To open long positions on GBP/USD, you need:

Despite the rather high volatility of the pound in the first half of the day, trading was still conducted within the side channel. Unfortunately, we did not reach the levels I indicated quite a bit. For this reason, there were no signals to enter the market. For the second half of the day, the technical picture was completely revised, although the strategy that I recommend following has not undergone any special changes. And what were the entry points for the euro this morning?

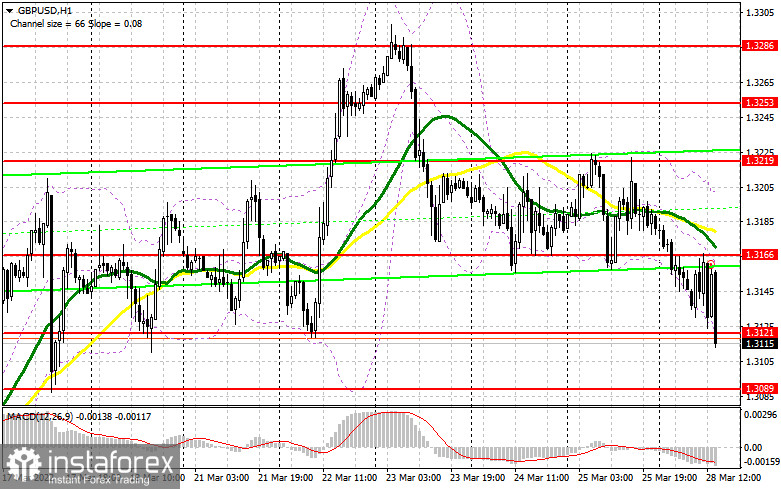

The speech of the Governor of the Bank of England, Andrew Bailey, was more concerned with the problems in commodity markets, which, according to him, continue to create serious inflationary pressure. The pound collapsed after the governor of the Bank of England reiterated statements made at the last meeting that officials consider it necessary to soften their language regarding the need for further interest rate hikes due to growing uncertainty. This tells us that the regulator does not intend to openly fight even with the current level of inflation, hoping for its slowdown after the risks of a geopolitical conflict begin to weaken. The bulls did not cope with the task, and now they need to think about how to protect and return to the nearest support level of 1.3121. Only growth above this area with its reverse test from top to bottom will give the first buy signal that can lead GBP/USD to almost a maximum in the area of 1.3166. There are moving averages that play on the sellers' side. To continue the growth of GBP/USD, an important task for buyers is to return 1.3166 under control. Only a breakout and consolidation with a reverse test from top to bottom of this range will lead to a buy signal, which will open a straight road to 1.3219. Going beyond this level will happen only with very positive news and increased demand for risky assets, which is not expected during the American session. A breakthrough and a reverse test of 1.3219 will give a buy signal, allowing the bulls to get out already to the area of the highs: 1.3253 and 1.3286, where I recommend fixing the profits. In the scenario of a further decline in GBP/USD, it is best to postpone purchases until the next support of 1.3089. I also advise you to open long positions there only when a false breakdown is formed. You can buy GBP/USD immediately on a rebound from 1.3046, or even lower - from a minimum of 1.3003, counting on a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Sellers are supported not only by Bailey's statements but also by the rapidly deteriorating situation with a new strain of coronavirus that was recently recorded in China. This is another reason for the growth of inflationary pressure, which British households can no longer cope with. Only a breakout and a reverse test of 1.3121 will lead to the formation of a sell signal for the pound. If we do not see a rapid downward movement after that - it is better not to rush with sales, so as not to get into short positions at the daily minimum. The formation of a false breakout at 1.3121 should push the pair to the nearest support of 1.3089, which is intermediate. A breakout and a reverse test of this level from the bottom up will form an additional sell signal, which will lead GBP/USD to lows: 1.3046 and 1.3003, where I recommend fixing the profits. In case of GBP/USD growth in the afternoon and weak sellers' activity at 1.3121, it is best to postpone sales to a large resistance of 1.3166, just above which the moving averages pass. I also advise you to open short positions there in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3219, or even higher - from a maximum of 1.3253, counting on a correction of the pair down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for March 15 recorded a sharp reduction in long positions and only small changes in short ones. The last meeting of the Bank of England reflected badly on the British pound. Despite the increase in interest rates, which was expected, the regulator did not signal an increase in aggressive policy, preferring more dovish rhetoric, despite inflation, which is breaking long-term records in the UK. The discontent of the country's population complicates the life of the British regulator, although more aggressive actions in the current difficult geopolitical conditions may harm the economy more than help it. Now everything depends on how to cause her the least harm, because the fight against inflation is just beginning, and what will happen this spring is a mystery to many. Against this background, traders are in no hurry to buy the British pound, which shows a rather large weakness in pair with the US dollar. The Federal Reserve meeting was also the central event of last week. As a result, the committee raised interest rates by 0.25%, which did not lead to serious changes in the market, as many expected such decisions. Against this background, I recommend continuing to buy the dollar, since the bearish trend for the GBP/USD pair has not gone away. The only thing that now saves the pound from a major sell-off is high inflation in the UK, which will eventually force the Bank of England to act more actively. The COT report for March 15 indicated that long non-commercial positions decreased from 50,982 to the level of 32,442, while short non-commercial positions decreased from the level of 63,508 to the level of 61,503. This led to an increase in the negative value of the non-commercial net position from -12,526 to -29,061. The weekly closing price dropped to 1.3010 against 1.3113.

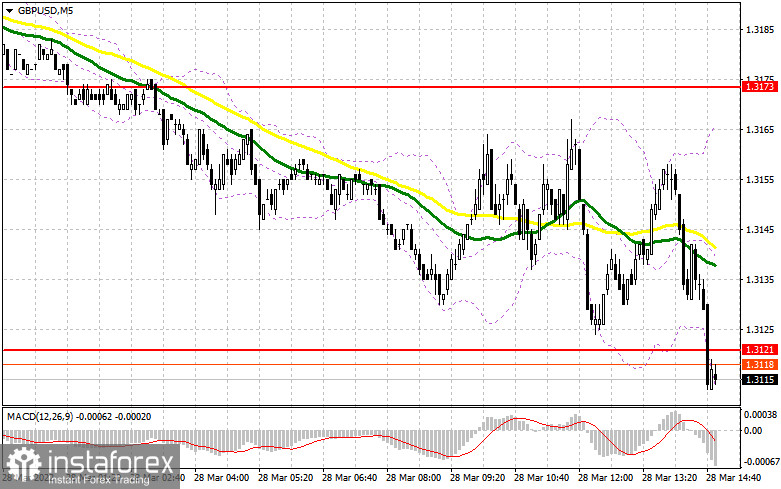

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the bearish nature of the market.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator in the area of 1.3160 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.