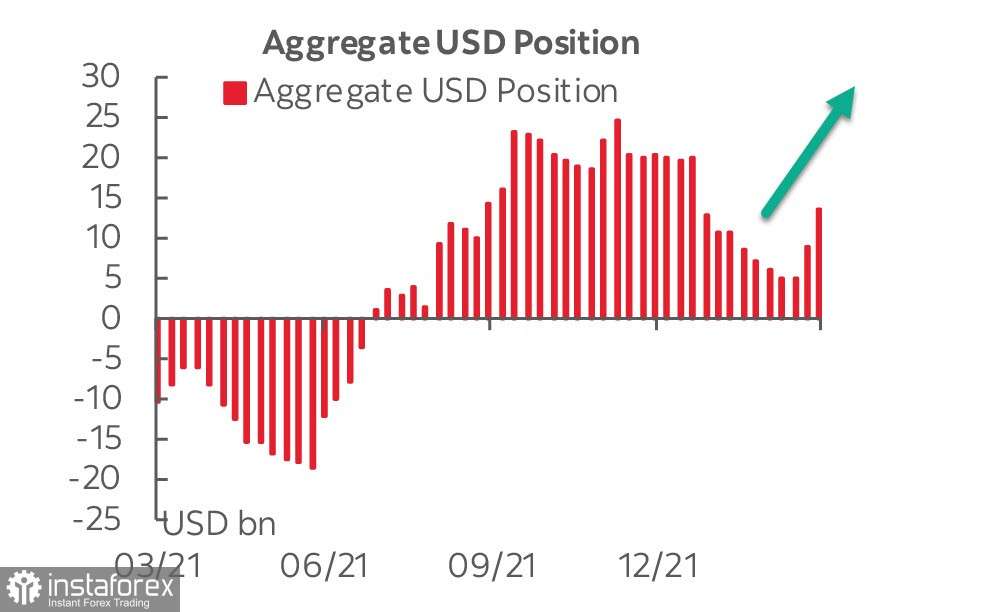

The weekly CAES report indicated several trends at once, which are likely to dominate the short-term outlook. Firstly, the dollar added 4.6 billion to the cumulative long position. In two weeks the sell-offs of 8 weeks have been recouped, and the dollar rate is now the highest since January.

The sell-off in commodity currencies should also be noted. The biggest weekly losses are in the Canadian dollar, but the other currencies have also deteriorated markedly. Perhaps this sell-off reflects risk aversion, i.e. it is short-term in nature. However, according to the latest PMI reports, such an explanation is too superficial and players are preparing for a large-scale decline in production, i.e. stagflation, as the causes contributing to higher inflation will not be eliminated for at least the next year.

There is a massive sell-off in the debt market and yields are rising at a high rate as hawkish calls to raise the Fed rate more aggressively get louder and louder. Citi, for example, is calling for the Fed to raise 50 points 4 times in a row and to bring the rate up to 3.75% in 2023. Bank of America sees a rate target of 3.25%, which is still higher than the Fed's forecast.

A bond sell-off is usually a sign of rising risk sentiment. However, the reason is different now. Investors are assuming that central banks will have to act more decisively in order to stem the rise in inflation. This means worsening financial conditions with mixed signs of economic recovery. It is no coincidence that the University of Michigan's consumer sentiment indicator stood at 59.4 points in March. This is the lowest level since August 2011. Consumers are pointing to declining living standards due to rising inflation.

EUR/USD

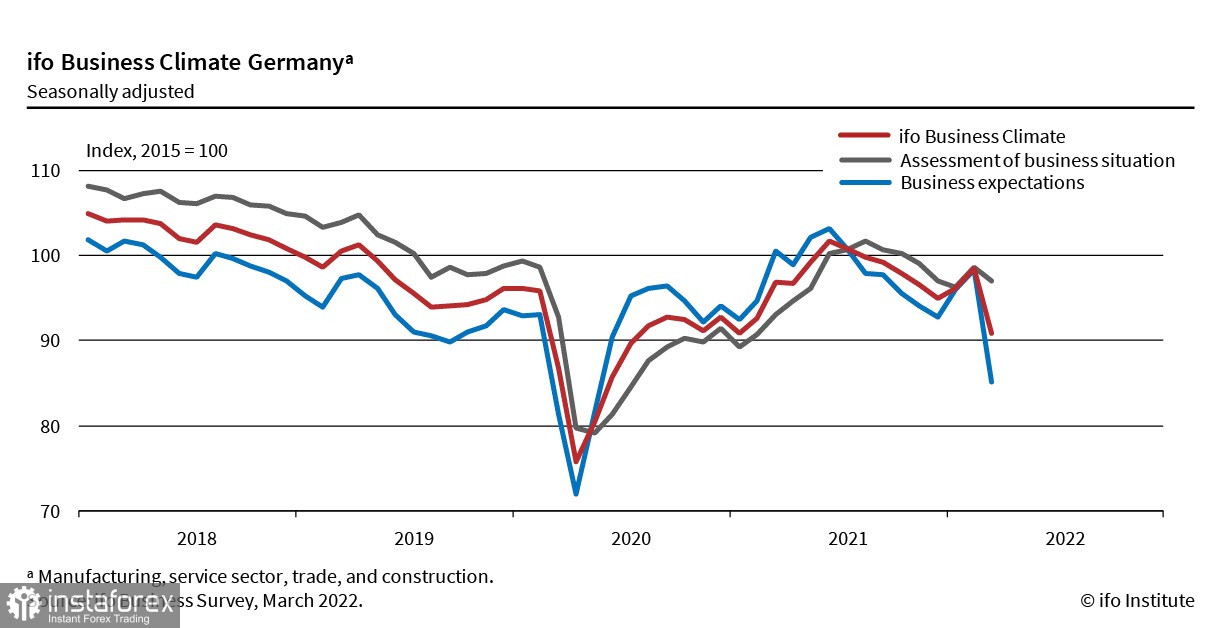

Economic sentiment in Germany is deteriorating rapidly in March, according to the Ifo Institute. The business climate index fell from 98.5 points to 90.8 points. Forecasts dropped by 13.3 points at once, which is even worse than at the start of the coronavirus crisis.

In manufacturing, the rate of decline is at an all-time high. Germany's industry will face grim times, as the end of cheap gas supplies from Russia will set both Germany and Europe as a whole back several decades. The introduction of the requirement to pay for gas in roubles is tantamount to stopping deliveries, because in order to pay for gas in roubles, Europe would need to get out of the sanctions' regime, which is hardly possible in the current reality.

ECB head Lagarde said on Saturday that incoming data did not indicate a significant risk of stagflation. This is a clear bearish signal for the euro.

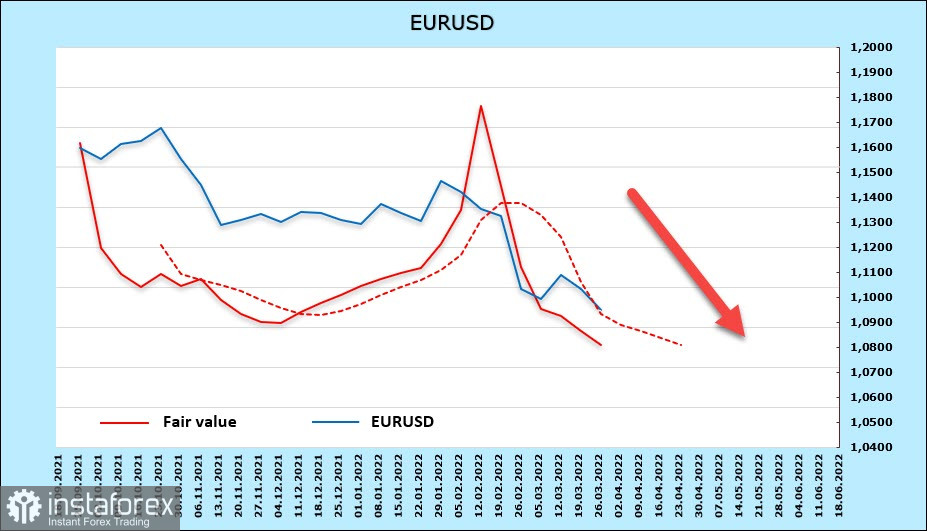

The CFTC report was positive for the euro, but it did not include the changes of recent days. The net long position increased by 713m to 2.29bn. The settlement price continues to move downwards. The rise in UST yields is contributing to this. Funds are fleeing Europe for fear of massive losses, and something needs to be done about it urgently.

There is no reason to revise the 1.0636 target. Bearish pressure remains strong, and the Euro will continue to decline.

GBP/USD

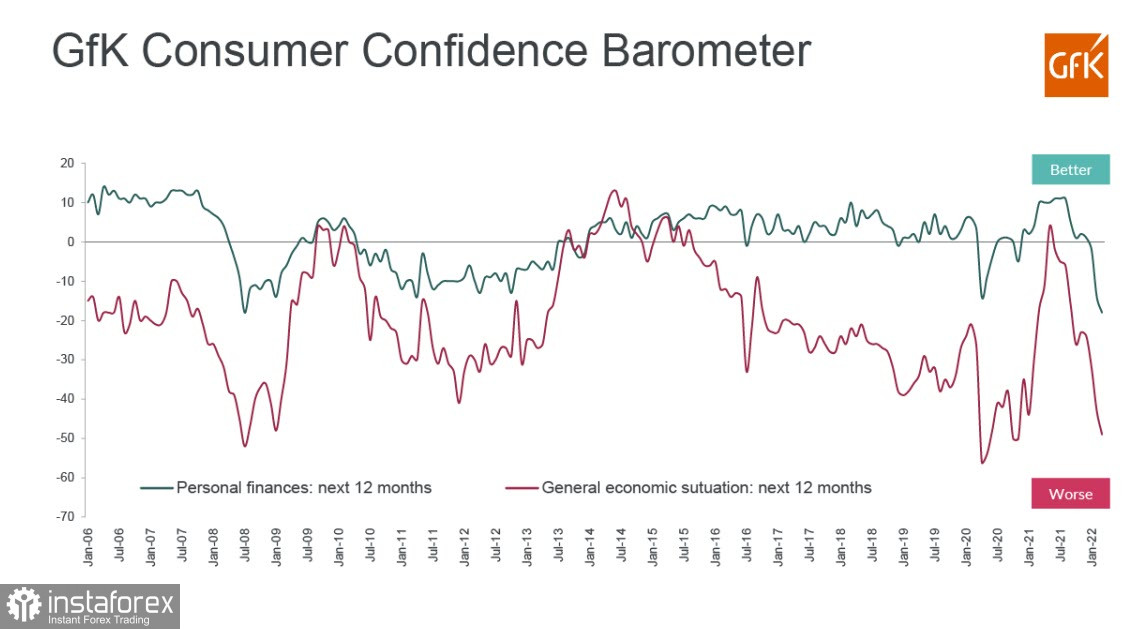

Consumer price inflation reached 6.2% year-on-year in February. It was forecast at 5.9%. Producer prices rose to 14.7% year-on-year. That means that inflationary pressures on the consumer sector are not subsiding, but are likely to increase. NIESR worsened the inflation forecast in the negative scenario to 9.3%.

The dynamics of personal finances and the general economic situation are already worse than during the Covid-19 fall and have almost caught up with the fall of 2008. The UK is on the verge of a major collapse into recession.

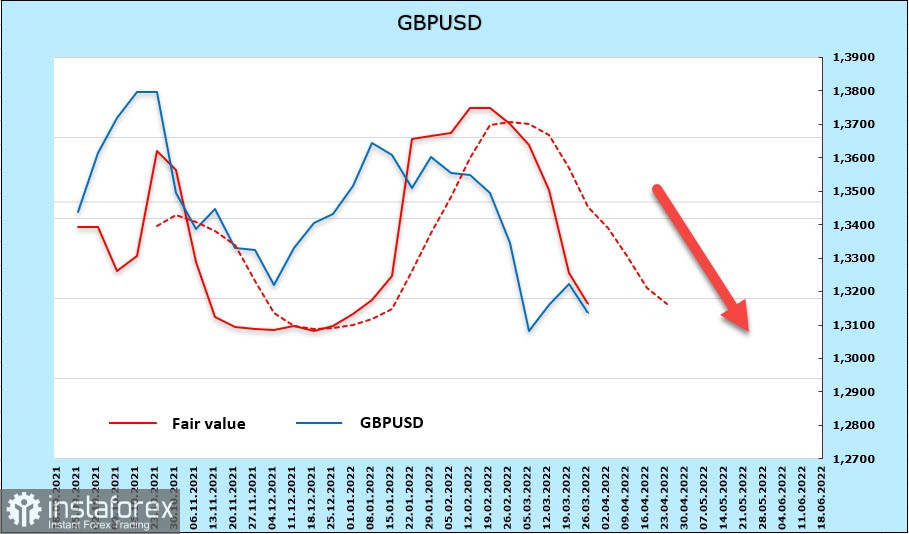

The CFTC report is bearish. During the week, 713m was lost. Net short position rose to -3.087bn. The settlement price is steadily downwards, with no sign of a reversal.

The pound stays in a bearish channel. The retracement was shallow and we expect further declines. Targets 1.30 and 1.2810/20 are relevant.