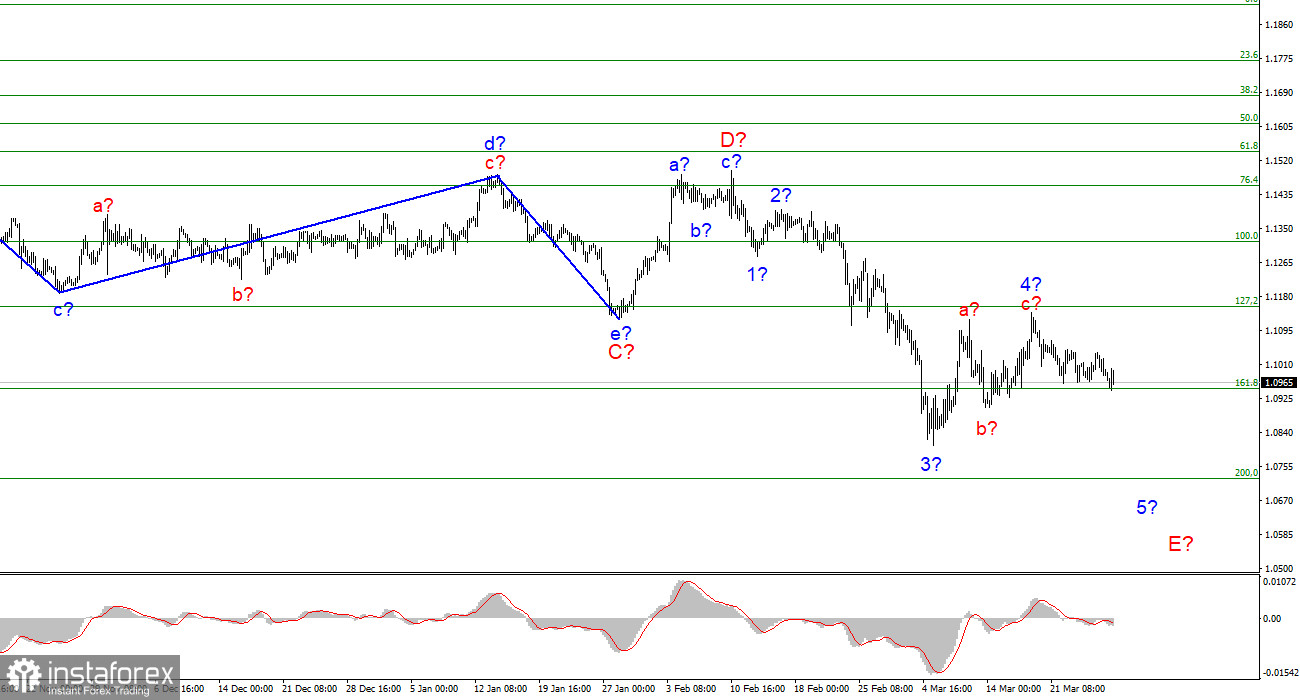

A wave layout for EUR/USD on the 4-hour chart remains the same and looks convincing. The trading instrument has been losing ground for a few days. So, we don't have an excuse to fine-tune our wave analysis. Currently, we suppose that wave E is underway. It is expected to consist of 5 waves. Wave E has already taken on an elongated shape. Hence, I expect to complete soon. For the time being, wave 4 inside the wave E structure is over. Wave 5 is emerging now. To confirm that wave 5 is underway, we should wait for a successful breakout of 1.0948 that matches the 161.8% Fibonacci level. If the price goes below wave b in 4, it will also confirm that a new downward wave is being developed. Otherwise, wave 4 in E could look like a 5-wave structure a-b-c-d-e. I don't consider alternative options of the wave layout because I don't see serious breaches in the ongoing wave layout.

EU ready to phase out gas dependence on Russian imports

EUR/USD shed 30 pips on Monday. The market was trading with moderate volatility. Demand for EUR is declining again. It means that the ongoing wave layout is still valid. The trading instrument could extend its decline in the coming weeks. There is positive news for EUR nowadays. The information background was thin on Monday. The economic calendar was empty for the US and the EU. Nevertheless, a mass of news that happened in a few recent days unfortunately indicates the escalating standoff between Russia and the West but not the opposite. European Union foreign policy chief Josep Borrell stated that the EU will slash imports of the Russian gas by two thirds by the year end. The more ambitious plan for Brussels is to terminate gas supplies in full from the dodgy regime in the nearest two years. The EU policymakers plan to adopt the practice of joint gas purchases to eliminate competition among EU countries and discontent of some members.

Let me remind you that Hungary flatly rejected to join the embargo on Russian oil and gas imports. He predicts that such a move will entail a serious energy crisis. US President Joe Biden pledged that his country would be able to provide the EU with enough gas supplies so that the EU authorities do not have to collaborate with the Kremlin. The trigger has been pulled. From now on, the EU and the US will step up pressure on Moscow. For the time being, there are no preconditions that the political pressure will be defused.

To make things worse, the conflict between Russia and Ukraine will hardly be solved in the near future. A new round of the talks between Russian and Ukrainian delegates is to kick off tonight in Turkey. However, analysts discourage market participants that the parties will hardly make any progress. Moscow and Kyiv insist express polar opposite stance. Their delegates have not come to a common denominator in some points yet. All in all, the geopolitical picture remains the same. So, the market has no reason to change sentiment.

Conclusion

On the basis of wave analysis, I make a conclusion that wave E is still in progress. If so, the time is right to sell EUR with targets at 1.0723 that coincides with the 200.0% Fibonacci level at each MACD's signal downwards. The ongoing wave layout suggests that wave 5 in W will come into being.

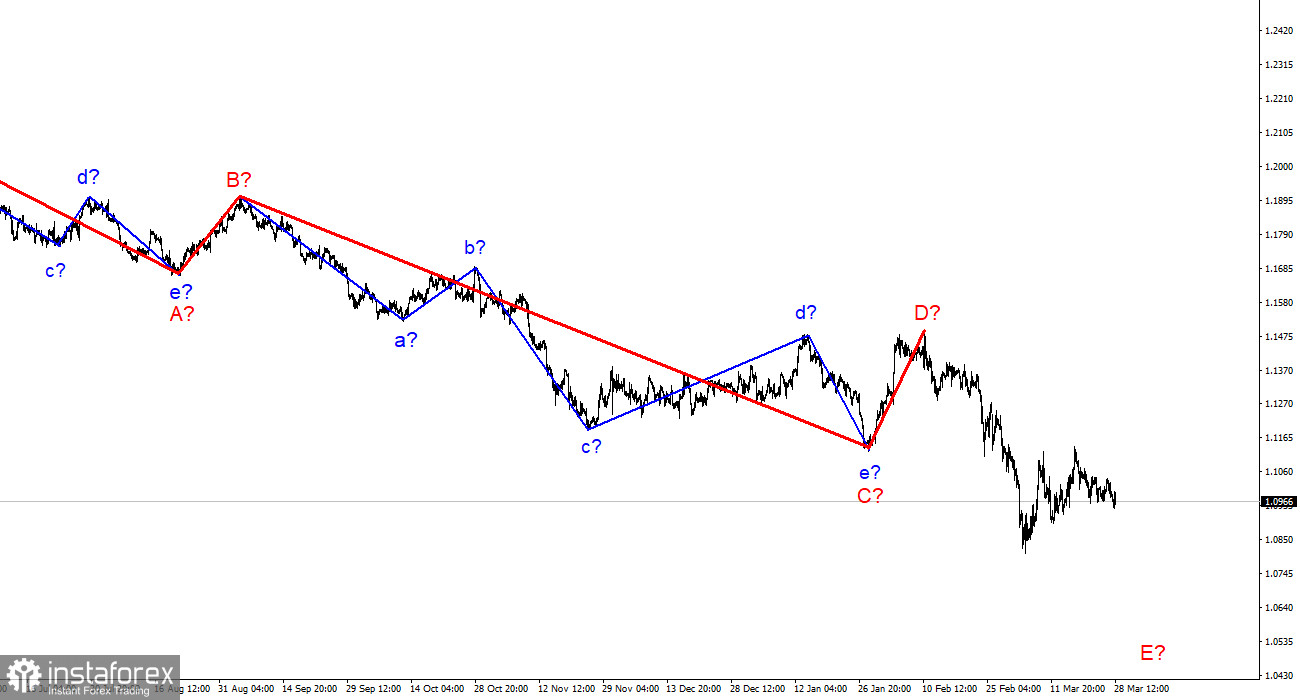

On a larger timeframe, it is clear that wave D is complete. The currency pair has printed lower lows. Thus, wave 5 is being developed inside the downtrend. This wave D could be as extended in the end as wave C. If this prediction is true, EUR is expected to continue its weakness.