Hi, dear traders!

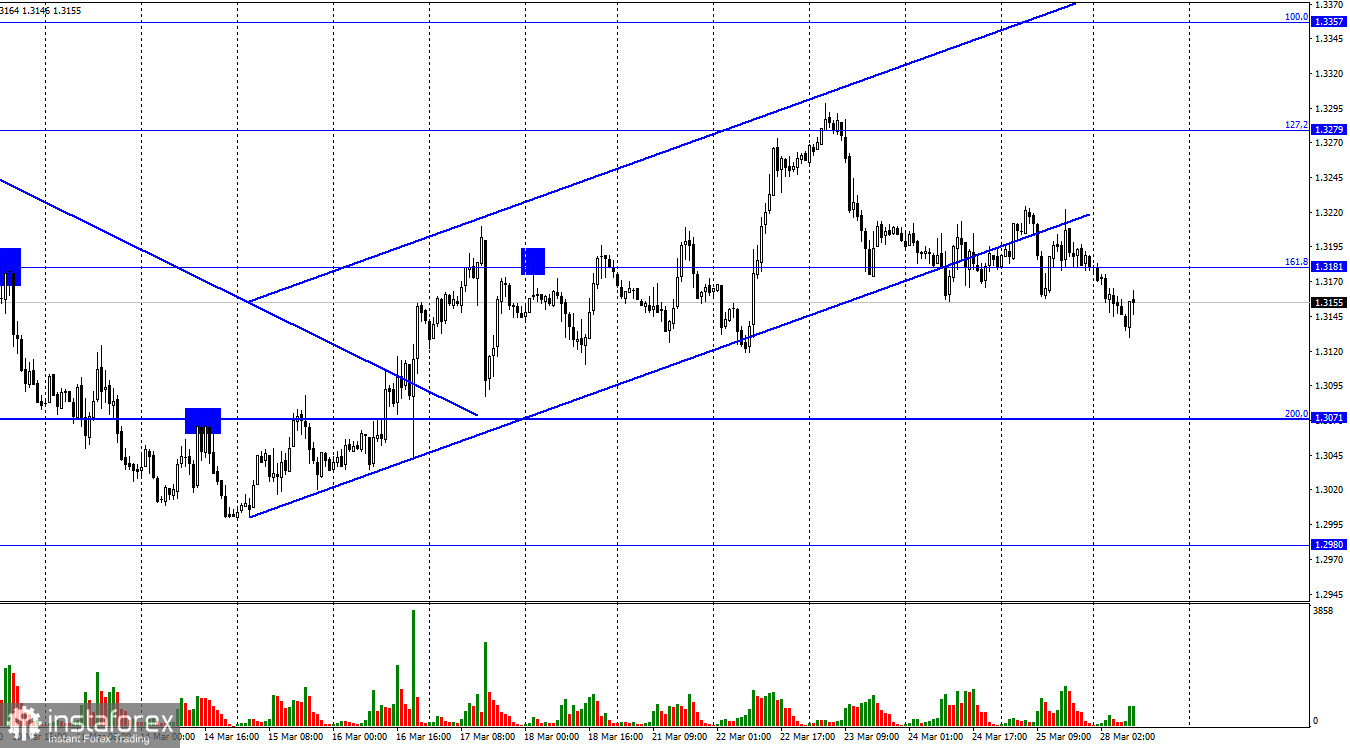

According to the H1 chart, GBP/USD traded without a clear trend on Friday and finished that day's session at the opening price. However, on Monday, the pair fell again towards the retracement level of 200.0% (1.3017) and closed below the ascending channel, indicating a bearish trend. The pair is likely to slump this week. Geopolitics remains a key factor for investors this week. Russia and Ukraine are set to have another round of peace talks. However, both sides cannot come to an agreement on principal questions. A breakthrough is unlikely this week, even though Ukraine has stated it would not join NATO. However, Kyiv wants security guarantees from nuclear powers. Moscow has stated it would stop its special military operation only if Russia and Ukraine come to an agreement on Russia's demands.

The question of Crimea and the Donbass remain a sensitive issue, on which Ukraine does not budge. It seems that both sides are having these talks solely to create an image of negotiating a diplomatic solution to the war. However, the longer these talks drag on, the higher is the death toll on both sides. The pound sterling and the euro could sink at any moment, as USD remains the safe haven asset of choice for investors. The situation worldwide is deteriorating and is absolutely unpredictable. NATO, the EU, and the US stand behind Ukraine and impose new sanctions against Russia. In the meantime, analysts are now talking about a possible nuclear war. There are practically no economic news at this point.

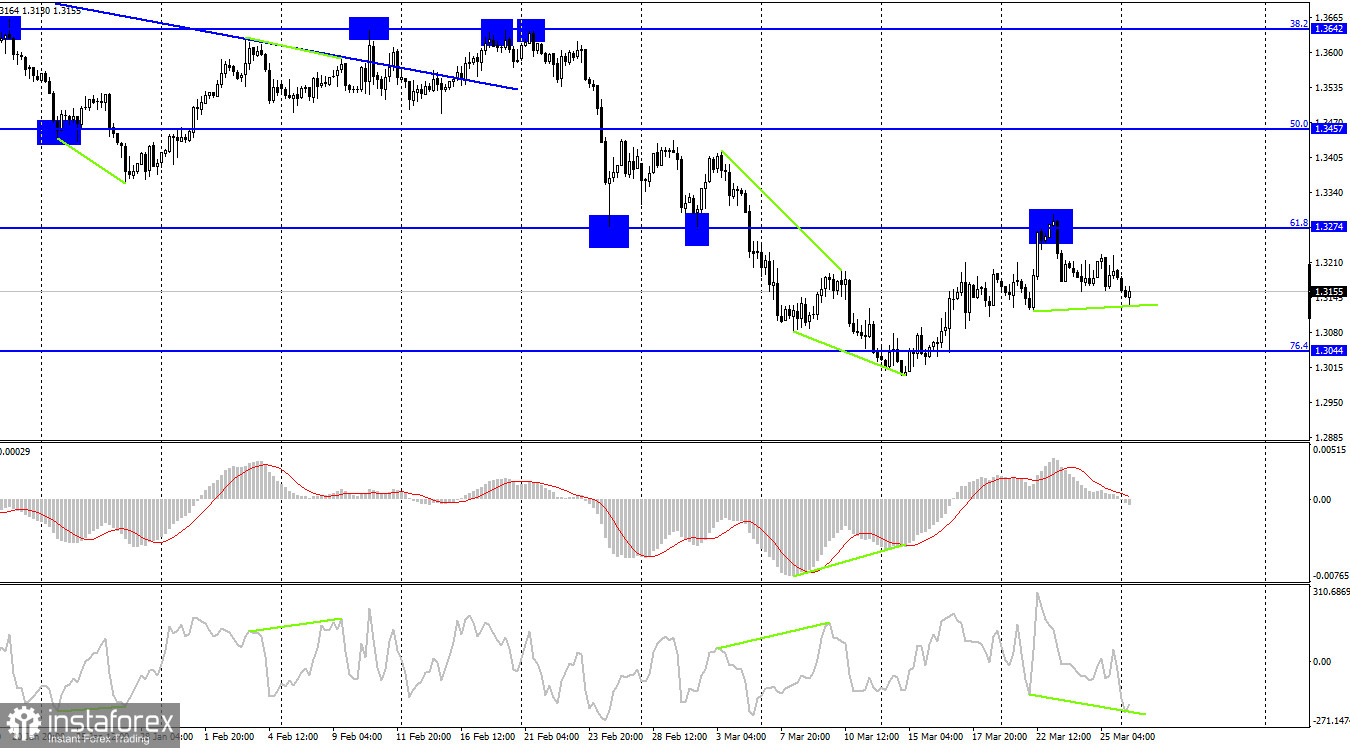

According to the H4 chart, the pair bounced off the retracement level of 61.8% (1.3274) downwards toward the Fibo level of 76.4% (1.3044). A bullish CCI divergence is forming, but it could still disappear. If the divergence does emerge, or the pair bounces off the Fibo level of 76.4% (1.3044), the pair could rise towards the retracement level of 61.8%.

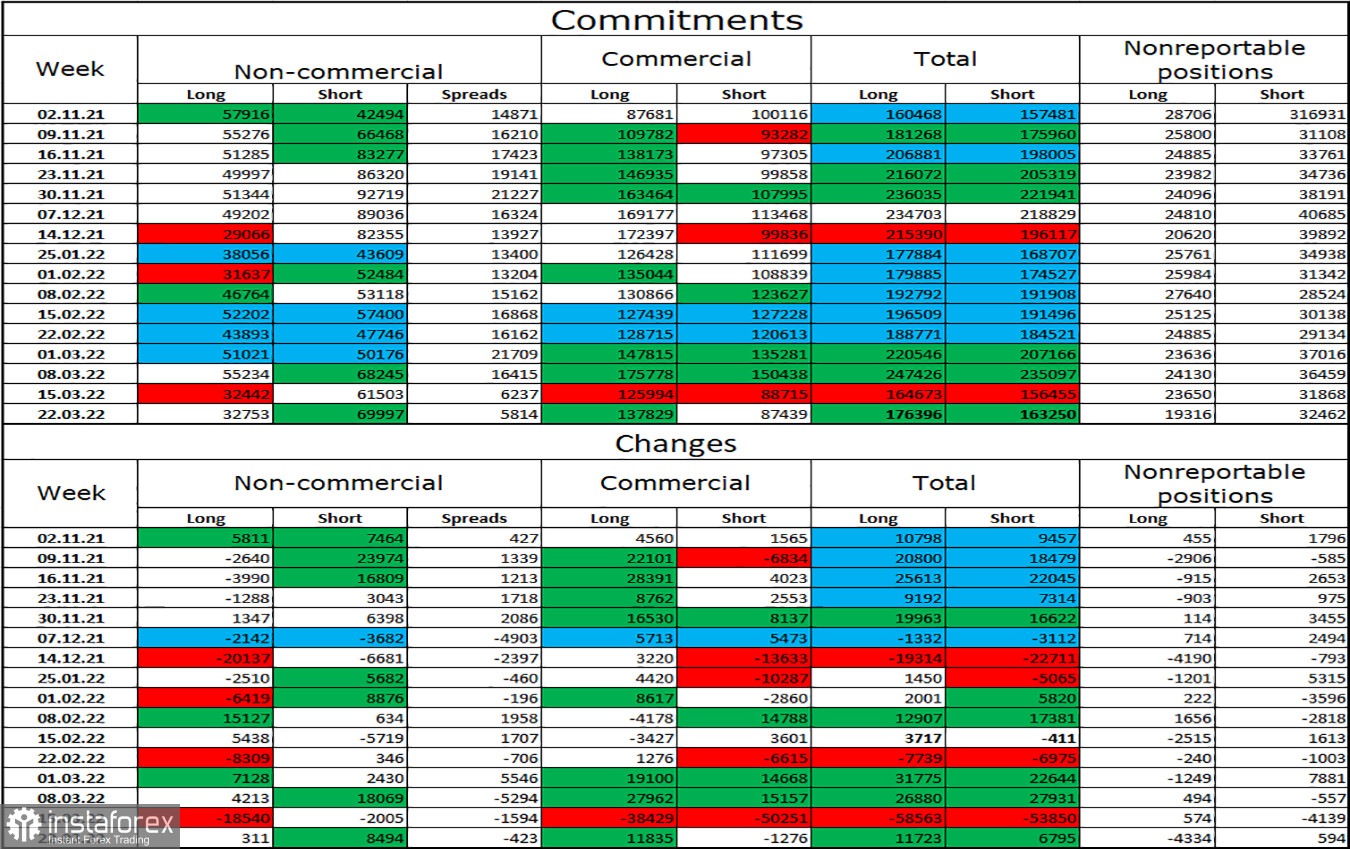

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders once again changed sharply during the last week covered by the report. 311 Long positions were opened, compared to 8,494 Short positions opened during the week, indicating that major market players are now increasingly bearish. The total number of open Long positions exceeds the number of Short contracts twofold. With GBP falling, and major market players opening more short positions, the balance between open Long and Short positions more corresponds to the actual situation. \judging by COT data and geopolitical factors, GBP could continue to fall.

US and UK economic calendar:

UK - speech by Andrew Bailey, governor of the Bank of England (11-00 UTC).

Today's economic calendar is almost empty. Andrew Bailey's statements could be considered important, however Bailey has recently focused on cryptocurrencies and not the state of the economy or monetary policy of the BoE.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if the pair closed below the price channel on the H1 chart with 1,3071 being the target. These positions can be kept open. Long positions can be opened if GBP/USD bounces off 1.3044 on the H4 chart, with 1.3274 being the target.