To say that the Japanese yen is seriously disappointing its fans is to say nothing. Not only is the Japanese currency the worst performer of the G10 since the beginning of the year, but it has also collapsed to its lowest level since the summer of 2015 against the U.S. dollar. The USDJPY pair momentarily hit the psychologically important mark of 125, which looks surprising against the backdrop of the armed conflict in Ukraine. Typically, recessions, crises, or escalating geopolitical risks drive up demand for safe-haven assets, including the yen. But not at this time.

If during the pandemic, the USDJPY pair was considered a kind of indicator of whether humanity will defeat COVID-19 with the help of vaccines or not, then now the events in Eastern Europe do not seem to touch the yen. From a safe haven, it has become a currency that allows you to understand what investors think about central bank rates. The USDJPY rally is due to the expectations of an aggressive monetary restriction from the Fed amid the intention of the Bank of Japan to maintain an ultra-soft monetary policy.

Indeed, looking at how the regulator reacted to the rise in the yield on the country's 10-year bonds to 0.25%, the highest level in 6 years, one can be sure that the start of the normalization of monetary policy is still very far away. BoJ came out with an offer to buy these securities without limit, and after it did not arouse interest, it made another offer - to purchase bonds with a maturity of 5-10. This time the counterparties appeared. They acquired debt obligations worth £64.5 billion.

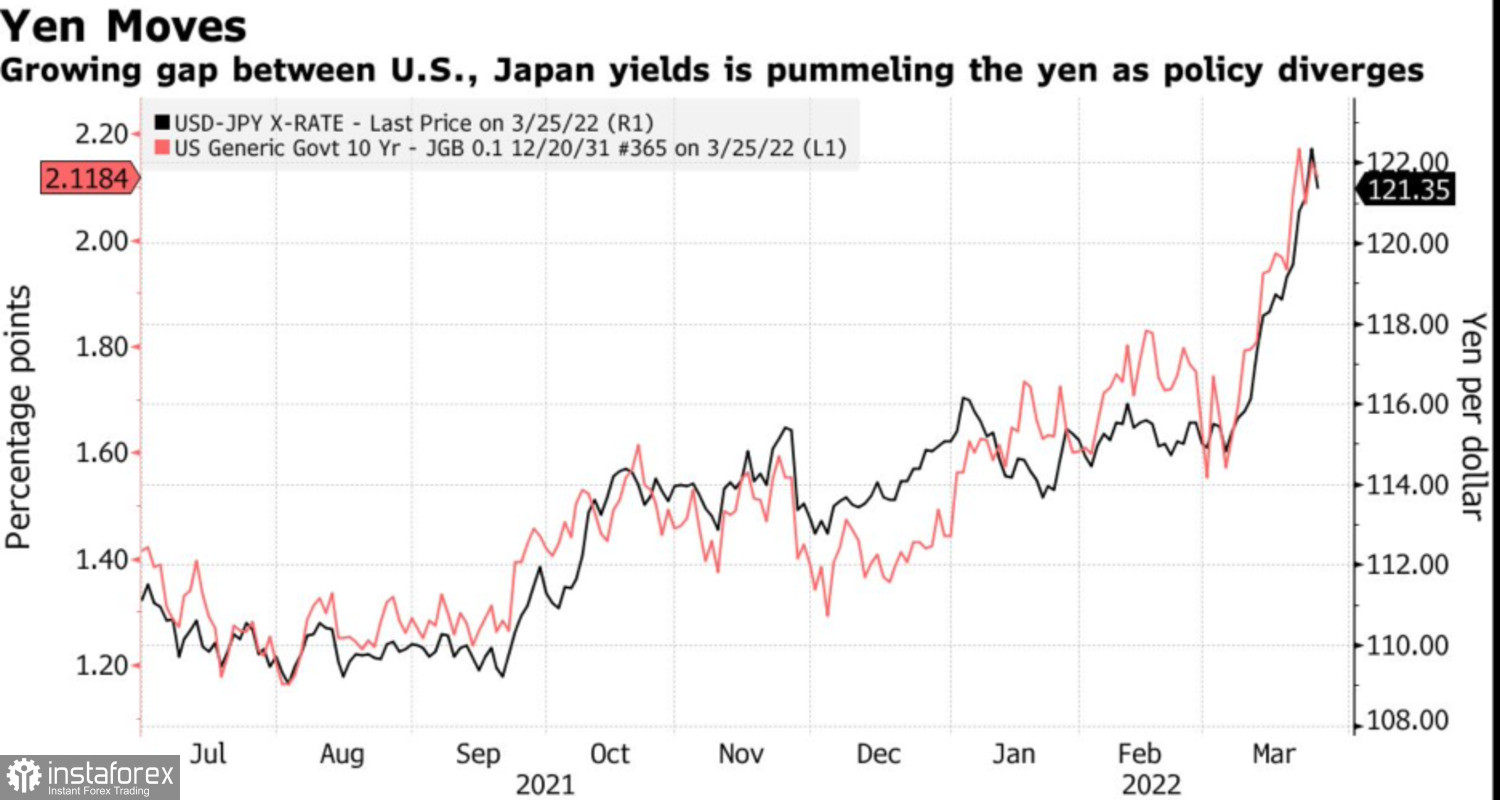

The intention of the Bank of Japan to keep yields of local bonds at a low level, by all means, leads to an expansion of the differential rates with their American counterparts and is the main driver of the USDJPY rally.

Dynamics of USDJPY and the yield differential of the U.S. and Japanese bonds

At the same time, Haruhiko Kuroda argues that it is inflation, and not a weak yen, that is the basis for making adjustments to monetary policy. The head of the BoJ once again emphasized the benefits of a depreciation of the national currency, while forgetting about the skyrocketing import prices and the negative impact of devaluation on imports and economic growth. It is likely that PPI will drag consumer prices, which will force the Bank of Japan to intervene. However, most likely, this will not happen this year.

The sensitive reaction of USDJPY to the dynamics of the yield of U.S. Treasury bonds allows us to consider the yen the most interesting currency of the week by April 1. Releases of data on U.S. inflation and employment can stir up a hornet's nest - lead to even more aggressive "hawkish" rhetoric of FOMC members and to a continuation of the rally in U.S. debt rates.

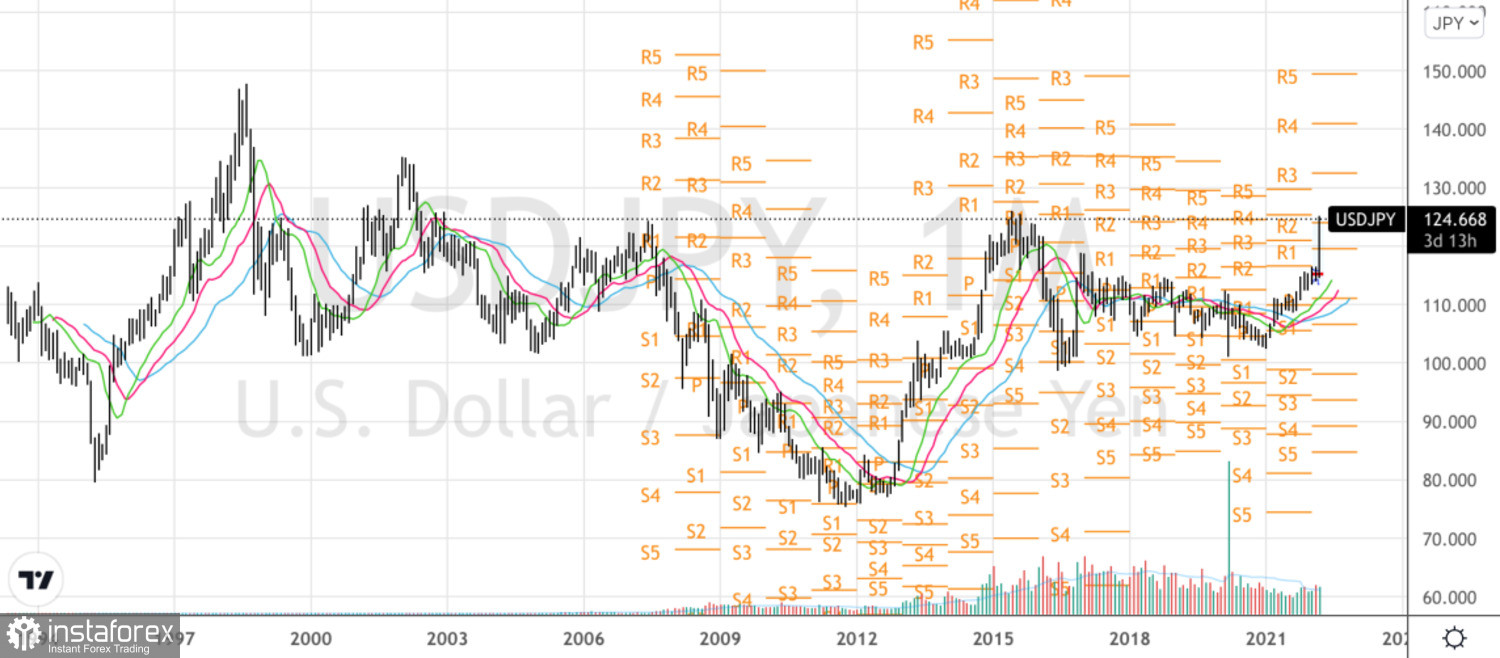

Technically, the further fate of USDJPY will depend on the ability of the "bulls" to return quotes above 125 and update the maximum achieved in the summer of 2015. It will work out - it will be possible to talk about the continuation of the rally to 135 and 140 as part of the implementation of the AB=CD harmonic trading pattern. The recommendation is to buy on pullbacks.

USDJPY, Daily chart