionally accompanied by an empty macroeconomic calendar. Nevertheless, stable information and news flow will continue to play on the nerves of speculators, which allows for new jumps in the market.

Trading plan for EUR/USD on March 28

In this situation, holding the price stable below 1.0960 in a four-hour period will lead to a phased recovery process. As a guide, market participants consider the values of 1.0900-1.0800.

An alternative market development scenario will be considered by traders if the price returns above 1.1000. In this case, the flat may resume.

Trading plan for GBP/USD on March 28

Based on a number of technical signals, we can say that the market is dominated by a downward trend. This could lead to further weakening of the pound towards the main level of 1.3000.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.